- Indices on Wall Street open higher

- The dollar rises after the attempt on Trump over the weekend

- Bond yields gain

- Smaller companies gain the most

The new week opens again in optimistic moods, fueled by speculation about Trump's victory in the November elections. After the assassination attempt at a campaign rally in Pennsylvania, investors are pricing in even higher chances of Donald Trump winning. Interestingly, Biden's ratings have also increased compared to his potential substitute candidates from the party, including Kamala Harris. As a result, we have seen a slight strengthening of the dollar and a rise in bond yields. However, the initial gains have already been almost completely reduced. At the same time, Trump Media & Technology Group (DJT) gains more than 40% on opening to $8 billion market cap. At the opening of the cash session, the USDIDX dollar index is trading flat, US500 is gaining 0.40%, US100 0.60%, while the smaller companies index US2000 is up 1.40%.

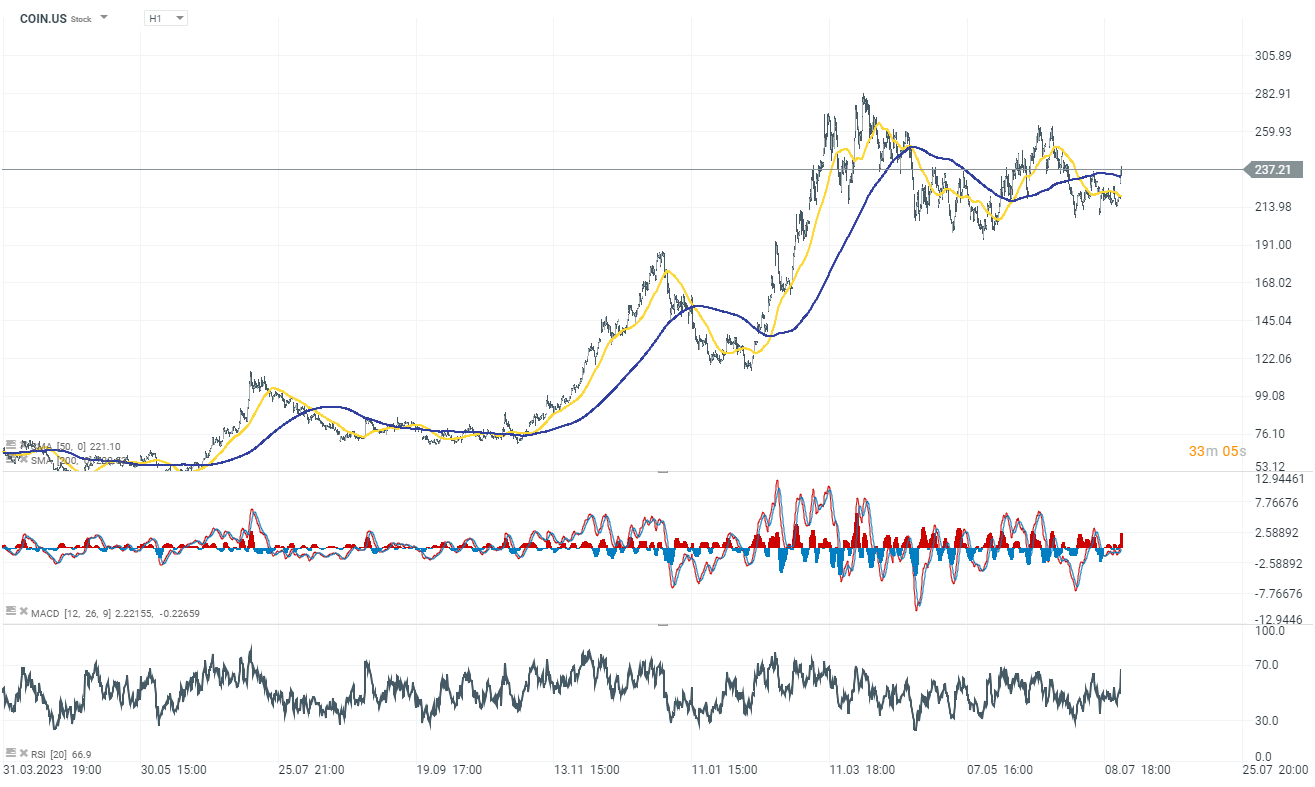

US2000

Since the last CPI report was published, investors are betting on the first interest rate cut in the US as early as September. The prospect of easing policy has restored investors' faith in smaller companies, and today we are seeing another session of capital rotation. The US2000 index (Russell 2000) stands out clearly with gains. At the time of publication, gains are already reaching 1.50%, and bulls are battling resistance at the 2200 point level.

Source: xStation 5

Company News

Tesla (TSLA.US) gains 4.50% on Monday as investors anticipate the Q2 earnings report and await updates on the August 8 robotaxi event. Morgan Stanley's analyst, Adam Jonas, suggests that a delay in the event could allow Tesla to showcase its broader AI capabilities, potentially linked to its ambitious Master Plan 4. Over the weekend, Elon Musk endorsed Donald Trump, which, along with a notable donation to a political action committee, has analysts speculating that Tesla might benefit from a new Trump administration.

Gains in the cryptocurrency market support crypto-related stocks. As Bitcoin to the USD 63,000 zone we can see notable gains on MicroStrategy (MSTR.US), Coinbase (COIN.US), Riot Platforms (RIOT.US) and Marathon Digital (MARA.US).

Super Micro Computer (SMCI.US) gains 1.00% after news that the copmany will join the Nasdaq-100 Index (NDX) and the Nasdaq-100 Equal Weighted Index (NDXE) on July 22nd, replacing Walgreens Boots Alliance (WBA.US).

Macy's (M.US) stock dips 15% after announcing the end of acquisition talks with Arkhouse Management and Brigade Capital Management. The board concluded that discussions did not result in a compelling, financeable proposal, despite extensive due diligence.

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.