- US stocks open sharply lower

- US, Conference Board consumer confidence well below expectations

- Applied Materials (AMAT.US) stock under pressure after analyst downgrade

US indices launched today's session sharply lower as a spike in Treasury yields dragged tech shares down. The ongoing energy crisis increased inflation fears and the yield on the benchmark 10-year Treasury note surged past 1.55%, the highest since June 17th. Nasdaq Composite fell more than 2.0%, near its lowest level in a month, while the S&P 500 fell 1.4% and the Dow Jones Industrial Average fell 1.0%. Also weak economic data weigh on market sentiment. The Richmond Manufacturing Index fell to -3 in September, its lowest level since May 2020, while US Conference Board consumer confidence for September dropped to 109.3, well below analysts' expectations of 114.5. Investors now focus on Fed Chair Powell and Treasury Secretary Janet Yellen's testimony on the Coronavirus and Cares Act before the Senate.

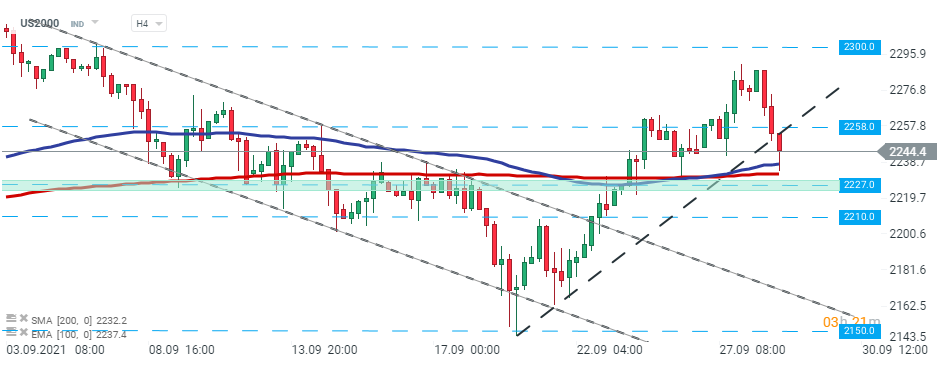

US2000 fell sharply during today’s session. Index broke below the upward trendline and is currently approaching strong support at 2227 pts which is additionally strengthened by EMA 100 (purple line) and 200 SMA (red line). Should break lower occur, then downward move may be extended to the 2210 pts handle or even support at 2150 pts. On the other hand, if buyers manage to halt decline, then another upward impulse towards resistance at 2300 pts may be launched. Source: xStation5

US2000 fell sharply during today’s session. Index broke below the upward trendline and is currently approaching strong support at 2227 pts which is additionally strengthened by EMA 100 (purple line) and 200 SMA (red line). Should break lower occur, then downward move may be extended to the 2210 pts handle or even support at 2150 pts. On the other hand, if buyers manage to halt decline, then another upward impulse towards resistance at 2300 pts may be launched. Source: xStation5

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appCompany news:

Applied Materials (AMAT.US) shares fell 3.6% in the premarket after New Street downgraded the stock of semiconductor equipment producer to “neutral” from “buy,” due to high valuation and limited upside potential.

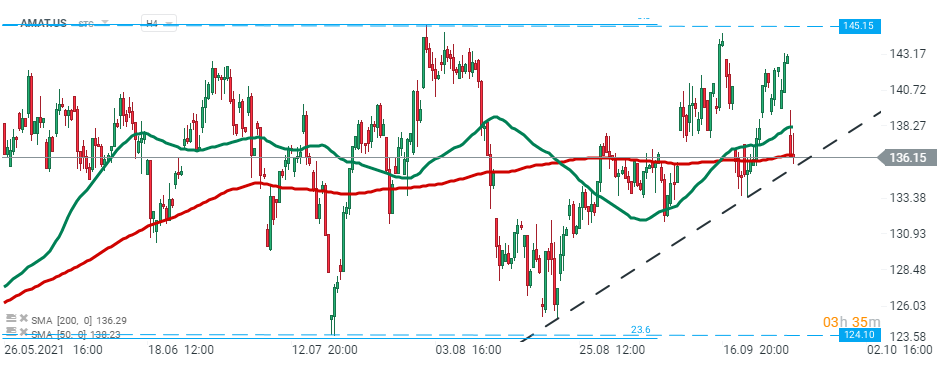

Applied Materials (AMAT.US) stock launched today’s session lower and is currently testing an upward trendline which coincides with the 200 SMA ( redline). Should break lower occur, then downward move may accelerate towards support at $124.10 which coincides with 23.6% Fibonacci retracement of the upward wave launched back in September 2020. On the other hand, if buyers manage to regain control, then another upward impulse toward all-time high at $145.15 may be launched. Source: xStation5

Applied Materials (AMAT.US) stock launched today’s session lower and is currently testing an upward trendline which coincides with the 200 SMA ( redline). Should break lower occur, then downward move may accelerate towards support at $124.10 which coincides with 23.6% Fibonacci retracement of the upward wave launched back in September 2020. On the other hand, if buyers manage to regain control, then another upward impulse toward all-time high at $145.15 may be launched. Source: xStation5

Ford (F.US) stock jumped over 3% in premarket after the company together with its South Korean partner SK Innovation announced plans to build a new U.S. electric vehicles assembly plant and three battery factories worth over $11 billion.

FactSet (FDS.US) reported quarterly earnings of $2.88 per share, beating analysts’ estimates of $2.72 per share. The financial information provider revenue also topped market forecasts, thanks to higher sales of analytics, content and technology solutions.

Thor Industries (THO.US) stock rose over 3% in premarket after the recreational vehicle maker reported better than expected quarterly figures. Company earned $4.12 per share, well above analysts’ expectations of $2.92 a share. Revenue also beat market projections. Company announced demand for RVs remains strong, with backlogs at a record high.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.