- Wall Street indices open lower

- US100 tries to bounce off the 19,000 pts area

- KKR, CrowdStrike and GoDaddy to join S&P 500 index

- Perion Networks slumps 30% after revising forecasts lower

Wall Street indices launched today's trading slightly lower, following a downbeat trading in Europe earlier today. However, scale of the move on Wall Street is much smaller than in Europe as declines on the Old Continent are driven by region-specific factors - political uncertainty caused by results of European Parliament elections and, especially, snap parliamentary elections called in France. S&P 500 launched today's trading 0.2% lower, Nasdaq dropped 0.3% at session launch, Dow Jones declined 0.1% and small-cap Russell 2000 plunged over 1%.

Source: xStation5

Source: xStation5

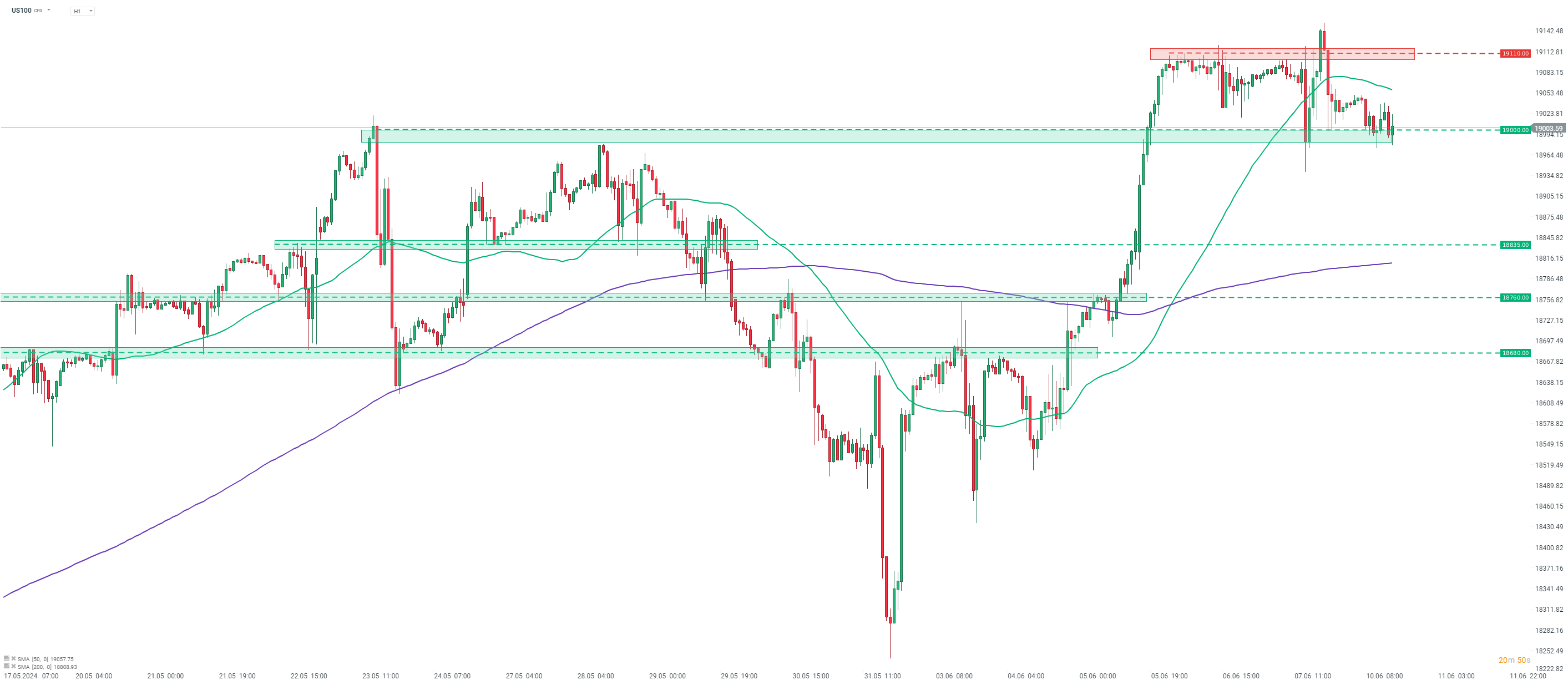

Nasdaq-100 futures (US100) are trading lower today. The index is testing support zone ranging below 19,000 pts area today, which served as a floor recently. A break below this area could pave the way for a deeper correction, with 18,835 pts zone being the first potential short-term support to watch. However, the index began to erase losses after launch of the Wall Street cash session and is now trying to bounce off the 19,000 pts mark. Should bulls regain control over the market and continue to push the index higher, the first near-term resistance zone be found in the 19,110 pts zone, just slightly below record highs.

Company News

S&P Dow Jones Indices announced the quarterly rebalancing changes to S&P 500 index. KKR & CO (KKR.US), CrowdStrike (CRWD.US) and GoDaddy (GDDY.US) will join S&P 500 index, replacing Robert Half International (RHI.US), Comerica (CMA.US) and Illumina (ILMN.US). Changes to the index will go into effect before the launch of Wall Street cash session on Monday, June 24, 2024.

Perion Network (PERI.US) launched today's trading with a big bearish price gap. Company revised its Q2 and full-year forecasts lower after it was notified by Microsoft Bing that a number of publishers will be excluded from search distribution marketplace. Perion now expects Q2 revenue to reach $106-108 million, down from previous guidance of $118-122 million, and Q2 adjusted EBITDA to reach $6.5-7.5 million, down from $10-12 million previously. Full-year revenue is now seen at $490-510 million, down from $590-610 million expected previously, and full-year adjusted EBITDA is seen at $48-52 million, down from previous goreacst of $78-82 million.

A 10-to-1 stock split on Nvidia (NVDA.US) went into effect on Friday after close of Wall Street session, meaning that today will be the first day when company trades at a post-split basis.

Southwest Airlines (LUV.US) is trading higher today, following a report from Wall Street Journal. WSJ reported that Elliott Investment Management, a well-known acitvist investor, built an almost $2 billion stake in the company, making Elliott one of the largest stakeholders in Southwest Airlines.

Analysts' actions

- Advanced Micro Devices (AMD.US) downgraded to 'equal-weight' at Morgan Stanley. Price target set at $176.00

- PG&E Corp (PCG.US) upgraded to 'overweight' at JPMorgan. Price target at $22.00

- Adobe (ADBE.US) downgraded to 'hold' at Melius Research. Price target set at $510.00

Perion Network (PERI.US) launched new week's trading with an around-30% bearish price gap, after revising its sales and adjusted EBITDA guidance lower. Stock plunge to the lowest level since early-December 2020 and is trading around 70% year-to-date lower. Source: xStation5

Perion Network (PERI.US) launched new week's trading with an around-30% bearish price gap, after revising its sales and adjusted EBITDA guidance lower. Stock plunge to the lowest level since early-December 2020 and is trading around 70% year-to-date lower. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.