- Wall Street opens lower as new quarterly reports came in

- Netflix, Tesla, TSMC, IBM and United Air quarterly results

- Blackstone became the first PE firm to manage $1 trillion

Wall Street opens lower as investors are digesting new quarterly results from the companies. SP500 declines 0.08% to 4560 points and Nasdaq 100 drops by 0.50% to 15750 points.

From markets

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app-

Blackstone has become the first private equity firm to manage $1 trillion, despite a decline in dealmaking that affected Q2 results, causing distributable earnings to fall by 39% to $1.2 billion.

-

Nasdaq futures have dropped in response to uncertain tech earnings.

-

Treasury yields are increasing, the yuan is strengthening following PBOC's intervention, and oil prices are climbing as gold stabilizes and wheat experiences its third day of gains. In an attempt to bolster the struggling property market, China is considering the relaxation of home-buying restrictions in its largest cities.

-

The Federal Reserve appears likely to implement a final 25 bp hike this cycle and maintain it until the year's end, as inflation relaxes. While the prospect of a US recession remains, survey results indicate that expectations of this have decreased from 63% to 58%.

US100 (Nasdaq 100 index) is currently trading at 15830 points, representing a 0.70% decline from the previous day. The index is closely hugging the upper line of an ascending channel, which traditionally signals a potential short-term correction due to possible overbought conditions. This could suggest a pullback or consolidation phase in the near term as the market adjusts and participants take profits. Despite this bearish outlook, the strong upward momentum that the index has seen recently could potentially overpower the correction forces, allowing bulls to turn the tide and end the day in the green, reducing the day's losses. Moreover, the index is merely 800 points away from its all-time high, and a push from bulls could drive the index towards this key psychological level.

US100 (Nasdaq 100 index) is currently trading at 15830 points, representing a 0.70% decline from the previous day. The index is closely hugging the upper line of an ascending channel, which traditionally signals a potential short-term correction due to possible overbought conditions. This could suggest a pullback or consolidation phase in the near term as the market adjusts and participants take profits. Despite this bearish outlook, the strong upward momentum that the index has seen recently could potentially overpower the correction forces, allowing bulls to turn the tide and end the day in the green, reducing the day's losses. Moreover, the index is merely 800 points away from its all-time high, and a push from bulls could drive the index towards this key psychological level.

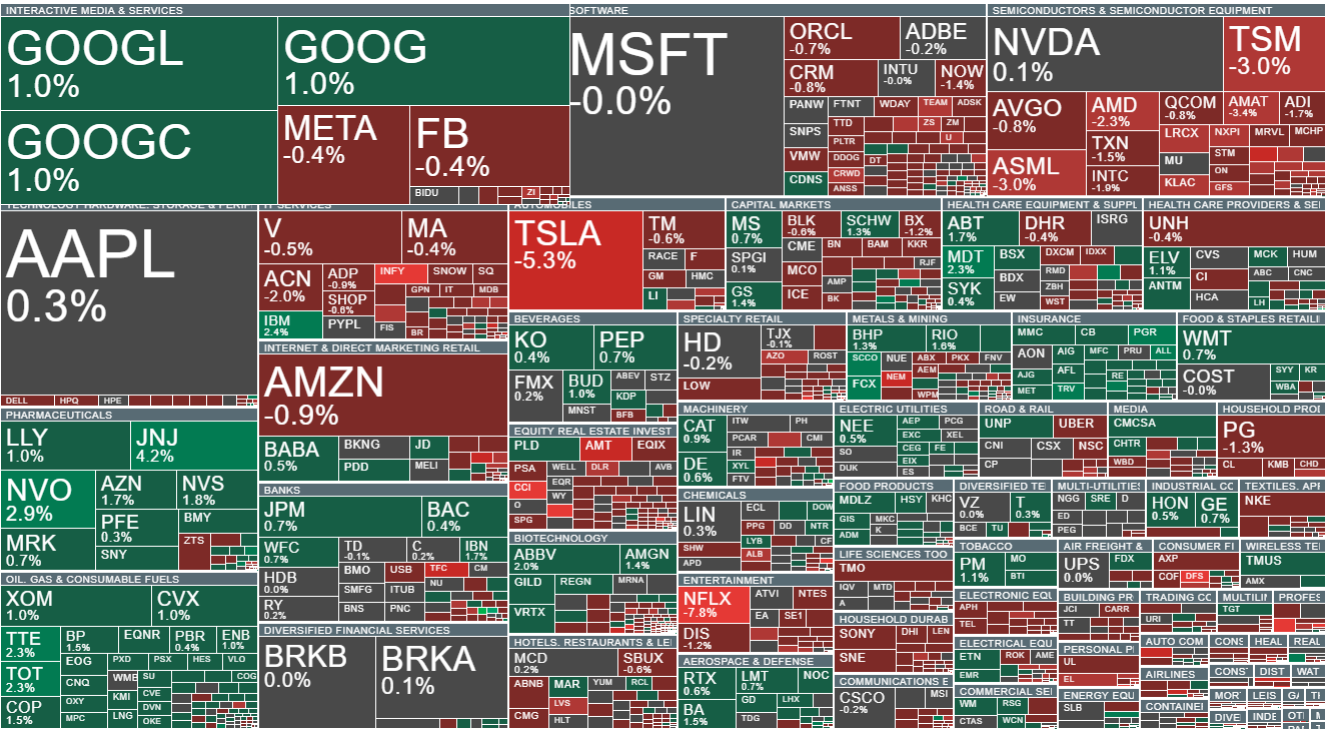

S&P 500 Index categorised by sector and industry. Size indicates market capitalisation. We see that large-cap companies are struggling to maintain growth today. However, other sectors such as Pharmaceuticals and Oil & Gas continue to rise and are in the green, Source: xStation5

S&P 500 Index categorised by sector and industry. Size indicates market capitalisation. We see that large-cap companies are struggling to maintain growth today. However, other sectors such as Pharmaceuticals and Oil & Gas continue to rise and are in the green, Source: xStation5

Company News

-

United Airlines' (UAL.US) shares rose by up to 3.8% following the narrowing of its full-year adjusted earnings per share outlook, surpassing Wall Street estimates. The raised forecast and higher-than-expected profits for the upcoming quarter come in response to a growing demand for international travel and robust fares. The airline has benefitted from the shift in travel demand from domestic to international, echoing a global trend as the industry emerges from the pandemic's worst impacts. The Q2 results featured an adjusted EPS of $5.03 against a forecast of $3.99, with operating revenue reaching $14.18 billion, up 17% YoY, outpacing estimates of $13.9 billion. However, cargo revenue dipped 37% YoY. Looking ahead, United's adjusted EPS is estimated at $11 to $12 for the full year, above the consensus estimate of $9.80. Analysts, including TD Cowen's Helane Becker and Citi's Stephen Trent, expressed optimism, acknowledging the positive surprise in results and praising the airline's efficient post-pandemic fleet management.

-

U.S. shares of Taiwan Semiconductor (TSM.US), the primary chipmaker for Apple and Nvidia, have fallen by 4.6% after the company downgraded its annual revenue outlook and pushed back the start of production at its flagship Arizona project to 2025. Bloomberg Intelligence suggests that the revised target indicates a sharper-than-anticipated decline in smartphone chips and end-market handset demand, exacerbated by deteriorating macroeconomic conditions, particularly in China. Despite the third cut in its revenue outlook for this cycle, which could disappoint some investors, Analysts maintain a 'buy' rating, anticipating that the lack of inventory rebuild will set up the company for strong growth in 2024.

-

Shares of International Business Machines (IBM.US) rose by 2.6% following Q2 results that slightly missed revenue expectations, sparking concerns about a slowdown in IT spending. Despite this, analysts overall found the results better than expected, although they noted some weakness in IBM's consulting and infrastructure businesses. Analyst commentary was generally optimistic, with Bank of America predicting continued growth and free cash flow improvement, alongside BMO Capital Markets and Evercore ISI expressing increased conviction in IBM meeting estimates. The company's revenue came in at $15.48 billion, slightly below estimates, with software revenue outperforming and infrastructure revenue lagging behind expectations. The company maintained its full-year forecast, projecting revenue growth of 3% to 5% at constant currency and free cash flow of about $10.5 billion. IBM's AI solutions were highlighted by CEO Arvind Krishna, and CFO James Kavanaugh underlined the growth in software and consulting.

-

American Airlines Group (AAL.US) anticipates third quarter profits to align with Wall Street's projections, a forecast that has dampened investor optimism, despite a surge in air travel which had buoyed U.S. carriers earlier this year. The forecast offers a sobering perspective after encouraging reports from United Airlines and Delta Air Lines. Large U.S. carriers are capitalizing on the resurgence in global travel, especially to Europe, as pandemic-related restrictions ease and domestic demand stabilizes. While American Airlines' shares dipped by 3.8%, the company's stock has climbed 46% this year, making it the second-best performer in the S&P index of the five largest U.S. carriers. Despite beating estimates in Q2 results and improving full-year projections, investor response has been tepid. American Airlines also faces uncertainty surrounding a forthcoming pilot contract, adding further complexity to their financial situation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.