- Wall Street opens slightly higher

- Weaker dollar and flat yields of 10-year bonds

- Qualcomm (QCOM.US) gains after renewing its deal with Apple

The start of an important week brings a bit of a rebound on the indices in the USA and in Europe after a weaker previous week. The dollar has slowed its gains, and the USDIDX index is almost 0.50% lower. The yields of 10-year bonds are gaining 0.80% and are quoted near their peaks from the end of October 2022 and the end of August 2023. The US500 index is gaining 0.40% at the beginning of the session and US100 0.55%.

Source: Bloomberg Finance L.P.

The market's focus this week will be mainly directed towards the CPI readings from the USA on Wednesday. An increase in inflation is forecasted for the second consecutive month to a level of 3.6% year-on-year, compared to 3.2% year-on-year last month. However, assuming that the data will not be significantly above expectations, a pause at the Fed meeting at the end of September is almost certain. Currently, the market is pricing in nearly a 7% chance of a hike at the next meeting and a 38% chance of a 25 bp increase by the next meeting in early November.

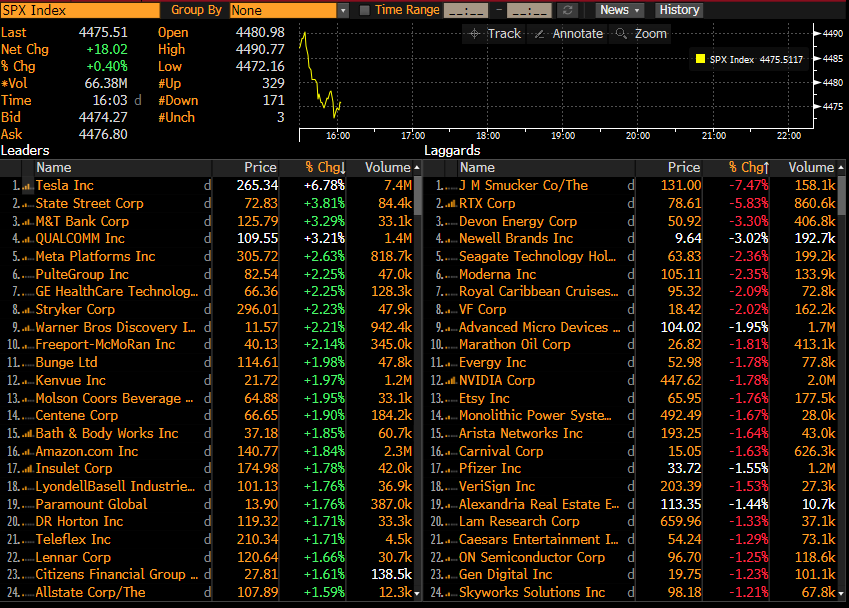

Leading today's gains on the SP500 (US500) is Tesla (TSLA.US), which is up 6.80%. Not far behind is Qualcomm, gaining 3.21%, and Meta Platforms (META.US), gaining 2.63%. On the flip side, among the companies losing the most are Nvidia (NVDA.US) with a 1.80% drop and AMD (AMD.US), whose shares are losing close to 2.0%.

Leading today's gains on the SP500 (US500) is Tesla (TSLA.US), which is up 6.80%. Not far behind is Qualcomm, gaining 3.21%, and Meta Platforms (META.US), gaining 2.63%. On the flip side, among the companies losing the most are Nvidia (NVDA.US) with a 1.80% drop and AMD (AMD.US), whose shares are losing close to 2.0%.

SP500

The US 500 chart currently shows a price of 4480 points, reflecting a 0.40% increase for the day. However, it's worth noting that the price of the US 500 index is still below the critical resistance level at 4500 points, which is pivotal for any potential upward trend continuation. While the index is testing this level, it's important to anticipate higher selling pressure as breaching this resistance barrier could prove challenging. Traders should closely monitor how the market reacts around this key level for potential clues about future price movements. Source: xStation 5

The US 500 chart currently shows a price of 4480 points, reflecting a 0.40% increase for the day. However, it's worth noting that the price of the US 500 index is still below the critical resistance level at 4500 points, which is pivotal for any potential upward trend continuation. While the index is testing this level, it's important to anticipate higher selling pressure as breaching this resistance barrier could prove challenging. Traders should closely monitor how the market reacts around this key level for potential clues about future price movements. Source: xStation 5

Company News

-

Qualcomm (QCOM.US) is gaining over 3,0% after Apple has decided to extend its agreement for another three years, securing modem semiconductors and indicating that the tech giant's efforts to design its own chips are progressing slower than anticipated. The renewed pact will encompass smartphone releases in 2024, 2025, and 2026. This extension comes as a surprise, as the agreement was initially set to conclude this year, and Apple's push for in-house chip development was expected to replace Qualcomm's modem chip in its devices. Qualcomm's position as a key supplier to Apple remains intact, as Apple is Qualcomm's largest customer, representing nearly a quarter of its revenue.

-

Tesla (TSLA.US) is gaining almost 7.0% following the emergence of a new value driver for the company's growth, which is expected to be the Dojo supercomputer. Today, also Morgan Stanley has raised its price target for Tesla Inc. to a Street-high of $400 per share. The Dojo supercomputer is anticipated to expedite the adoption of robotaxis and network services, potentially contributing up to $500 billion to Tesla's market value. Analysts believe that Dojo has the potential to open up new markets, akin to the way Amazon Web Services (AWS) did for Amazon.

Morgan Stanley's recommendation of 400 dollars per share for Tesla is exactly at the top of the company's historic price reached in mid-2021. Source: xStation 5

Morgan Stanley's recommendation of 400 dollars per share for Tesla is exactly at the top of the company's historic price reached in mid-2021. Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.