- Wall Street indices trade higher

- US500 breaks above 50- and 200-hour moving averages

- Western Alliance jumps on deposit growth

Wall Street indices launched today's cash trading higher with S&P 500 jumping 0.5% and Nasdaq-100 moving 0.4% higher at the opening. This comes after a rather downbeat trading in Asia-Pacific and an upbeat trading in Europe earlier today. Still, no breakthrough was made on debt ceiling and the latest comments from Republicans and Democrats suggest that agreement may not be reached until next week. As both sides are trying to secure the most beneficial deal for their party, it looks likely that deal may not be reached until last minute and will likely be a short-term solution.

Source: xStation5

Source: xStation5

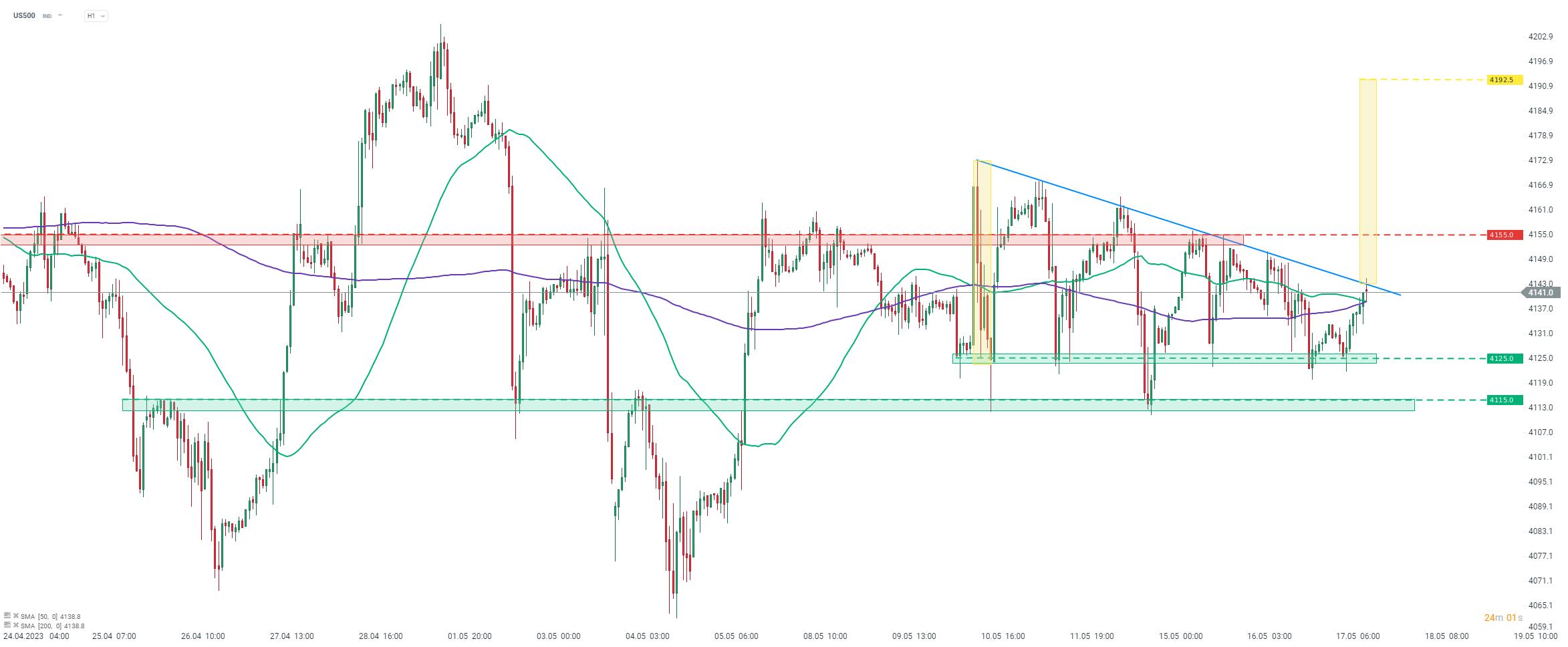

S&P 500 futures (US500) are closing in on an important technical resistance - a short-term downward trendline. Index broke above the 50- and 200-hour moving averages earlier today, green and purple lines respectively, and is now testing the aforementioned trend line. A break above would pave the way for a move towards another important short-term swing level in the 4,155 pts area. However, bulls may not stop there - note that a textbook range of the bullish breakout from the triangle pattern suggests a possibility of a 50 points upward move. This suggests a possibility of a move towards the 4,192.5 level.

Company News

Target (TGT.US) released an earnings report for fiscal-Q1 2024 (calendar February-April 2023) today ahead of the Wall Street session open. Results turned out to be a positive surprise with sales matching estimates but profits coming in above. Sales at $24.95 billion were 0.5% YoY higher (exp. $24.97 billion) while EBITDA of $2.02 billion turned out to be 1.1% YoY lower (exp. $1.81 billion). Adjusted EPS dropped from $2.19 in fiscal-Q1 2023 to $2.05 now but still came above expected $1.77. While the number of customer transactions was 0.9% YoY higher, average transaction amount dropped 0.9% YoY (exp. +0.2% YoY). Company provided a rather lackluster guidance for fiscal-Q2 with adjusted EPS seen in the $1.30-1.70 range (exp. $1.91).

Western Alliance (WAL.US) is trading higher after the latest deposit update. Bank said that its deposits grew by more than $2 billion since the end of Q1 2023 (as of May 12, 2023). Quarter-to-date deposit growth was said to be $1.8 billion in a previous report (dated May 9, 2023). This means that the company has managed to attract around $200 million in deposits between May 9 and May 12.

TJX (TJX.US) reported fiscal-Q1 2024 earnings report today (calendar February-April 2023). Company reported a 3.3% YoY increase in net sales, to $11.78 billion (exp. $11.82 billion) and a 3.0% YoY increase in comparable sales (exp. +3.1% YoY). EPS increased from $0.49 in fiscal-Q1 2023 to $0.76 now. Merchandise inventories dropped 7.9% YoY, to $6.44 billion (exp. $6.84 billion). TJX expects EPS for fiscal-Q2 2024 to reach $0.72-0.75 with comparable sales growing 2-3%. Adjusted EPS forecast for full fiscal-2024 was boosted from $3.29-3.41 range to $3.39-3.48 range.

Tesla (TSLA.US) trades slightly higher today following the annual shareholder meeting yesterday. Elon Musk, company's CEO, said that first deliveries of Cybertrucks are expected later this year. Moreover, Musk said that Tesla will engage more in marketing and begin to advertise its vehicles.

Tesla launched today's trading slightly higher following the shareholder meeting. However, stock started to erase those gains and it looks like another attempt at breaking above the $155 resistance zone. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.