- U.S. indexes open up as much as 1.00% higher.

- Technology companies are again the leaders in growth.

- Apple and Alphabet about potential AI Gemini integration.

- High hopes around Nvidia conference.

The beginning of the new week on Wall Street looks interesting. At the opening of the cash session, U.S. indexes are gaining even 1.50%. US500 is quoted 0.90% higher at 5230 points, US100 gains nearly 1.50% to the level of 18340 points, and US2000 loses 0.15% to 2060 points. Nonetheless, we also observe a slight increase in the value of the dollar (USDIDX) and a renewed rise in the yield of U.S. bonds to the level of 4.32%.

Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

In the market, we observe high interest in information coming from the technology and AI sector on one hand, and nervousness ahead of the upcoming Fed and BoJ decisions on the other. Today, the 4-day Nvidia GTC conference began, which will last until March 21, i.e., Thursday. Market interest and hopes are definitely high. In the first part of the session, we observe increases in technology sector companies, especially AI and GPU. Investors hope for progress in chip development, the announcement of a new GPU model, and new partnerships formed at the conference between companies. On the other hand, we can also notice that part of the capital in the market is returning to safe assets such as the dollar and bonds. This week, Fed and BoJ will publish their decisions, and in both cases, the opinion of the central banks will be extremely important. Hawkish Powell may restore markets to balance, while from BoJ, an expectation is there that it will make a historic interest rate hike.

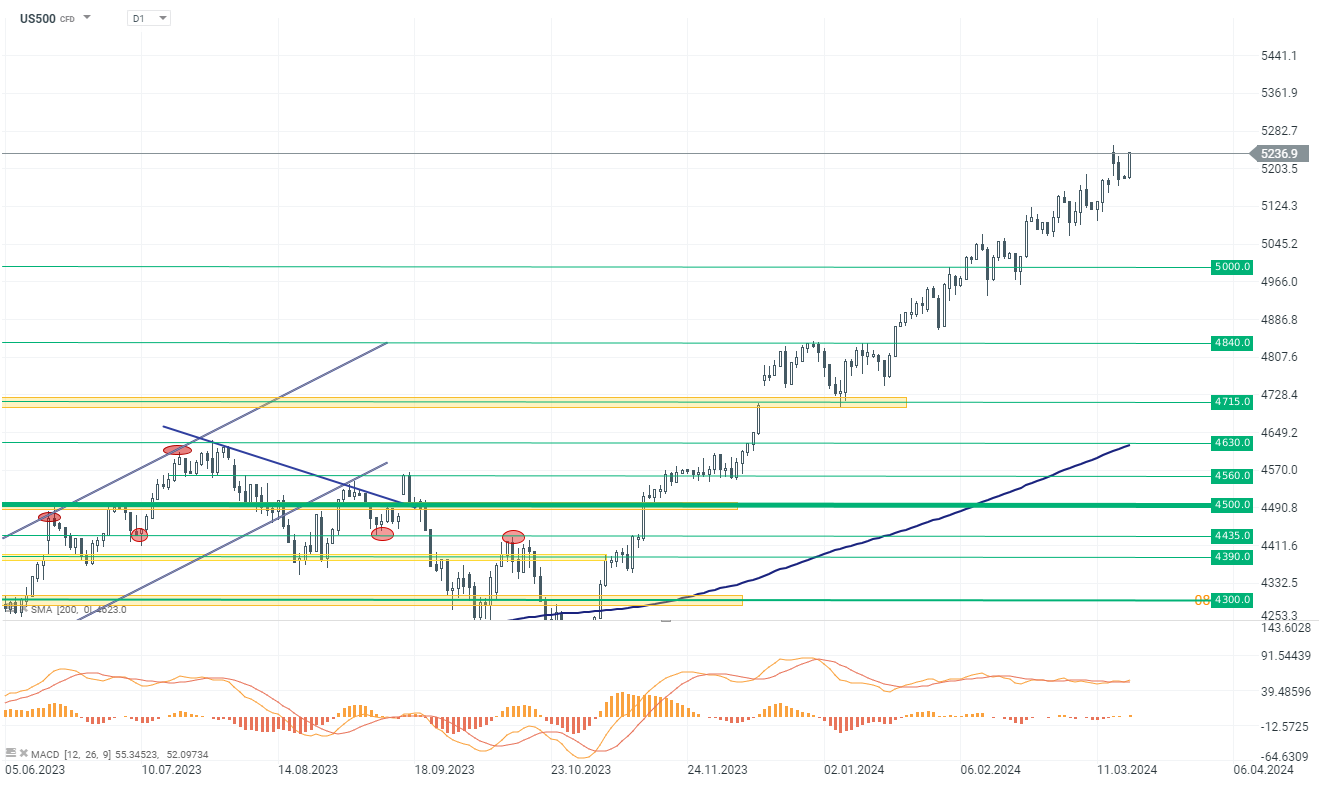

US500

The index continues its upward journey, and the long-awaited correction still does not occur. Since the end of January, quotes have been moving in a very narrow and dynamic upward channel, and every few sessions, they set new ATHs (All-Time Highs).

Source: xStation 5

Company News

Alphabet (GOOGL.US) gains as much as 6.50% following reports of Apple's interest in licensing Google's Gemini suite of AI tools for future iPhones. Gemini includes chatbots and coding assistants, and its integration is expected to introduce new features in iPhones later this year.

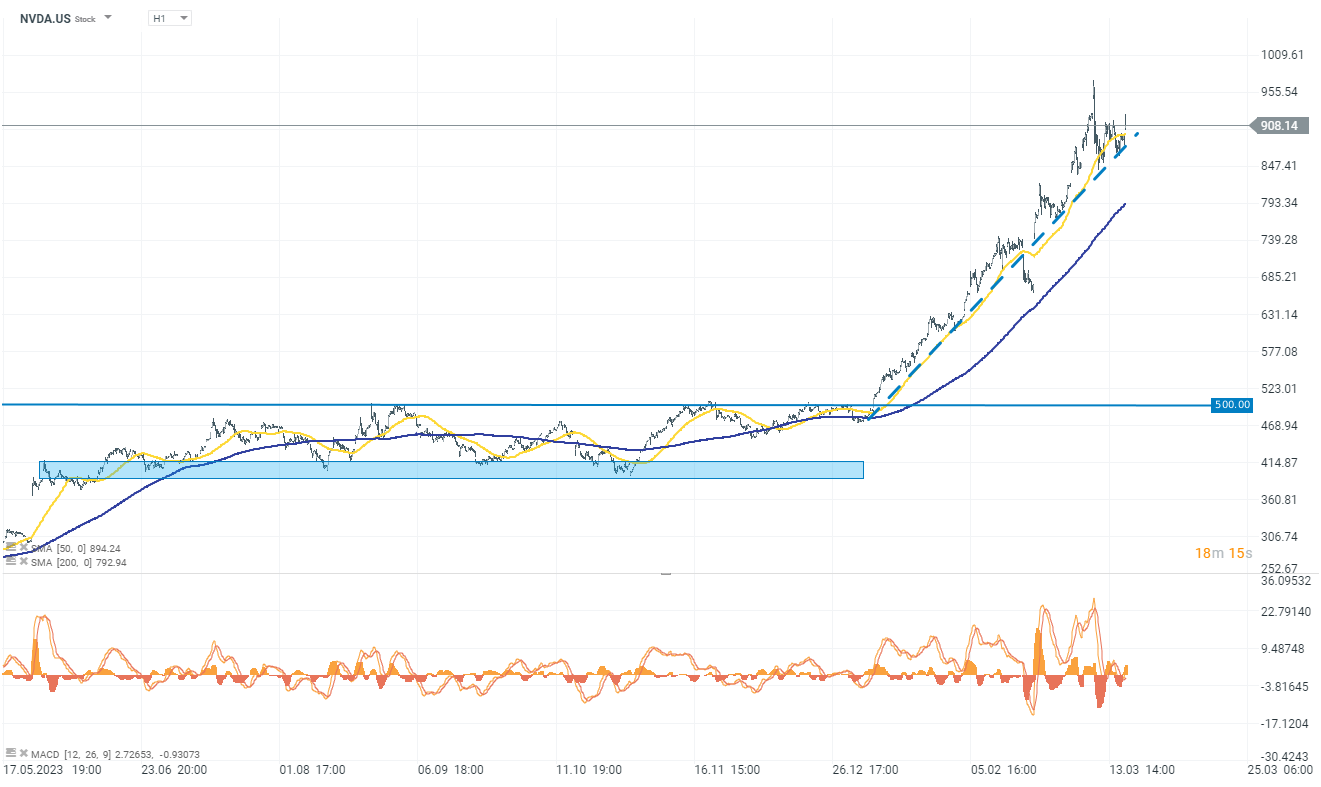

source: xStation 5

Nvidia (NVDA.US) Shares increased by 3.40% in anticipation of its annual GTC conference and CEO Jensen Huang's keynote. Wall Street's focus is on Nvidia's new Blackwell B100 AI chip. The B100 is set to be a significant development in the AI industry, and investors are keen on details like pricing, memory usage, and release date. HSBC raising Nvidia price target to $1,050.

Source: xStation 5

Intuitive Surgical's (ISRG.US) obtained the FDA's 501(k) clearance of the da Vinci 5, their new multiport robotic system. CEO Gary Guthart expressed satisfaction with this advancement. Analysts are optimistic about the system's impact on the company's long-term financial profile and see it as a catalyst for a multiyear revenue driver.

Shift4 Payments (FOUR.US) fell almost 10% after a memo from CEO Jared Isaacman indicated that buyout offers undervalued the company. The board deemed these offers as insufficient.

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.