- Wall Street gains after strong GDP data and higher jobless claims reading. US500 gains 0.3%

- Nearly 12% gains on IBM (IBM.US) shares, the company expects catalysts from AI, cuts costs and expects a strong 2024

- American Airlines (AAL.US) shares soar nearly 9% after earnings per share beat Wall Street forecasts

- Tesla (TSLA.US) loses under pressure from weaker results and high valuation. Declines spill over to Fisker (FSR.US)

- FAA halts planned increase in production of 737 MAX models, Boeing (BA.US) loses 6%

- Defense conglomerate Northrop Grumman (NOC.US) loses after comments on losses from production of the B-21 bomber; shares erase gains since Ukraine invasion entirely

- US home sales marginally below forecasts

Today's macro readings from the US supported sentiment on Wall Street and signaled that the US economy remains very strong. Quarterly GDP for Q4 2023 rose 3.3% and 2.7% after adjusting for government spending and inventories. At the same time, benefit claims rose to 217,000, up nearly 27,000 from last week's reading. The market perceived the data as a potential harbinger of a soft landing, and indeed, the transmission of the Fed's restrictive policy to the macro data seems to 'go on and on', while inflationary pressures will gradually ease. The rally is still led by technology companies today, with the Nasdaq 100 gaining despite a nearly 10% drop in Tesla shares. U.S. home sales rose 8% m/m vs. a 10% forecast and more than 12% drop previously (664k vs. 649k forecast and 590k previously).

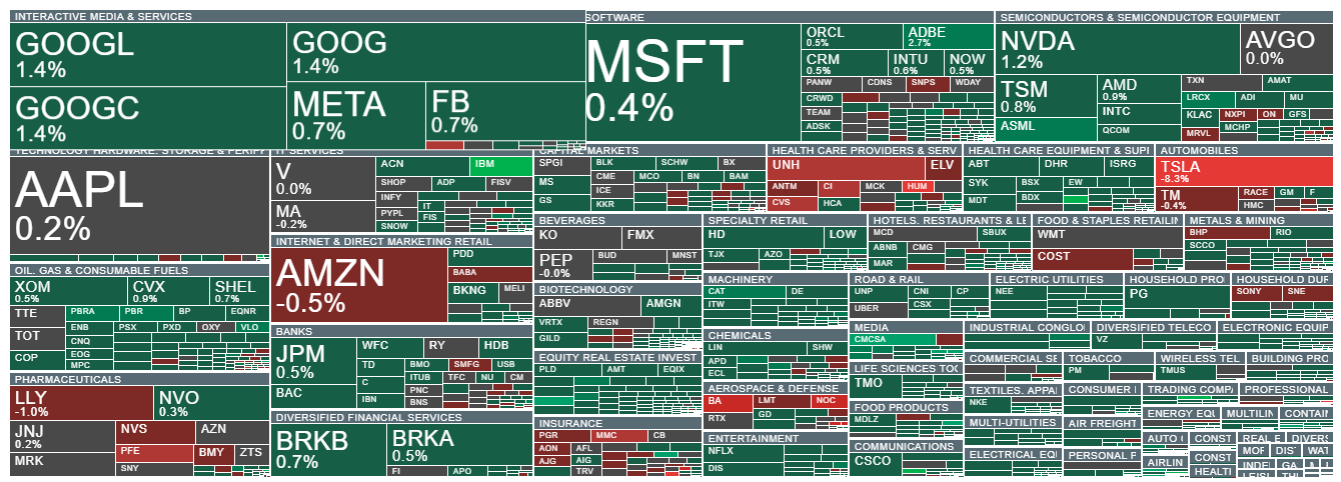

Declines deepened today for Pfizer shares, the insurance (Humana) and health (UnitedHealth) sectors continue to perform poorly. Tesla shares are pulling down sentiment among EV manufacturers. At the same time, we can still see strong rises among software and semiconductor-related companies. Source: xStation5

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appUS500 chart (H1)![]()

In a correction scenario on the US500, a test of the 4870-point level, where we also see the 23.6 Fibonacci retracement of the upward wave from early January 2024, is not out of the question. If the trend were to continue, the main resistance remains the psychological zone around 5000 points. Source: xStation5

News from companies

- American Airlines (AAL.US) gains after reporting expected annual profit above analysts' expectations and optimistic forecasts

- IBM (IBM) posts double-digit gains and its best session in years as the IT company reported fourth-quarter results that beat expectations.

- Comcast (CMCSA.US) gains 5%, after posting better-than-expected earnings and sales.

- Insurance company Humana (HUM.US) loses nearly 12% today, as it withdrew its profit forecast for fiscal 2025 and estimates profit, for 2024, much lower than Wall Street expected.

- JPMorgan downgraded its recommendation on car rental company Hertz (HTZ.US) to neutral. The bank cited several short-term cyclical factors.

- Las Vegas Sands (LVS.US) gains nearly 3.5% as results met expectations and the company reported that Chinese citizens continue to enjoy casinos in Macau, contradicting fears of an economic slowdown.

- Paramount Global (PARA.US) is trading 4% higher as Bloomberg reported that Skydance Media

- has made an offer to buy the Redstone family holding company, which controls 77% of Paramount's voting shares

- Shares of the world's largest alternative fund, Blackstone (BX.US) are gaining, after results met Wall Street expectations and assets under management (AUM) beat analysts' forecasts

Unlucky Pentagon contract for Northrop Grumman?

Northrop Grumman shares are losing today, as the company estimates that the cost of producing the B-21 Raider for the USAF will be at least $1.2 billion apiece. The company won the contract in 2015, and prices have risen many times since then, with the result that it is likely to lose money on the first five batches of bombers, the contract was on fixed price terms. The maximum price in the contract per plane is $700 million, suggesting a half-billion loss on each B-21 produced.

The RSI indicator on the daily interval fell to 24 points, suggesting an extreme oversold condition, but declines have not stopped near the 38.2 Fibonacci elimination of the 2020 upward wave. If the stock does not quickly return above $430 per share, a test of $400 and $350 per share may not be out of the question in the medium term. Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.