-

US indices launched today's trading lower

-

Dow Jones drops and approaches 35,100 pts support zone

-

Qualcomm and Etsy plunge after earnings

Wall Street indices launched today's cash session lower, following a mixed Asia-Pacific session and amid a downbeat trading in Europe, where major indices trade 1% lower. Drops on Wall Street at the beginning of the session were smaller than data but still - S&P 500 and Nasdaq opened around 0.5% lower, Dow Jones dropped 0.3% and Russell 2000 slumped 0.8% at session launch.

Economic calendar for the US session today is light and all important readings that could impact stocks were released already. Final services PMI for July was released at 2:45 pm BST and came in at 52.3 - slightly below 52.4 in flash reading. Services ISM was released at 3:00 pm BST and was expected to show a drop from 53.9 to 53.0 in July. Actual data showed a slightly deeper drop to 52.7, driven by plunge in Employment subindex. EIA will release weekly report on natural gas inventories at 3:30 pm BST but it should not have any impact on equities.

Source: xStation5

Source: xStation5

Dow Jones was halted on its way back towards all-time highs. Index is pulling back for another day in a row and is closing in on the 35,100 pts support zone, marked with a 78.6% retracement of a drop launched in early-2022. However, even a break below would not change a technical picture, at least for now. The lower limit of a local market geometry can be found around 34,730 pts and a break below would signal a bearish trend reversal. Until then, trend remains bullish and current pullback should be perceived as a correction.

Company News

Qualcomm (QCOM.US) reported fiscal-Q3 (April - June 2023) revenue at $8.44 billion (exp. $8.50 billion) as well as adjusted EPS at $1.87 (exp. $1.81). Company said that it expects $1.80-2.00 EPS in fiscal-Q4 as well as $8.1-8.9 billion in sales. Midpoints show that this was slightly weaker forecast than $1.91 EPS and $8.7 billion in revenue expected by the market. Company said that it continues to expect handset shipments to decline high-single digit this year amid slow recovery in China.

Moderna (MRNA.US) gained following the release of Q2 earnings. Company reported revenue of $344 million (exp. $320 million) and $3.62 loss per share (exp. $4.04). This is a massive plunge from $4.75 billion in sales report in Q2 2023 and was driven by a 94% drop in Covid vaccine sales. Net loss of $1.38 billion was reported in Q2 2023, compared to net income of $2.2 billion a year ago. Nevertheless, stock gains as the company said it expects $6-8 billion in Covid vaccine sales this year, up from previous forecast of $5 billion.

Etsy (ETSY.US) shares slumped after online retailer reported Q2 earnings yesterday after close of market session. Company reported $629 million in sales (exp. $619 million) and adjusted EPS of $0.45 (exp. $0.42). Gross merchandise sales reached $3.01 billion and were higher than $2.98 billion expected. While company managed to beat Q2 expectations, forecasts for Q3 2023 disappointed. Company expects gross merchandise sales to reach $2.95-3.10 billion (exp. $3.08 billion) and revenue to reach $610-645 million (exp. $632 million).

Warner Bros Discovery (WBD.US) reported Q2 2023 revenue at $10.36 billion, below $10.44 billion expected by analysts. Loss per share amounted to $0.51 and was deeper than $0.38 loss expected. While net loss reached $1.24 billion, it was a significant improvement compared to $3.42 billion loss in Q2 2022 ($1.50 per share). Global streaming subscribers dropped by almost 2 million compared to end-Q1 and reached 95.8 million (exp. 96.7 million). Nevertheless, shares gained as the company announced a tender offer to pay down $2.7 billion in debt.

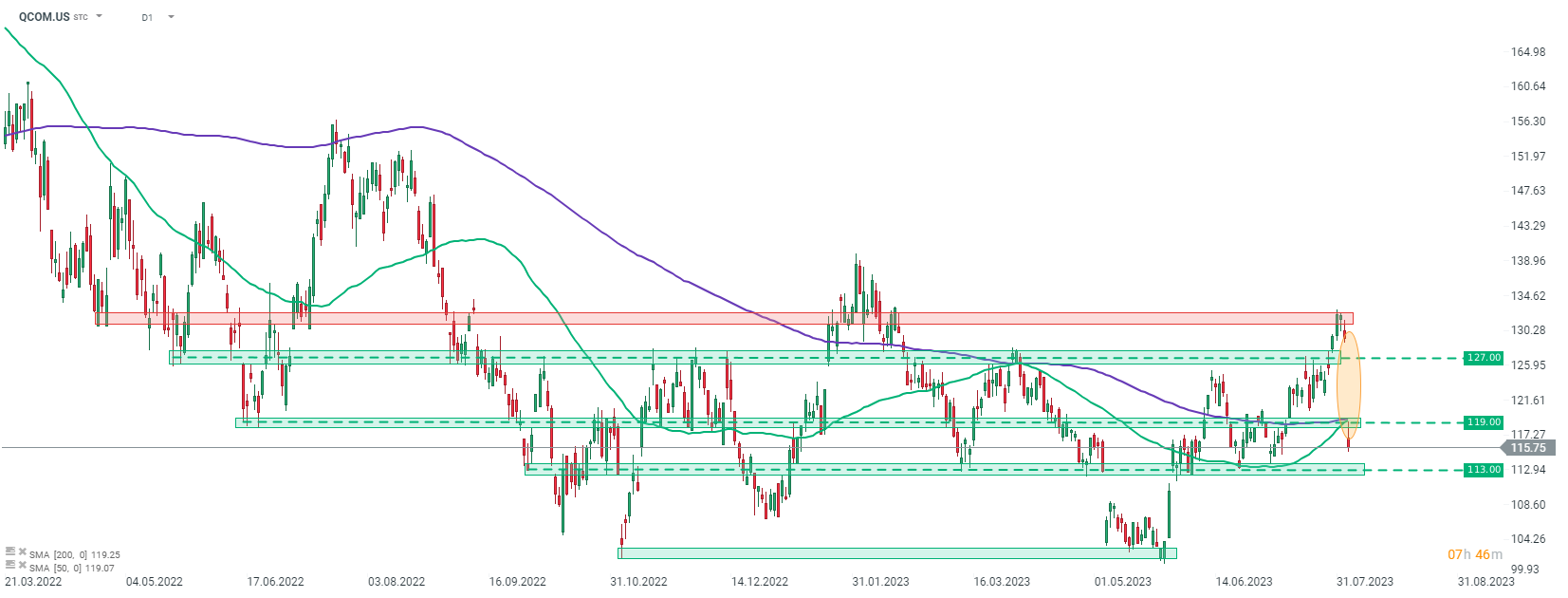

Qualcomm (QCOM.US) slumps over 10% after giving weak guidance for the current quarter. Stock plunged below 50- and 200-session moving average in the $119 area and continues to move lower. The next support zone in-line can be found in the $113 area - slightly more than 2% below current market price. Source: xStation5

Qualcomm (QCOM.US) slumps over 10% after giving weak guidance for the current quarter. Stock plunged below 50- and 200-session moving average in the $119 area and continues to move lower. The next support zone in-line can be found in the $113 area - slightly more than 2% below current market price. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

STM is growing stronger thanks to a new partnership with AWS!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.