- US indices open higher amid speculations of possible slowdown in interest rates hikes

- Apple is stable amid expectations of sustained iPhone Sales this year

- Rivian is down more than 1% at the open, despite better results but with worse expectations

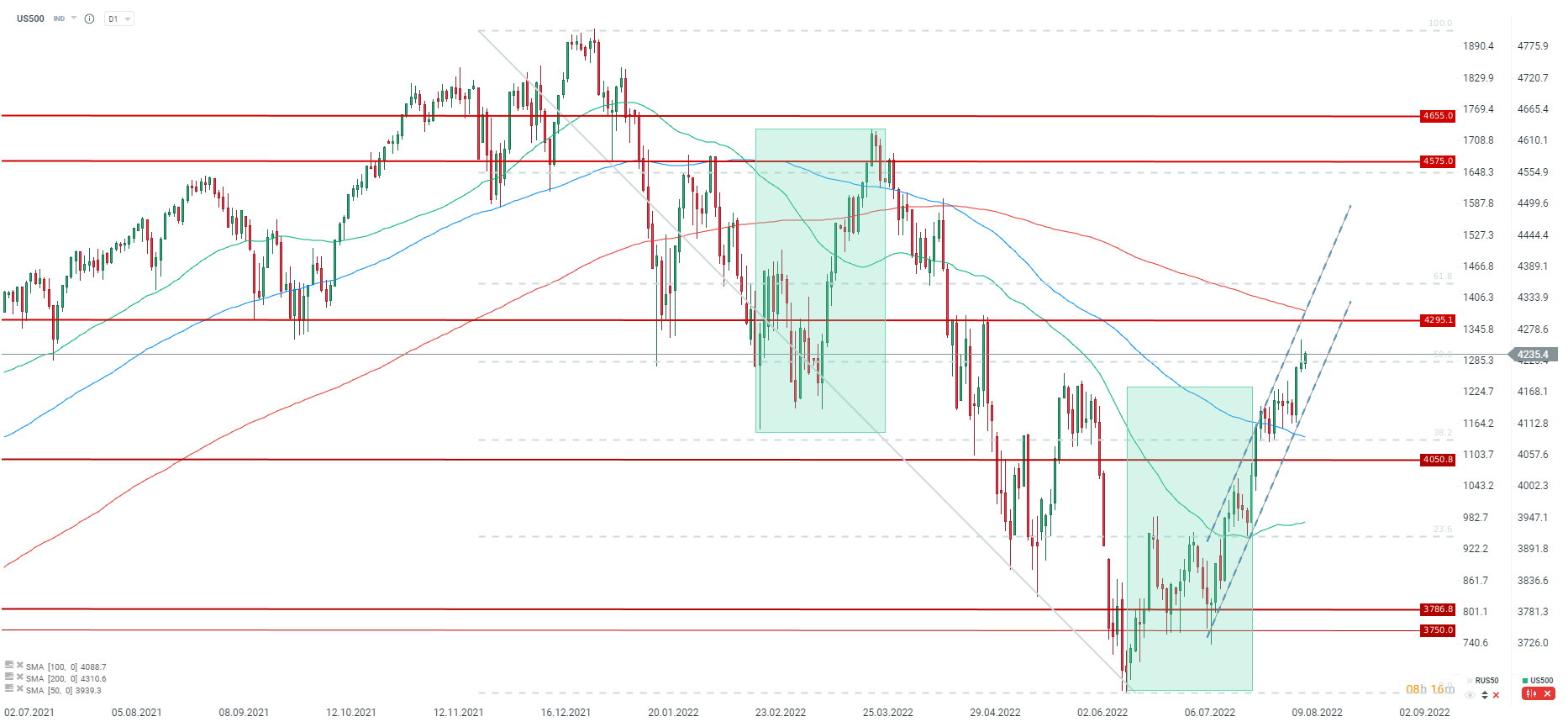

US500 is set for another weekly gain, mainly due to signs of inflation cooling. After marginal loss yesterday, S&P 500 cash index started about 0,5% higher. US500 (S&P 500 fut.) is still slightly above 50% Fibonacci retracement of the whole downward wave from the first half of the year. Bulls will be looking at vicinity of 4300 points and 200 SMA which is slightly above mentioned resistance. On the other hand, the nearest support zone can be seen between 4180 and 4200. Moreover, current correction wave should be intact as long the price stays in upward trend channel. Source: xStation5

US500 is set for another weekly gain, mainly due to signs of inflation cooling. After marginal loss yesterday, S&P 500 cash index started about 0,5% higher. US500 (S&P 500 fut.) is still slightly above 50% Fibonacci retracement of the whole downward wave from the first half of the year. Bulls will be looking at vicinity of 4300 points and 200 SMA which is slightly above mentioned resistance. On the other hand, the nearest support zone can be seen between 4180 and 4200. Moreover, current correction wave should be intact as long the price stays in upward trend channel. Source: xStation5

Company news:

Rivian (RIVN.US) is in spotlight after electric car maker reported better than expected financial results in the second quarter of the year. Rivian reported revenue of 264 million dollars versus 337.5 million dollars expected. The loss was 1.62 USD per share and it was slightly less than 1.62 USD loss expected. The company also confirmed that expects to make about 25k vehicles in 2022, in line with guidance and it has 98 net preorders for its R1-series truck ans SUV. On the other hand, company sees deeper losses for the whole year due to further supply-chain issues. EBITDA is set to come at negative 5.4 billion dollars which is higher than previously expected 4.75 billion dollars loss. Rivian is loosing about 1,5% after the start of US session. Rivian is still about 80% down from all-time high.

Apple (AAPL.US) asked its suppliers to produce as many iPhone this year as in 2021. Despite possible slowing down in consumer purchasing power, Apple wants to make and sell 90 million of its newest iPhone model. Totally, Apple wants to make and sell 220 million devices in 2022 which means that company is confident about its future. Apple is up 0.8% after the opening bell.

Rivian is close to 40 USD per share and more than 100% higher than all-time low from May. However, the price is still about 80% lower than all-time high and momentum is not quite strong. The key resistance is around 58 USD per share, close to 23.6 Fibonacci retracement. On the other hand the nearest support can be found close to 29 and 30 USD per share. Source: xStation5

Rivian is close to 40 USD per share and more than 100% higher than all-time low from May. However, the price is still about 80% lower than all-time high and momentum is not quite strong. The key resistance is around 58 USD per share, close to 23.6 Fibonacci retracement. On the other hand the nearest support can be found close to 29 and 30 USD per share. Source: xStation5

Company news from Wall Street. Source: Bloomberg

Company news from Wall Street. Source: Bloomberg

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.