-

Wall Street indices open mixed ahead of Fed decision

-

FOMC almost certain to deliver 25 bp rat hike

-

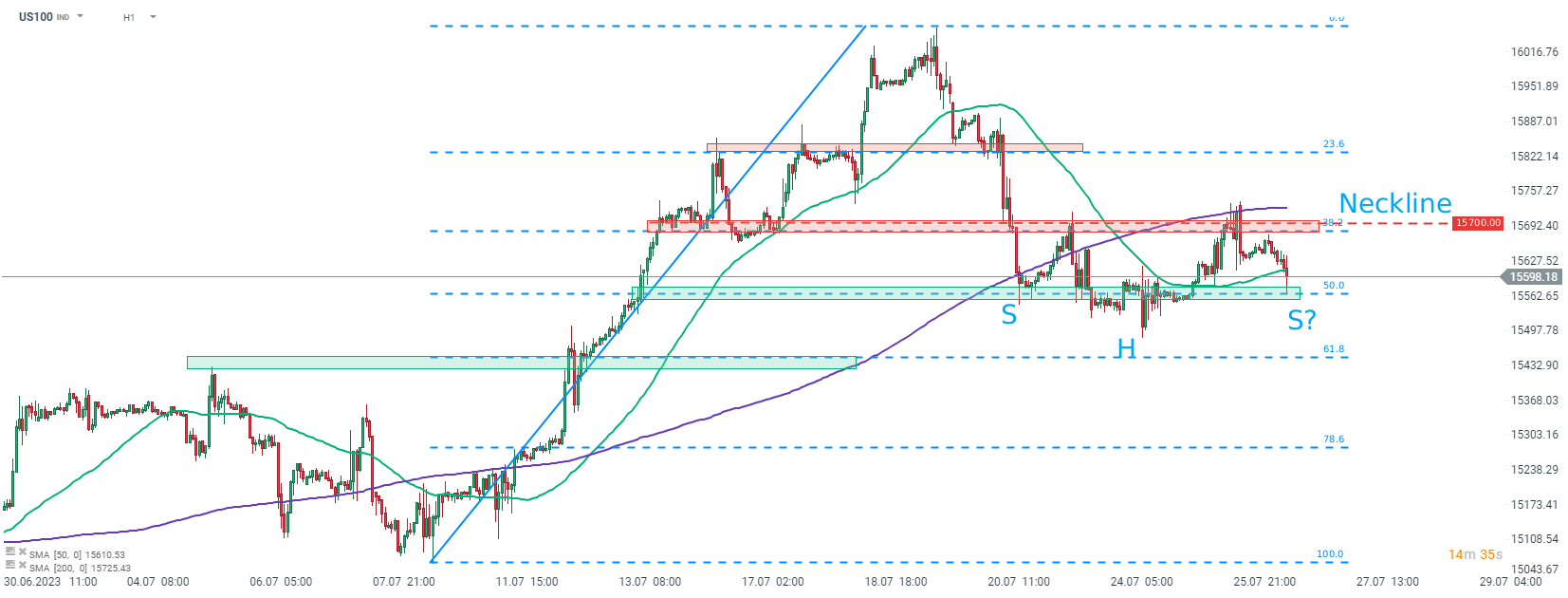

US100 with potential inverse head and shoulders pattern

Wall Street indices launched today's trading mixed. S&P 500 and Nasdaq dropped at the opening, Dow Jones traded flat and Russell 2000 gained slightly.

FOMC rate decision at 7:00 pm BST is a big event of the day. Market is almost 100% sure that the US central bank will decide on a 25 basis point rate hike after pausing at the June meeting. Having said that, guidance for the next meetings will be crucial. Fed Chair Jerome Powell will likely stick to its previous message that one more 25 basis point rate hike will likely come later this year. Check out our preview of today's decision here.

Source: xStation5

Source: xStation5

Taking a look at Nasdaq-100 futures (US100) at H1 interval, we can see that the index is trading in an interesting technical spot. After two failed attempts at breaking back above the 38.2% retracement of recent upward impulse, an inverse head and shoulders pattern began to build on the chart. Price is testing area marked with 50% retracement at press time and should bulls manage to defend it, the right should of the pattern would be painted. In such a scenario, a break back above the 15,700 pts area could signal that a large upward move is looming. However, a dovish Fed may be needed for this scenario to materialize.

Company News

Amazon (AMZN.US) launched today's slightly lower. The move comes after Politico reported that the US Federal Trade Commission (FTC) is finalizing a long-awaited lawsuit against the company. The lawsuit will challenge a number of Amazon's practices and rules that restrict competition. In the most dramatic scenario it could break up parts of the company but it will likely take a long time before any action is taken.

PacWest (PACW.US) jumped on news that it will merge with its smaller rival, Bank of California. A bank with $36 billion in combined assets will be create through an all-stock merger and an additional $400 million of new shares will be sold to private equity firms Warburg Pincus and Centerbirdge Partners.

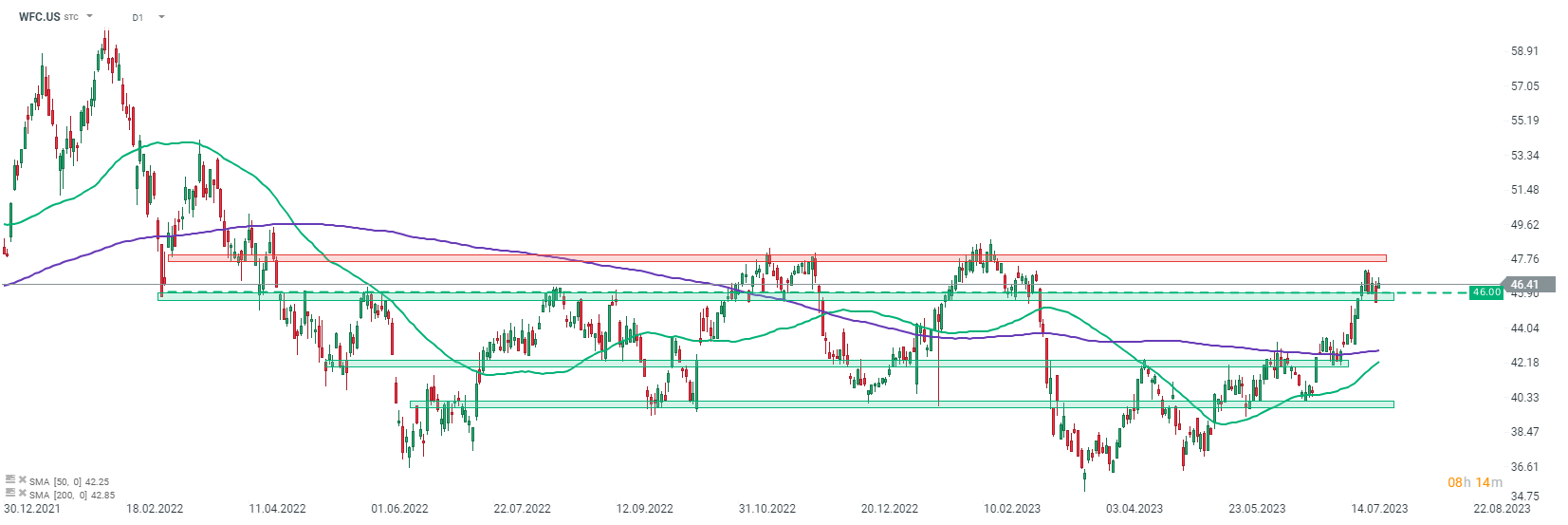

Wells Fargo (WFC.US) trade higher after the bank announced a $30 billion share repurchase programme. Well Fargo said that Board approved a dividend increase from $0.30 to $0.35 that was previously announced and that it has authorized a buyback of $30 billion worth of shares.

Dish (DISH.US) stock jumped following Bloomberg report that Amazon plans to begin offering cheap wireless plans from Dish through its platform. According to Bloomberg, deal was finalized and products may be offered through Amazon as soon as this week.

Wells Fargo (WFC.US) launched today's trading higher after announcing a buyback programme. Stock bounced off the $46.00 support and traded around 3% higher at one point. However, part of the gain has been already erased. Source: xStation5

Wells Fargo (WFC.US) launched today's trading higher after announcing a buyback programme. Stock bounced off the $46.00 support and traded around 3% higher at one point. However, part of the gain has been already erased. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.