-

Wall Street opens higher after relatively worse macro data

-

Jobless Claims lower than expected and GDP declines

-

Meta Platforms is on a roll after beating financial results

Today's calendar is quite intense. Investors have already received several key economic data on the US economy, as well as financial reports from important companies. At 1:30 (BST time) there was a publication of GDP, PCE and Jobless Claims data.

Even though the Gross Domestic Product (GDP) only grew by 1.1%, which is lower than the expected 1.9% and the previous quarter's 2.6%. In the first quarter, final sales made to domestic buyers increased by a much stronger 3.2%. This may suggest that there is no immediate risk of a recession. The current data will probably strengthen the Federal Reserve's commitment to raise rates by 25pb in the upcoming meeting in early May, to combat the core inflation.

At the same time PCE data was released. The core inflation increased more than anticipated to 4.9% Q/Q compared to 4.7% expected.

The last important publication was Jobless Claims, which came as the only one better-than-expected. Jobless Claims fell to 230k, although this result is still higher than the data in recent months. This was contrary to expectations of a small increase.

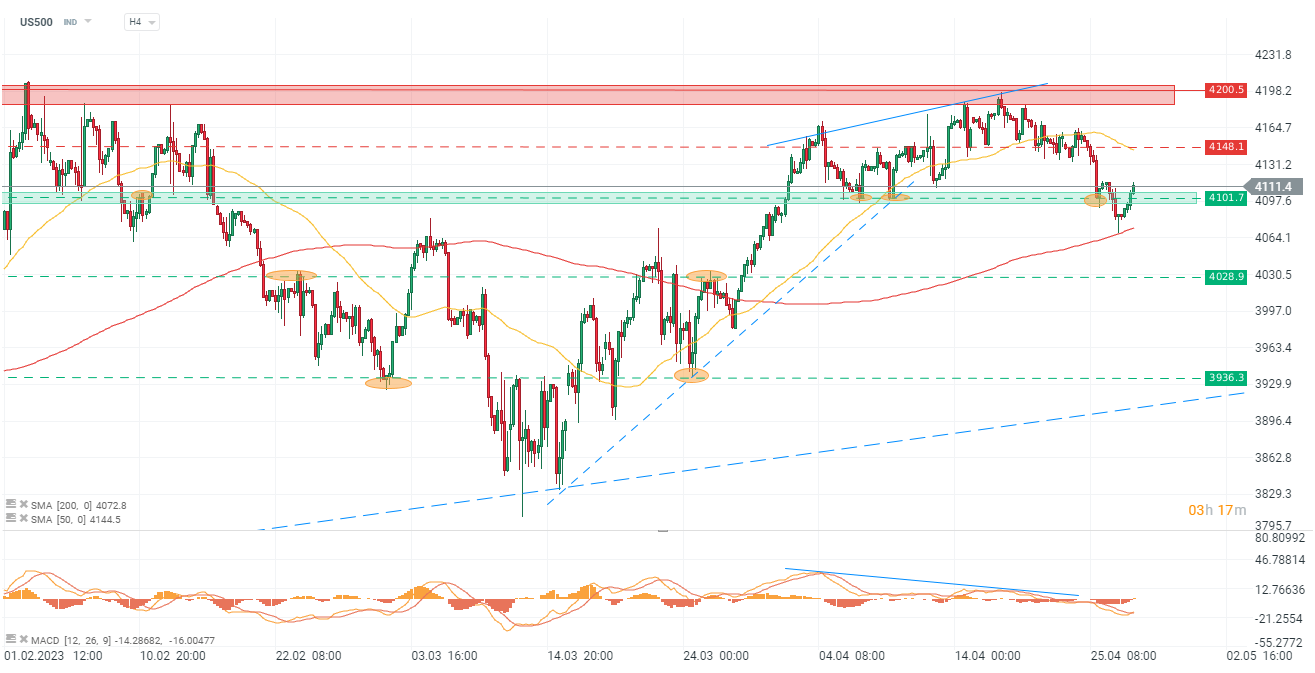

US500, the current index price is 4112 points. The price has broken through the resistance level at 4100 after rebounding from the 50 day SMA.The price has returned to the consolidation range, which suggests that there may be a lack of momentum for the index to continue to rise. Traders and investors may want to closely monitor the index to see if the price can break out of this consolidation range and establish a new upward trend, or if the price will continue to consolidate and potentially decline.

Company News

- Meta Platforms (META.US) rose as much as 14% on Thursday, after the company Q2 revenue beat expectations.

- EBay (EBAY.US) rose as much as 3.1% after the e-commerce company forecast better-than-expected net revenue for the second quarter. Analysts noted that the company’s focus categories, which include refurbished products and collectibles, outperformed the rest of the marketplace.

- Seres Therapeutics (MCRB.US) shares surge 9% after the developer of biological drugs received FDA approval for its therapeutics Vowst to prevent the recurrence of C. difficile infection (CDI) in adults.

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.