- US market opens lower on the first day after the long weekend.

- Factory Orders came slightly better than expected.

- Saudi Arabia extends cuts.

- Catalent (CTLT.US) rise 1.2% and Oracle (ORCL.US) gains 1.8% following the higher stock recommendation

U.S. markets opened with a subdued tone on Tuesday following the Labor Day weekend, with both the S&P 500 and the Nasdaq Composite registering slight declines of 0.1% and 0.3% respectively, while the Dow Jones Industrial Average remained flat. This low momentum coincided with the release of Chinese data that signaled a slowdown in its services sector, adding to global growth concerns. US treasury yields inched up to 4.233% from 4.17% on Friday.

Saudi Arabia

Saudi Arabia and Russia have extended their unilateral oil supply curbs for an additional three months, aiming to stabilize a fragile global market. This move exceeded market expectations and will keep Saudi production at its lowest level in several years, around 9 million barrels a day, while Russia will continue its export reduction of 300,000 barrels a day. The decision has been met with criticism from major oil-consuming nations, warning that the curbs could hinder economic recovery by driving up inflation. Despite the economic costs, including a significant downgrade in Saudi Arabia's economic growth projections by the IMF, both countries seem committed to maintaining higher oil prices over increasing production volumes.

Durable Goods and Factory Orders

In July, orders for manufactured goods declined by 2.1%, marking the first drop after four consecutive months of gains, according to the Commerce Department. While economists had expected a 2.3% fall, the numbers were not as bad as anticipated. However, when transportation is excluded, orders actually increased by 0.8% following a 0.3% rise in the previous month. Durable-goods orders revised fell by 5.2% but in line with analysts expectations. Non-durable goods orders saw a 1.1% increase. Economists attribute the decline in orders to higher interest rates impacting business equipment spending.

US500

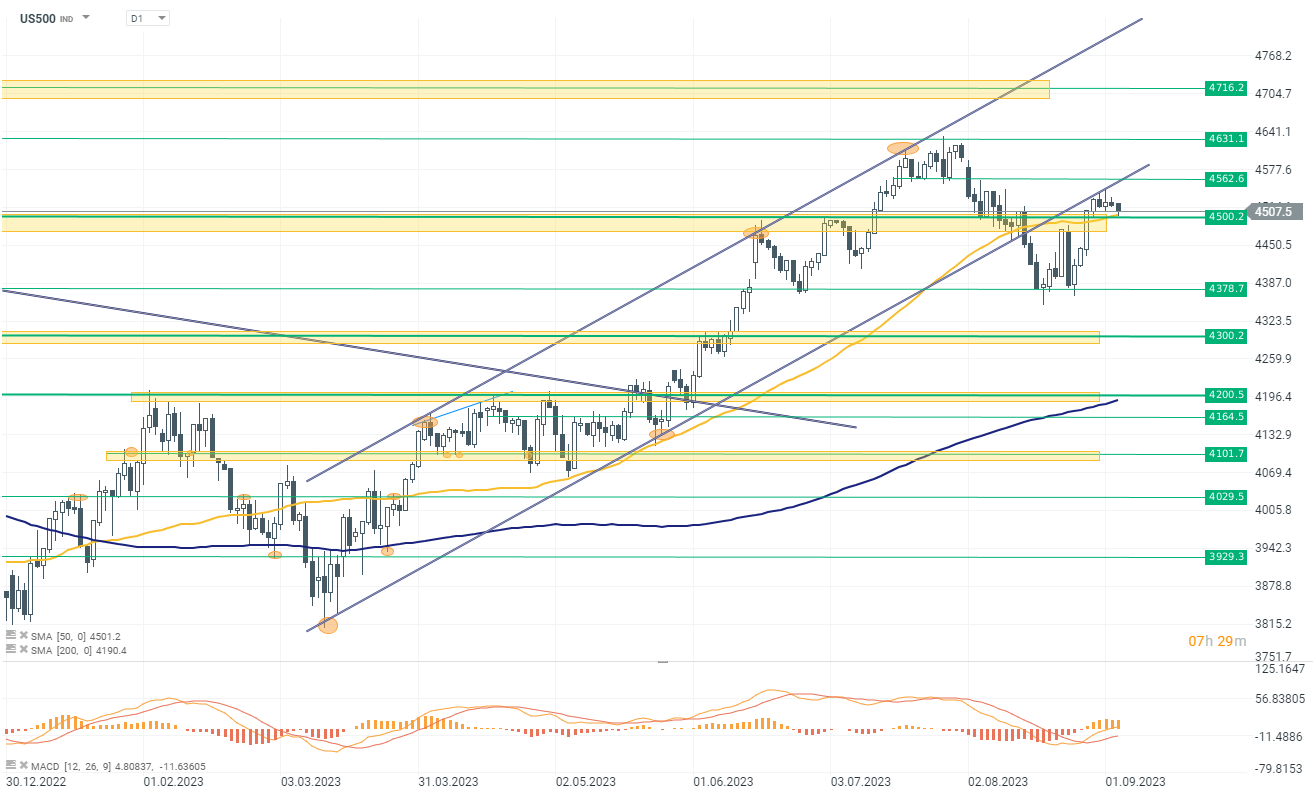

US500 index currently faces a 0.25% decline at around 4510 points, showing a weakening rebound following recent significant corrections. This decline has resulted in the index remaining below its recent upward trendline, indicated by a blue line. Critical levels to monitor are 4500 points and the recent local low of 4378 points. If selling pressure intensifies and US500 breaks below the 4500 level, further downside movement could occur, potentially leading to increased bearish momentum. Conversely, a consolidation phase might emerge if the index manages to hold above 4500 points. For the Wall Street bulls to sustain an upward trajectory towards the year's peak at 4600 points, a triggering catalyst is necessary. The upcoming two weeks hold key events, including the CPI report and the FED interest rate decision, which could provide the impulse for the desired upside continuation.

US500 index currently faces a 0.25% decline at around 4510 points, showing a weakening rebound following recent significant corrections. This decline has resulted in the index remaining below its recent upward trendline, indicated by a blue line. Critical levels to monitor are 4500 points and the recent local low of 4378 points. If selling pressure intensifies and US500 breaks below the 4500 level, further downside movement could occur, potentially leading to increased bearish momentum. Conversely, a consolidation phase might emerge if the index manages to hold above 4500 points. For the Wall Street bulls to sustain an upward trajectory towards the year's peak at 4600 points, a triggering catalyst is necessary. The upcoming two weeks hold key events, including the CPI report and the FED interest rate decision, which could provide the impulse for the desired upside continuation.

Company News

-

Oracle's stock (ORCL.US) gained 0.7% after Barclays upgraded its rating from 'equal-weight' to 'overweight,' highlighting the company as a "multi-year growth story". Analyst also increased the price target to a $150 from $126, citing strong potential for growth at high margins. The upbeat outlook is backed by the positive contributions from Oracle's Software as a Service (SaaS) and Oracle Cloud Infrastructure (OCI) segments, which are expected to offset slower growth areas within the company. The new price target suggests a 24% increase from Friday's close.

-

Viatris (VTRS.US) gains 0.7% after the firm said the US FDA has tentatively approved a drug cocktail for children with HIV-1

-

Catalent (CTLT.US) shares climbed as much as 2.5% following an upgrade from 'hold' to 'buy' by analysts at Argus Research. The firm set a price target of $62, pointing to several positive factors as Catalent transitions to a post-Covid landscape. In addition to exceeding Wall Street's revenue expectations for 2024, the company also projected solid non-Covid revenue in its Biologics segment. Catalent is improving its profit margins through operational initiatives and has shifted its focus from COVID-19 vaccines to the development and commercialization of advanced biologics and gene therapies. The company is also collaborating with Novo Nordisk in manufacturing the GLP-1 weight loss drug Wegovy and has other GLP-1 assets in its development pipeline. This comes alongside a recent deal Catalent secured with activist investor Elliott Investment Management, adding new seats to its board.

Source: xStation 5

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

STM is growing stronger thanks to a new partnership with AWS!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.