- US indices launched today's cash trading higher

- ISM manufacturing at 3:00 pm GMT

- FOMC minutes at 7:00 pm GMT

- Salesforce (CRM.US) surges on restructuring plan

Three major Wall Street indices launched today's session in green, with Dow Jones trading 0.4% higher, while the S&P 500 and Nasdaq rose 0.6% and 0.5% respectively as traders brace themselves for ISM Manufacturing PMI data release and the FOMC minutes, which could potentially offer critical insight into the next move in interest rates and the health of the US economy. Stocks gain even despite hawkish comments from FED's Kashkari, which said that despite signs of inflation peaking, the pace of tightening should be maintained at the next few FOMC meetings until policymakers will be confident that inflation has peaked.

S&P 500 index stocks categorized by sectors and industries. Size represents market cap. Source: xStation5

Start investing today or test a free demo

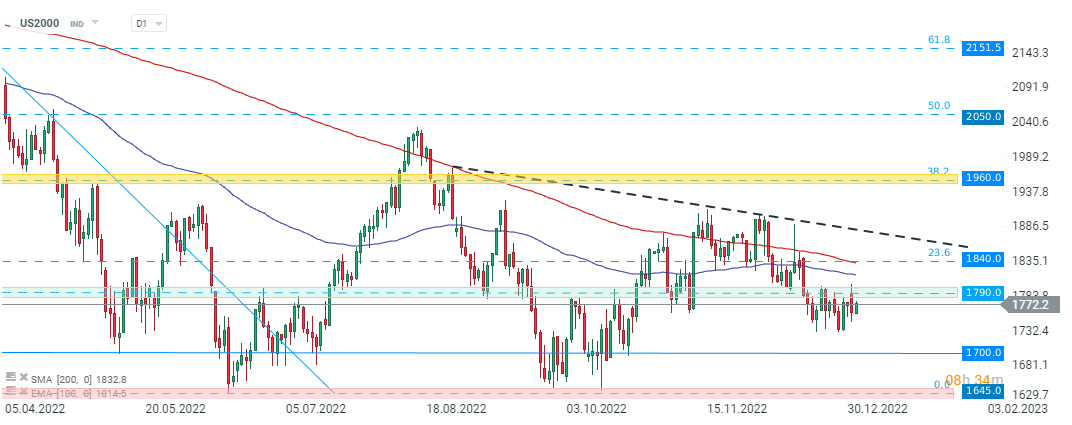

Open account Try demo Download mobile app Download mobile app US2000 pulled back sharply yesterday as buyers again failed to break above major resistance at 1790 pts, which is marked with previous price reactions. As long as price sits below this level, downward move may deepen towards support at 1700 pts or even 1650 pts where Octobers lows can be found. On the other hand, moods improved slightly during today's session and buyers may launch another attack on the aforementioned resistance zone. Should break higher occur, key resistance at 1840 pts may be at risk. Source: xStation5

US2000 pulled back sharply yesterday as buyers again failed to break above major resistance at 1790 pts, which is marked with previous price reactions. As long as price sits below this level, downward move may deepen towards support at 1700 pts or even 1650 pts where Octobers lows can be found. On the other hand, moods improved slightly during today's session and buyers may launch another attack on the aforementioned resistance zone. Should break higher occur, key resistance at 1840 pts may be at risk. Source: xStation5

Company news:

Salesforce (CRM.US) stock surged nearly 5.0% in off-hours trading after the cloud giant revealed restructuring plan that includes lay off about 10% of its employees and the closure of some offices.

Salesforce (CRM.US) stock launched today's session with a bullish price gap and is trading above local support at $140.00. Nevertheless as long as price sits below lower limit of the descending channel, main sentiment remains bearish. Source: xStation5

Apple (AAPL.US) stock jumped over 1.0% in premarket, attempting to erase some of yesterday's sharp losses. On Tuesday, the iPhone maker's stock market value fell below $2 trillion for the first time since March 2021.

Shares of Chinese companies listed in the US rose sharply after Ant Group received permission from China’s securities regulators to raise capital. Alibaba (BABA.US), which owns 33% of Ant, and JD.com (JD.US) rose more than 8.0% and 6%% before the opening bell.

Target (TGT.US) shares dropped over 1.6% in off-hours trading after Wells Fargo downgraded the retailer to “equal weight” from “overweight”, saying company is not an attractive investment amid broader economic uncertainty.

Microsoft (MSFT.US) stock plunged over 3.0% in premarket after UBS downgraded tech giant to “neutral” from “buy” as it expects deteriorating growth of its cloud computing platform Azure.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.