- Wall Street opens higher near record levels

- The US Dollar (USD) depreciates

- Yields on U.S. bonds remains unchanged

On Thursday, U.S. indices start the cash session with solid gains. At the time of publication, the US500 is up 0.70% to 5150 points, and the US100 is up 1.00% to 18220 points. The gains are supported by the weakening Dollar (USD), which is one of the weakest currencies in the G10 today. The USD Index (USDIDX) records a 0.30% loss to 103 points.

US100

The technology company index gains 1.00% at the start of the session and is approaching historical highs around 18330 points. The index is attempting to break out of a short-term consolidation upwards. However, on the MACD indicator, a divergence is observed, suggesting a weakening upward momentum.

Source: xStation 5

Company News

The Honest Company (HNST.US) gains as much as soared 25% following a profitable Q4. The company reported a 10% rise in sales that surpassed estimates. For 2024, the company projects low-to-mid single-digit percentage revenue growth, expecting a softer first half compared to the second. CFO Dave Loretta highlighted the company's focus on profitable growth and confidence in its long-term strategy and financial prospects.

Source: xStation 5

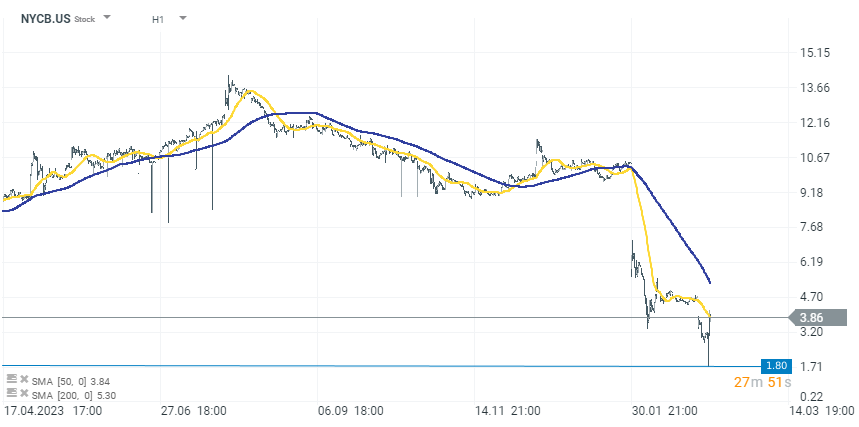

New York Community Bancorp (NYCB.US): Shares of New York Community Bancorp rebounded by almost 10% after a dramatic drop. The bank secured over $1B in capital, notably from Liberty Strategic Capital and other investors. To raise this capital, NYCB will issue shares at $2.00 and offer warrants. The bank has reduced its quarterly dividend by 80% and appointed Steven Mnuchin and Joseph Otting (the new CEO) to its board, aiming for future growth stabilization.

Source: xStation 5

American Eagle Outfitters (AEO.US) gains over 4,00% after exceeding holiday quarter expectations and revealing a new strategic plan. The company anticipates 2024 operating income between $445M and $465M and revenue growth of 2% to 4%.

Big Lots (BIG.US) dips over 5,00% ahead of its Q4 earnings report with analysts expecting a quarterly loss. The consensus EPS estimate is at -$0.26, a 7.1% year-over-year improvement, with revenue estimates down 7.1% at $1.43B.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.