- Major indices open lower

- US500 records smallest drop at start of session

- At the time of publication, indices are already gaining

- USD rebounds after yesterday's declines

- US Treasuries yields also rebound

Markets are trying to recover from yesterday's dramatic collapse in global stock exchanges. However, sentiment remains far from optimistic. Today, investors' attention is again turning to quarterly earnings on Wall Street. Before the session, companies like Uber and Caterpillar published their reports. At the time of publication, the US500 index is up 0.50%, the dollar index (USDIDX) is up 0.45%, and the yields on 10-year bonds have risen to 3.83%.

US500

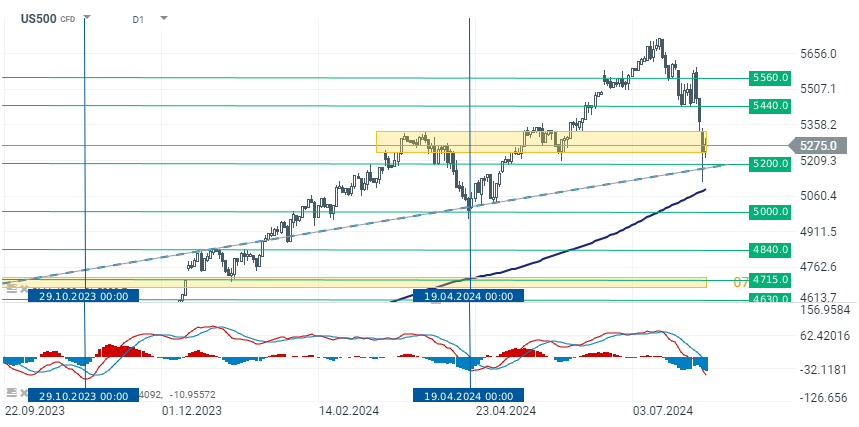

US500 futures on the S&P500 index are gaining the most among American indexes today. The US100 is still under supply pressure and has recorded a significantly larger drop than the US500, indicating that capital has slightly moved away from tech giants, at least momentarily. Bulls on US500 have managed to defend a crucial support line of the upward trend (blue dashed line) and remain above the support zone around 5200 points. Theoretically, this looks promising. The quotes remain in consolidation within the 5200-5350 point range.

Source: xStation 5

Earnings after market close

Amgen (AMGN.US) is set to release its Q2 results after market close, with expectations of earning $5 per share on $8.35 billion in revenue. Focus will be on the performance of its key products, including Prolia, Enbrel, Otelza, and Repatha. Additionally, updates on its investigational weight loss therapy, MariTide, will be closely monitored.

Airbnb (ABNB.US) Q2 earnings are awaited after market close, with projections of 91 cents per share on $2.74 billion in revenue. Analysts will particularly watch the room night growth metric, especially after Booking Holdings noted a potential slowdown. Another point of interest will be Airbnb’s strategy regarding potential regulatory challenges in Europe, similar to Barcelona's decision not to renew tourist apartment licenses after 2028.

Company News

Uber Technologies (UBER.US) stock gains 6% following a second-quarter earnings beat. The company reported daily cab trips averaging 30 million, contributing to a 19% year-over-year increase in gross bookings, totaling $40 billion. CEO Dara Khosrowshahi highlighted the strength of Uber’s consumer base, noting increased usage frequency. For Q3, Uber projects gross bookings between $40.25 billion and $41.75 billion, slightly below consensus estimates.

Caterpillar (CAT.US) gains 3.65% after the company reported Q2 earnings. Caterpillar saw a 4% drop in Q2 revenue year-over-year due to lower sales volume, despite price increases. Dealer inventory levels remained stable. The Irving, Texas-based firm provided a positive forecast, expecting higher full-year adjusted operating profit and EPS, with second-half sales and revenue anticipated to exceed first-half figures.

Lucid Group (LCID.US) gains over 5% despite mixed Q2 results. Revenue increased by 33% year-over-year, with 2,110 vehicles produced and 2,394 delivered. The company remains on target to produce about 9,000 vehicles annually. CEO Peter Rawlinson highlighted Lucid's technological edge, particularly noting an efficiency milestone of 5.0 miles per kilowatt-hour, which reinforces its status as a leader in technology.

Palantir Technologies (PLTR) stock jumps over 9% following strong Q2 performance with a 27% year-over-year increase in revenue, bolstered by its AI platform. U.S. commercial revenue surged by 55%, and government revenue increased by 24%. The company upgraded its FY2024 revenue forecast to $2.75 billion from $2.74 billion, above the consensus of $2.70 billion. For Q3, Palantir expects revenue between $697 million and $701 million, significantly higher than the expected $681.4 million.

CSX Corporation (CSX.US) gains 4% after Q2 earnings slightly exceeded expectations. Revenue aligned with forecasts, but profits were higher than anticipated. The company saw a 2.1% increase in volume, against a forecasted 1.6%, though pricing fell by 2%.

Lumen Technologies (LUMN.US) soared over 58% after the company announced securing $5 billion in new contracts, driven by high demand for connectivity due to AI advancements. Lumen is also discussing additional sales potentially worth $7 billion with customers, capitalizing on this growing market.

ZoomInfo Technologies (ZI.US) dropped over 17% after its Q2 earnings missed expectations. The Q3 revenue forecast of $298 million to $301 million fell below the consensus of $317.51 million. Adjusted EPS for Q3 is expected to be between $0.21 and $0.22, lower than the consensus of $0.25. The company also lowered its FY2024 revenue guidance from $1.255 billion to $1.27 billion to between $1.19 billion and $1.205 billion.

SunPower (SPWR.US) filed for Chapter 11 bankruptcy, leading to a 35% drop in its stock value. The company announced plans to sell its Blue Raven Solar, New Homes, and non-installing Dealer network to Complete Solaria for $45 million.

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.