- Wall Street opens higher

- Dollar loses slightly

- Bond yields lose for third consecutive session

Weak NFP data reignited investor hopes for faster interest rate cuts. While total employment came in above expectations at 206k market attention shifted to strong downward revisions for last month's data, a rise in the unemployment rate and lower private sector growth. Following the release of the data, we saw a sharp jump in index futures and a fall in the value of the dollar. However, moments later, the initial movements were erased. Investors are pricing in the chances of a cut in September and less than a cut in December this year. Following the release of the reports, the chances of interest rate cuts in the US have increased.

Today's market rises are mainly driven by the largest companies, as can be seen very well in the graphic presented above. Source: xStation 5

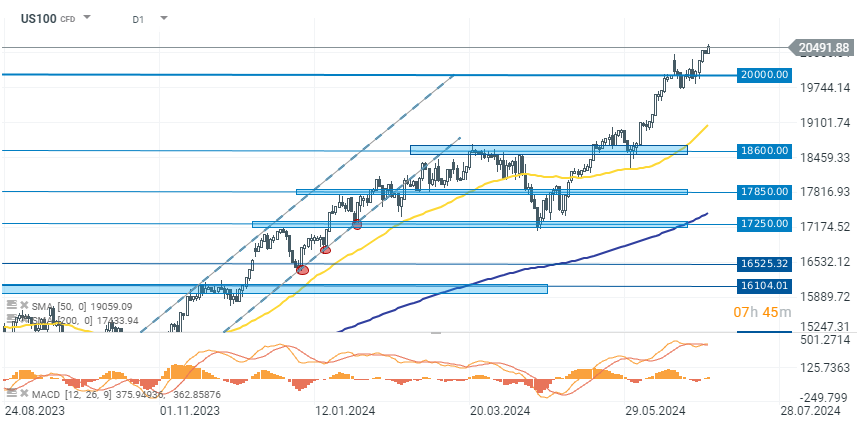

US100

The technology companies index (US100) is back on the rise after a brief consolidation at the 20000 point level. The US100 is today gaining 0.70% above 20500 points. The increases are mainly driven by the largest companies, including Amazon, Google and Meta Platforms.

Source: xStation 5

Company news

Macy (M.US) gains over 9% after an investor group, including Arkhouse Management and Brigade Capital Management, raised their takeover bid to $24.80 per share, valuing the company at approximately $6.9 billion. This new offer follows earlier rejections of $24 per share in March and $21 per share in December.

Crypto-related stocks are experiencing panic sellof as Bitcoin's price continued to drop for the fourth day in a row, decreasing nearly 6% to $54,300 ahead of a $9 billion payout to users of the defunct Mt. Gox exchange. The decline in Bitcoin is also affecting other cryptocurrencies like Ethereum, which fell about 10%, and related stocks such as Riot Platforms (RIOT.US), MicroStrategy (MSTR.US), CleanSpark (CLSK.US), Coinbase (COIN.US) and Marathon Digital (MARA.US).

Cleanspark stock price, source: xStation 5

Cleanspark stock price, source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.