- Wall Street open higher

- Goldman Sachs with the weak quarterly results

- Housing market in the US has shown signs of contraction

On Wednesday, U.S. stocks hit their highest levels in 15 months, with the Dow Jones Industrial Average on track to extend its winning run for an eighth consecutive day - marking its longest streak in years. The Dow increased by 0.4% to reach 35,078, while the S&P 500 grew by 0.5% to 4,577. The Nasdaq 100 Index also experienced growth, rising by 0.2% to 15,860.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appUS Housing Market

U.S. new home construction dipped by 8% in June as homebuilders shifted their focus from initiating new single-family homes to completing existing projects. Housing starts decreased to an annual pace of 1.43 million from May's 1.56 million. This contraction in construction pace followed a near 16% surge in May. While analysts had predicted a sharper 9.2% drop, the decline in June was the steepest since July 2022. Both single and multi-family construction experienced a downturn as builders concentrated on selling their existing inventory. Nevertheless, strong demand for new homes persists due to a shortage in the resale market for existing homes. The Midwest saw the sharpest drop in construction at 33%, while building permits, indicative of future construction, also declined by 3.7%. Despite the current pullback, demand for new homes remains robust, contributing to a decrease in sales incentives like price cuts.

US500

The S&P 500 index has displayed a bullish trend, with the current price standing at 4600, representing a 0.5% increase for the day. Since March 2023, the price has been consistently moving within a steep ascending channel, indicating strong upward momentum. The index has successfully surpassed several resistance zones, most notably the recent 4550-4580 points. The next significant resistance level lies within the 4615-4630 range, aligning with the upper resistance of the ascending channel. Consequently, a correction cannot be ruled out, as the price may encounter selling pressure and face challenges in breaking above this level. Traders should remain cautious and monitor price action for potential reversals, source xStation 5

The S&P 500 index has displayed a bullish trend, with the current price standing at 4600, representing a 0.5% increase for the day. Since March 2023, the price has been consistently moving within a steep ascending channel, indicating strong upward momentum. The index has successfully surpassed several resistance zones, most notably the recent 4550-4580 points. The next significant resistance level lies within the 4615-4630 range, aligning with the upper resistance of the ascending channel. Consequently, a correction cannot be ruled out, as the price may encounter selling pressure and face challenges in breaking above this level. Traders should remain cautious and monitor price action for potential reversals, source xStation 5

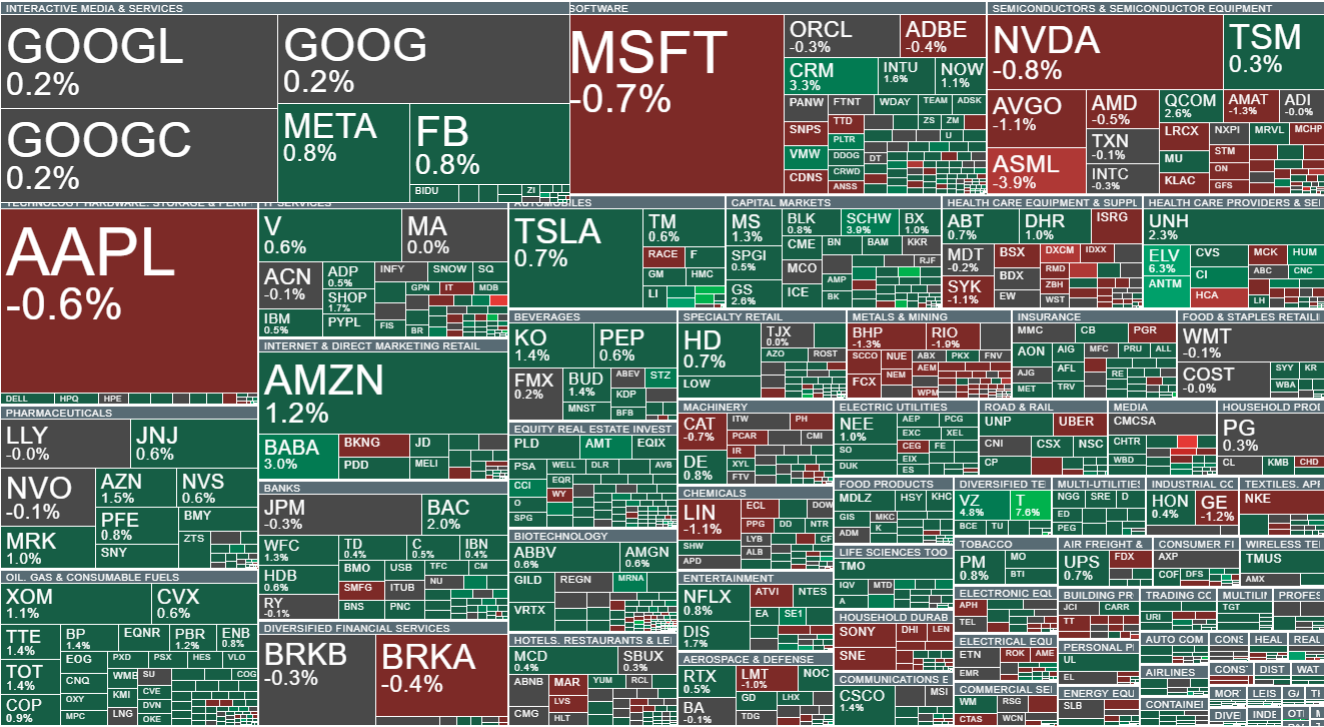

US companies categorised by sector and industry. Size indicates market capitalisation. Source: xStation5

US companies categorised by sector and industry. Size indicates market capitalisation. Source: xStation5

Company News:

- Cisco Systems Inc. (CSCO.US) shares rise 2% after JPMorgan upgraded the networking company to overweight, citing “ levers for earnings growth.”

- Gitlab (GTLB.US) falls 2% after the software company named Chris Weber as its chief revenue officer, replacing Michael McBride.

- Interactive Brokers (IBKR.US) slips 4.7% after the company reported 2Q adjusted earnings per share that missed estimates.

- Toast (TOST.US) tumbles 10% after the restaurant software provider said it will walk back its plan to add a 99-cent order processing fee to the new version of its digital ordering suite

- Goldman Sachs (GS.US) released its quarterly earnings report, which led to fluctuating share prices. The company's earnings per share for the quarter were $3.08, a decline from $7.73 in the same period last year. Additionally, the FICC sales & trading revenue fell short of analyst expectations. The quarter was described as "noisy" by analysts, who noted that investors were prepared for potential turbulence and had lowered their expectations. Despite the mixed results, Chairman and CEO David Solomon emphasized the strong performance in Global Banking & Markets and the company's position as a leader in completed M&A transactions. Analyst opinions varied, with some considering the quarter in line with expectations, while others highlighted the bottom line miss but noted positive revenue trends. Shares initially fluctuated during the earnings call but ultimately rose by 1.5%. Looking ahead, Goldman Sachs' strategic shift towards alternative asset management and noncore business exits was seen as a positive move for the company's future.

Goldman Sach share price (GS.US), D1 interval, source xStation 5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.