- Wall Street opens flat ahead of the crucial week

- Ten year bond yields head higher

- Micron (MU.US) rises after higher recommendation

- Oil nears $95 highlighting inflationary pressures

As the global markets brace for a series of central bank meetings this week, the US stock market fluctuates after the Friday selloff. Declines are also magnified by escalating oil prices nearing $95 a barrel thereby adding to the inflationary pressures. Benchmark Brent observed an 11% spike over a three-week rally in oil prices, a phenomenon posing challenges to central banks globally in mitigating inflation. The US Treasury yields witnessed a rise, with expectations of a tumultuous week ahead laden with policy determinations that could shape the economic landscape.

Central banks, including the Federal Reserve, the Bank of England, and the Bank of Japan, are preparing for policy announcements scheduled this week. Many analysts anticipate that they will issue strong warnings due to ongoing high inflation concerns. However, given the already high level of monetary tightening, decision makers might opt for a 'hawkish pause,' refraining from further interest rate hikes for the time being. This is also the case for the Fed, which is expected to leave the interest rates unchanged.

Currently, the markets are literally pricing in zero chances of a Federal Reserve interest rate hike at this week's decision. However, according to the same model, the probability of a hike in November already stands at 31%. Everything will depend on Jerome Powell's communication during the conference on Wednesday following the decision. Source: Bloomberg Finance L.P.

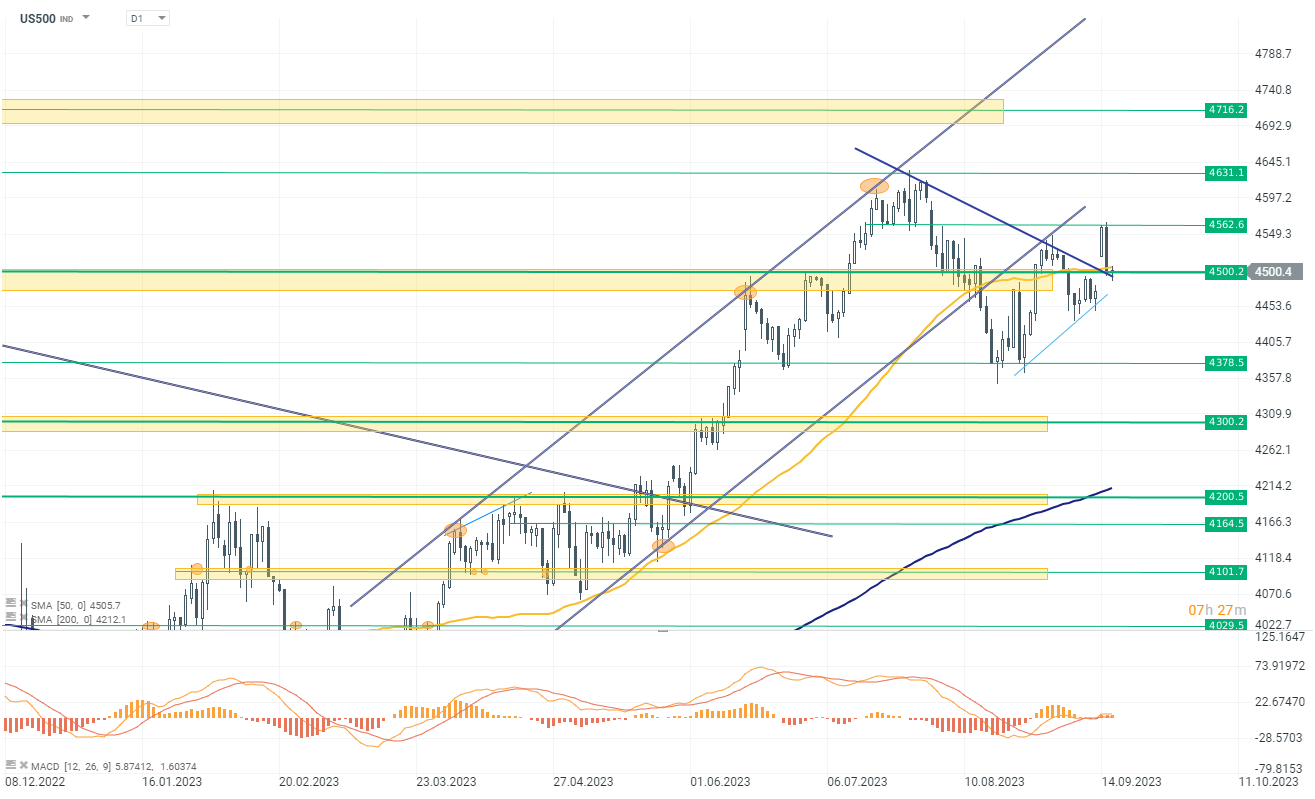

SPX (US500)

At today's Wall Street open, the market landscape exhibited mixed signals, with US stocks experiencing a slump on Friday and consumer sentiment slightly diminishing according to the University of Michigan Surveys of Consumers.

The US500 is currently trading at 4495, experiencing a slight 0.05% decrease today. It appears to be hovering around a critical support level at 4500 points. The index price retraced back to the base after recently breaking this level and subsequently retracing from the 4560 level. If selling pressure persists, a potential break below 4500 could be anticipated, with support zones at 4380-4400 emerging as the next levels to monitor. Conversely, the 4560 resistance level remains a significant hurdle for further upward movement. The upcoming week is expected to introduce heightened market volatility, making it a pivotal period for traders and investors.

Company News

Alteryx (AYX.US) shares experienced a 3.5% surge in US market trading after receiving an upgrade from equal-weight to overweight by Morgan Stanley. The rationale behind the upgrade was that the current valuation undervalues the company's growth and profit potential. They attribute Alteryx's weak first-half results to a challenging customer spending environment rather than heightened competition. Singh expects a future improvement in the budgetary environment, combined with an enhanced cloud portfolio, to lead to stabilization in new business.

Apple (AAPL.US) rises as much as 1.5%. Analysts are positive on the tech company’s pre-orders for the latest iPhone 15, saying data so far is surpassing expectations and could bode well for the shares if momentum is sustained.

PayPal (PYPL.US) experienced a 1.7% decline following a downgrade from outperform to market perform by MoffettNathanson analyst Lisa Ellis. This downgrade is based on expectations of sluggish gross profit growth and a deceleration in earnings per share (EPS) growth due to intense competitive pressure in both branded and unbranded checkout markets. While the analyst is enthusiastic about the company's new beginning under incoming CEO Alex Chriss, she also anticipates a challenging road ahead in the coming year. The price target for PayPal was revised down from $85 to $75.

Micron (MU.US) shares surged by up to 1.7% after US market open following an upgrade from hold to buy by Deutsche Bank. The analyst raised Micron's price target to $85 from $65, attributing the bullish outlook to a faster-than-expected improvement in DRAM chip prices. This turnaround in DRAM prices came about a quarter earlier than initially anticipated, driven by robust demand for AI servers. Deutsche Bank believes these price gains will be sustainable, backed by positive supply chain assessments, and anticipates further acceleration in the next two quarters. Moreover, they expect Micron to guide 1Q revenue and EPS above current Street estimates.

Source: xStation 5

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.