-

US indices set for a green open today

-

Russell 2000 (US2000) nears key resistance at 1700 pts

-

Morgan Stanley (MS.US) recorded 30% YoY jump in earnings for Q4 2019

US stocks finished yesterday’s trading higher as markets got optimistic on ‘Phase One’ trade deal signing and potential tax cuts hinted by Kudlow. The US stock futures point to a green open today with S&P 500 launching trade above 3300 pts. Morgan Stanley is expected to open higher following earnings release while Tesla may trade under pressure after downgrade and lacklustre data from California.

While S&P 500, Nasdaq and Dow trade at their all-time highs, small-cap Russell 2000 (US2000) is still trying to break above its record high from September 2018. The stock is eyeing a test of the final resistance on its way to ATH - resistance zone ranging above 1700 pts. The nearest support can be found at 78.6% Fibo level (1640 pts). Source: xStation5

While S&P 500, Nasdaq and Dow trade at their all-time highs, small-cap Russell 2000 (US2000) is still trying to break above its record high from September 2018. The stock is eyeing a test of the final resistance on its way to ATH - resistance zone ranging above 1700 pts. The nearest support can be found at 78.6% Fibo level (1640 pts). Source: xStation5

Morgan Stanley (MS.US) reported earnings today ahead of the opening bell. The US bank recorded an EPS of $1.30 in Q4 2019, easily beating consensus estimate of $0.99. Details of the report echoed key highlights we saw in reports of other major US banks. Namely, equities trading revenue recorded a slight slide as it decreased 0.5% YoY while fixed income and currencies trading revenue jumped from $564 million in Q4 2018 to $1.27 billion in Q4 2019. Total net revenue stood at $10.86 billion in Q4 2019 marking a 27% YoY increase.

Morgan Stanley (MS.US) posted a strong quarterly results for Q4 2019 and is expected to open higher. A point to note is that the stock reacts to Fibonacci retracements of downward move started in March 2018 therefore 78.6% retracement at $54.65 could be the level to watch today. Source: xStation5

Morgan Stanley (MS.US) posted a strong quarterly results for Q4 2019 and is expected to open higher. A point to note is that the stock reacts to Fibonacci retracements of downward move started in March 2018 therefore 78.6% retracement at $54.65 could be the level to watch today. Source: xStation5

Tesla (TSLA.US) shares slipped below $500 in today’s pre-market trading. A drop can be ascribed to two factors. The first one is downgrade the company has received at Morgan Stanley. The Bank lowered recommendation for the stock to “underweight” and set a price target of $360. The second reason is a report saying that Tesla registrations dropped 46.5% YoY in California in December. California is considered a bellwether market for electric vehicle sales.

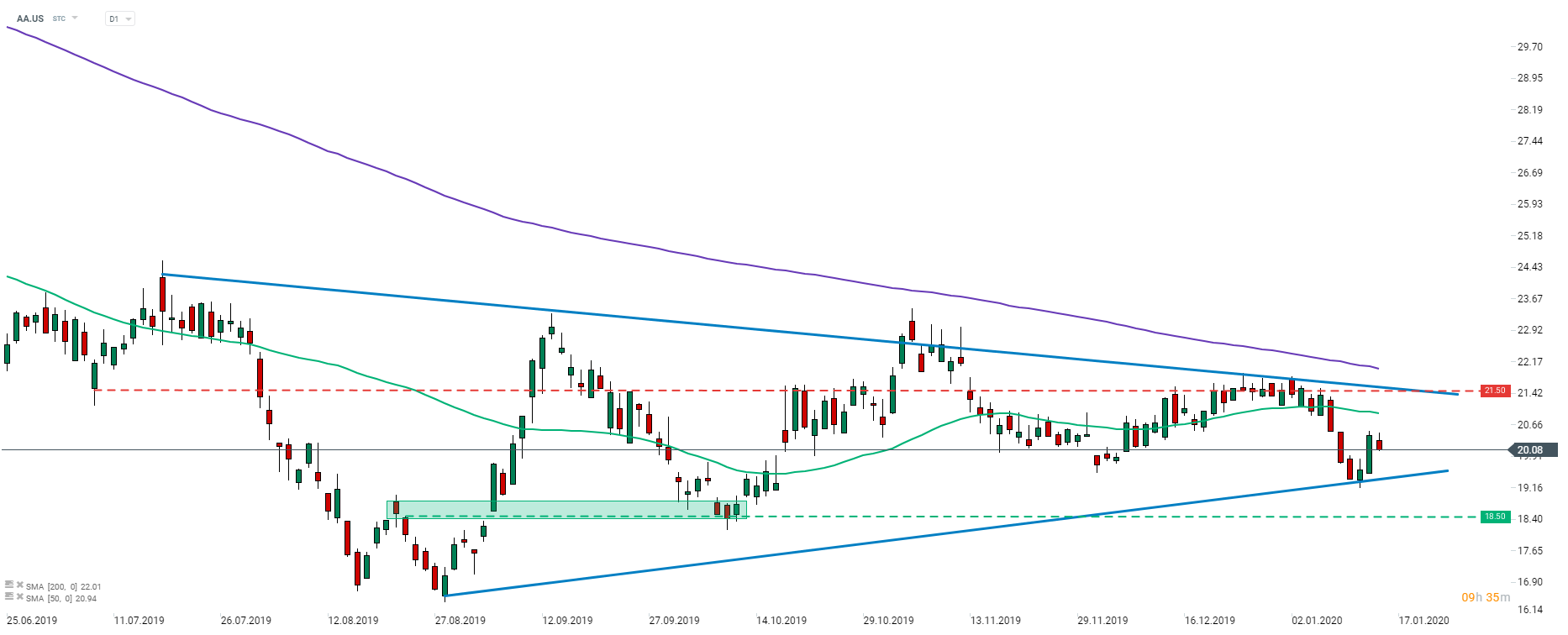

Alcoa (AA.US), the US biggest aluminium producer, reported another weakish quarter in terms of earnings. The company reported a loss per share of $0.31 against a profit of $0.66 in Q4 2018. Market has called for a loss of $0.21. Sales of $2.44 billion were 27% YoY lower but were more or less in line with median estimate. The company expects the aluminum market to record a surplus of 600k-1kk tonnes in 2020.

Alcoa (AA.US) is trading in a triangle pattern. The stock has been in a downward move for Q2 2018 when aluminium prices peaked. Lower opening is expected and one cannot rule out a possibility of breaking below the lower limit of the pattern. In such a scenario, support at $18.50 could be in danger. Source: xStation5

Alcoa (AA.US) is trading in a triangle pattern. The stock has been in a downward move for Q2 2018 when aluminium prices peaked. Lower opening is expected and one cannot rule out a possibility of breaking below the lower limit of the pattern. In such a scenario, support at $18.50 could be in danger. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.