- Wall Street open higher after soft US CPI reading

- Headline US inflation drops below core gauge for the first time since late-2020

- American Airlines project lower-than-expected EPS in Q1 2023

Wall Street launched today's cash trading higher as risk assets caught a bid following softer than expected US CPI print for March. Headline inflation dropped from 6.0 to 5.0% YoY (exp. 5.2% YoY) while core gauge climbed from 5.5 to 5.6% YoY as expected. It means that US core CPI is now higher than headline CPI - the first such situation since late-2020. This is possible thanks to a negative contribution from fuel inflation as oil prices dropped significantly year-over-year. Market odds of a 25 basis point Fed rate hike at the May meeting are still higher than 50% but have dropped following CPI data today. Nevertheless, acceleration in the core gauge should be seen as a source of worry.

Fuel contributed negatively to US CPI reading for March. Source: Bloomberg, XTB

Fuel contributed negatively to US CPI reading for March. Source: Bloomberg, XTB

Wall Street caught a bid after dovish CPI print. Taking a look at Nasdaq-100 (US100) chart at D1 interval, we can see that the index tested a recently-broken price zone near 38.2% retracement, this time as a support, and bulls managed to defend it. However, much of the post-CPI gain was already erased. The index continues to trade within an upward channel and a positive price reaction to support retest suggests that upward move may be about to accelerate. In such a scenario, the first resistance zone to watch can be found ranging around 50% retracement in the 13,620 pts area.

Source: xStation5

Source: xStation5

Company News

Bed, Bath & Beyond (BBBY.US) trades higher today after the company informed that it raised $48.5 million via at-the-market share offering as of April 10, 2023. The company aims to raise as much as $300 million by April 26, 2023 as it seeks funds to avert bankruptcy.

Emerson Electric (EMR.US) is set to buy National Instruments for $8.2 billion in a cash transaction. An offer translating to $60 per share, represents an over-14% premium over yesterday's closing price ($52.58).

American Airline stock (AAL.US) trades slightly lower after the company said it expects adjusted EPS for Q1 2023 to come in at $0.01-0.05, lower than $0.06 in analysts' median forecast. Company reported a preliminary Q1 revenue at $12.19 billion - more or less in-line with $12.21 billion expected by the market.

Analysts' actions

- Global Payments (GPN.US) was upgraded to "buy" at Goldman Sachs. Price target set at $127.00

- Las Vegas Sands (LVS.US) rated "buy" at Roth MKM. Price target set at $74.00

- Dow (DOW.US) upgraded to "overweight" at Piper Sandler. Price target set at $118.00

- LyondellBasell (LYB.US) upgraded to "overweight" at Piper Sandler. Price target set at $68.00

- Confluent (CFLT.US) upgraded to "overweight" at Morgan Stanley. Price target set at $30.00

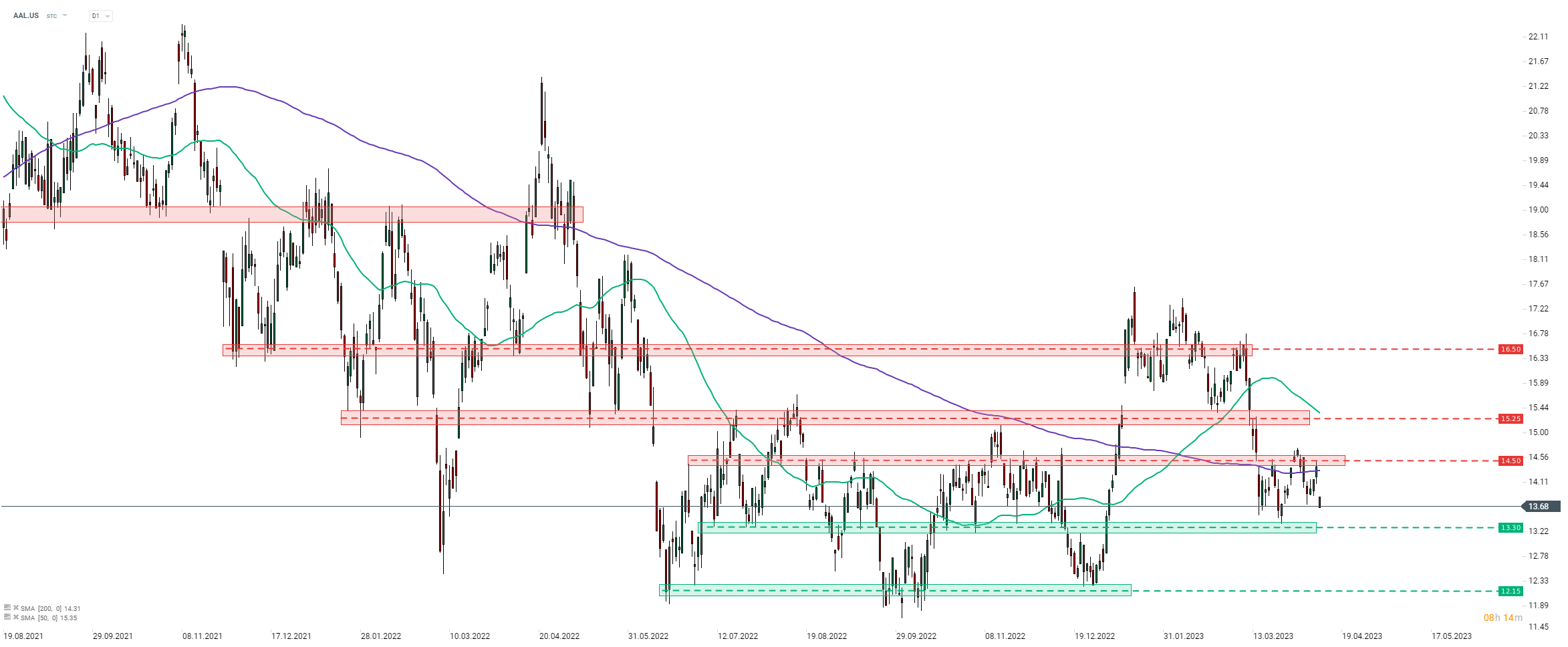

American Airlines (AAL.US) launched today's trading lower after the company warned that it is likely to miss Q1 earnings estimates. Stock is pulling back from the $14.50 resistance zone and unless bulls manage to regain control over the market, price may look towards a near-term support in the $13.30 area. Source: xStation5

American Airlines (AAL.US) launched today's trading lower after the company warned that it is likely to miss Q1 earnings estimates. Stock is pulling back from the $14.50 resistance zone and unless bulls manage to regain control over the market, price may look towards a near-term support in the $13.30 area. Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.