- Wall Street opens lower after weaker ISM report

- Quarterly earnings from Caterpillar, Pfizer and Uber Technologies

Major US indices accelerate losses after US ISM report and Job Openings data. SP500 declines 0.40% to 4570 points, Nasdaq 100 drops 0.30% to 15700 points and Russell 2000 is up by 1.10% to 2003 points. Meanwhile, investors are analyzing mixed earnings reports from Pfizer, Caterpillar and Uber. Looking ahead, Wall Street economists anticipate a pause from the Federal Reserve's September meeting. With anticipated low inflation readings and new challenges like the restart of student-loan payments, there will be more justification to delay any immediate actions.

ISM update

The U.S. manufacturing sector experienced its ninth consecutive month of contraction in July, as indicated by the latest Manufacturing ISM Report. The July Manufacturing PMI registered at 46.4, showing a slight increase from June's 46. Although various indices like New Orders, Production, Prices, and Backlog of Orders showed minor improvements, the Employment Index declined further into contraction. Despite the overall contraction, there were signs of a slightly slower rate of decline, with some companies managing outputs due to continued order softness.

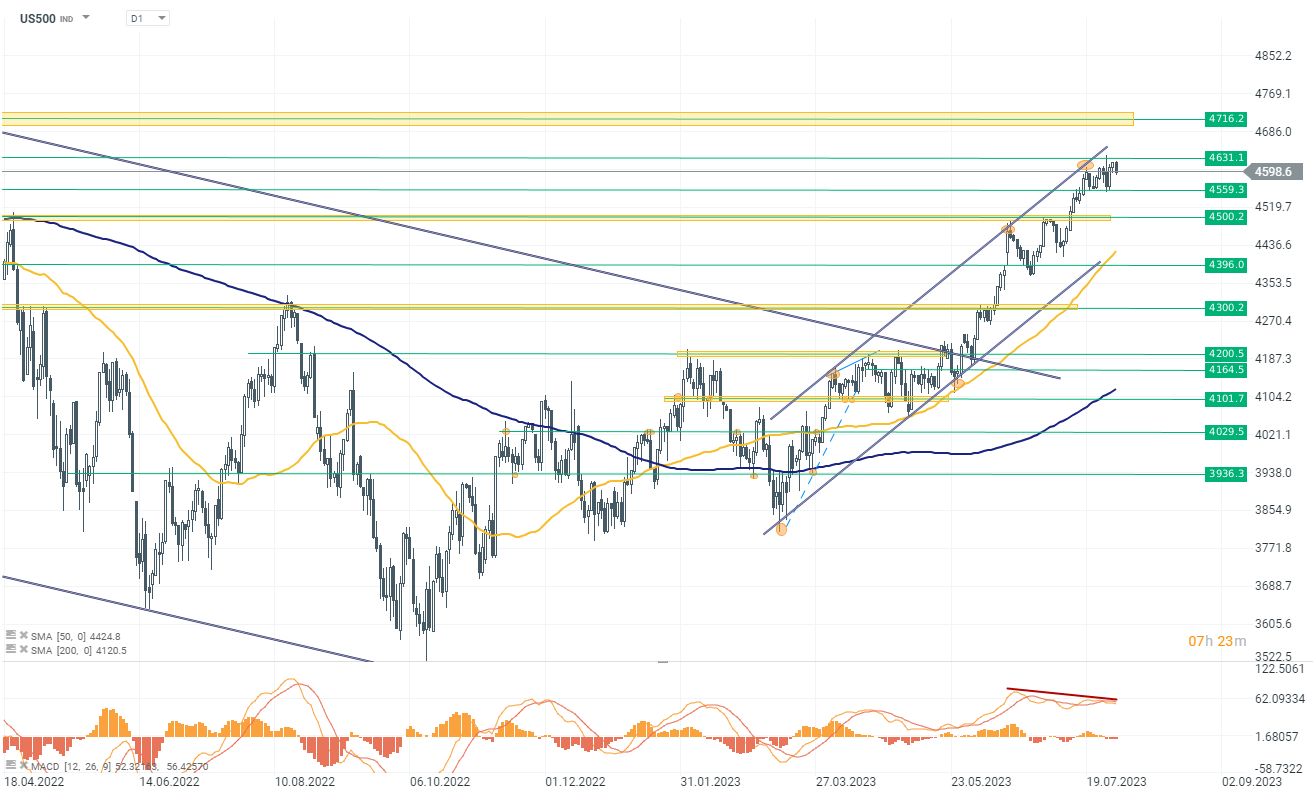

The US500 CFD index is currently trading at 4598, lower by 0.40%. It has been facing difficulty in surpassing the 4630 level, indicating strong resistance in the market. Recently, the price experienced a rebound from the upper resistance line of an ascending channel that has been respected since mid-February. This suggests selling pressure around this area and there is a possibility of short-term consolidation or correction. Additionally, the MACD indicator is showing divergence, indicating a weakening momentum in the market. This further supports the idea of a potential correction or sideways movement in the near term. Traders should closely monitor the 4560 support line, as a break below this level could signal a further downside movement.

Company News:

-

Caterpillar (CAT.US) rises 7.8% after the company reported impressive second-quarter earnings, surpassing Wall Street's expectations, largely driven by increased construction sector contributions due to higher infrastructure spending, including President Joe Biden's infrastructure bill. The company's adjusted profits rose by a remarkable 75% year-on-year to $5.55 per share, with group revenues increasing by 21.4% to $17.3 billion. The operating profit margin also saw a substantial jump from 13.6% to 21.1%. The CEO, Jim Umpleby, expressed satisfaction with the strong operational performance and emphasized the commitment to customer service and long-term profitable growth. Despite pandemic-related challenges, Caterpillar seems to have overcome supply chain issues and is experiencing robust demand.

-

Uber Technologies (UBER.US) surprised the market by reporting better-than-expected net income in the second quarter, indicating progress towards its profitability goals and moving beyond its cash-burning startup phase. The company achieved its first-ever GAAP operating profit of $326 million, far surpassing analysts' expectations. The positive results were mainly attributed to record ridership volumes and unrealized gains in equity investments. Uber's net income for the quarter was $394 million, while the free-cash-flow reached $1.14 billion. CEO Dara Khosrowshahi expressed confidence in sustaining strong, incremental profit generation. Additionally, it was announced that Chief Financial Officer Nelson Chai would step down on January 5.

-

Pfizer (PFE.US) shares are up 1.22% after second-quarter revenue fell short of estimates as Covid-19 product sales declined. However, the company's internal innovation strategy led to new drug approvals and 5% growth in sales excluding Covid-19 products. CEO Albert Bourla expects commercial sales to reduce uncertainty. Second-quarter net earnings were $2.3 billion, with adjusted earnings per share of 67 cents, beating forecasts. Pfizer aims to launch 19 new products or indications within 18 months to offset patent expirations. The proposed $43 billion Seagen acquisition is expected to contribute $10 billion in revenues by 2030. Pfizer forecasts $13.5 billion in revenue from its Covid-19 vaccine this year, down two-thirds from 2022, and $8 billion from Paxlovid, down 58% from last year.

-

Marathon Petroleum (MPC.US) stock rose up to 0.5% after reporting adjusted earnings per share for the second quarter that exceeded the average analyst estimate. The earnings beat was driven by strong refining captures, throughput, and operational expenses. The company's refining gross margin was $22.10 per barrel, higher than the bank's expectation of $21.82 per barrel. Despite the positive results, JPMorgan maintains a neutral rating. In the second quarter, Marathon Petroleum reported adjusted EPS of $5.32, beating the consensus estimate of $4.58. The company's total revenues and other income declined by 32% year-on-year to $36.82 billion. Looking ahead to the third quarter, Marathon Petroleum forecasts total throughput of 2,930 mb/d and direct operating cost per barrel of $5.10. President and CEO Michael J. Hennigan credited the second-quarter results to the company's continued execution of strategic initiatives.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.