- Wall Street opens slightly higher

- The dollar strengthens, and yields gain slightly

- Quarterly results from Coca Cola (KO.US), General Electric (GE.US), and General Motors (GM.US)

Futures contracts gain slightly today, but these increases are more of a reaction to recent declines rather than a decisive rebound. In the broader market, the dollar is gaining again and remains one of the strongest currencies. EURUSD is down 0.51%. Yields on 10-year bonds gain 0.41% and are around 4.85%. The market shows mixed sentiments after the PMI data from Europe and from the USA.

PMI data

Preliminary PMI readings from the Eurozone were mixed, and values still remain significantly below the 50-point level. PMI manufacturing from the US came much better, also from the expectation.

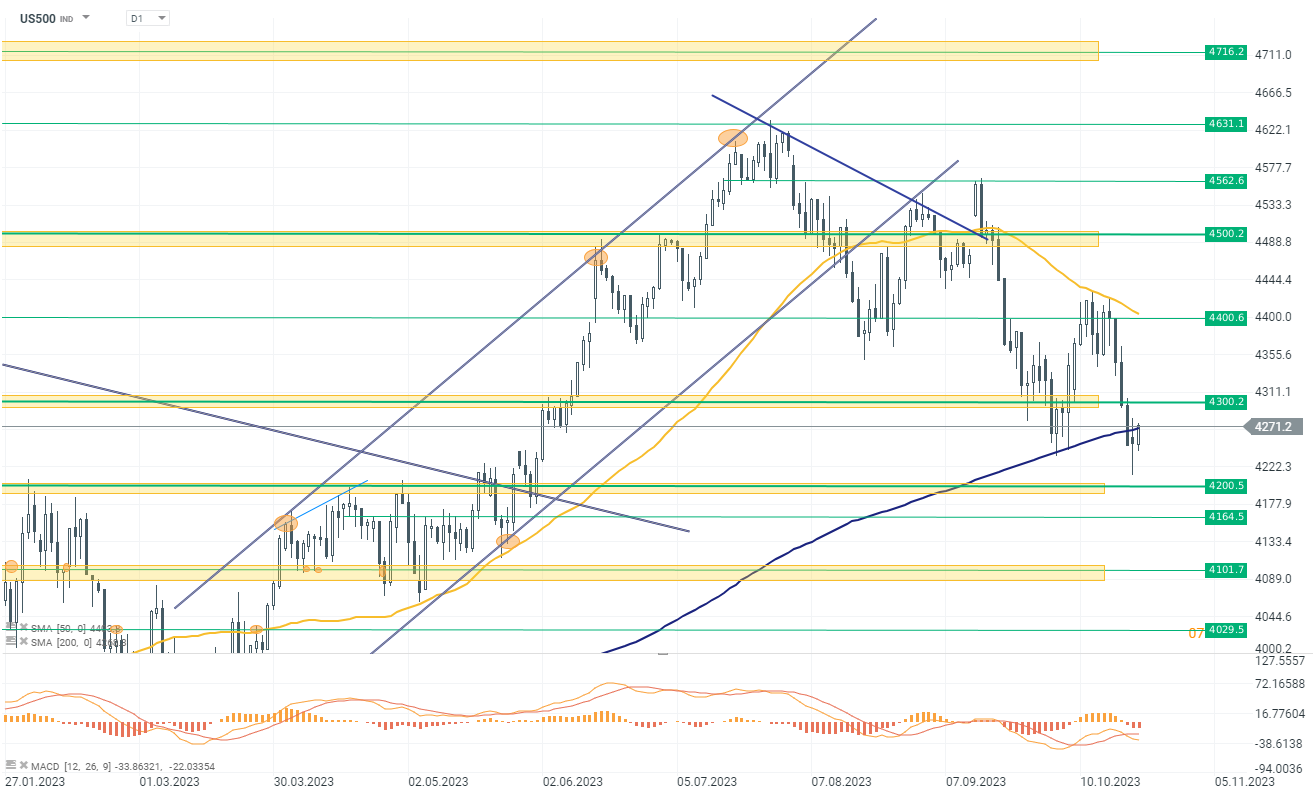

US500

The US500 has rebounded decisively from the support line at 4200, showing a 0.40% gain today. It's noteworthy that the index is currently testing the 200-session Simple Moving Average (SMA) from below, which could act as a significant resistance level. As we navigate through the quarterly earnings season, the performance of key market giants like Microsoft (MSFT.US) and Alphabet (GOOGL.US), who are set to release their results today, will likely play a crucial role in determining the overall direction of the index. Investors will be closely monitoring these earnings reports for insights into market sentiment and potential market-moving developments.

Company news

Coca-Cola's (KO.US) shares rose in premarket trading after the company reported third-quarter results that exceeded expectations and subsequently raised its annual sales forecast. The beverage giant now anticipates an adjusted organic revenue growth of 10% to 11% for the full year, up from its previous projection of 8% to 9%. The third-quarter results showcased a revenue of $12.0 billion, beating the $11.5 billion estimate. The company's price mix increased by 9%, outperforming the anticipated 6.2% rise, and its volume grew by 2%, also surpassing estimates. Despite the price hikes, consumers continue to show a willingness to pay for beverages, leading Coca-Cola to enhance its full-year outlook. CEO James Quincey acknowledged the company's strong quarterly performance in a statement.

Nvidia (NVDA.US) is entering into the personal computer processor market, leveraging Arm Holdings Plc technology to create chips that could rival Intel Corp. processors. While Nvidia is renowned for its dominance in artificial intelligence accelerator chips, it is now reportedly developing central processing units (CPUs) for PCs that would be compatible with Microsoft Corp.’s Windows operating system, aiming for a release by 2025. Intel, a pioneer in PC processors, is already grappling with competition from Advanced Micro Devices Inc. (AMD.US) and Qualcomm Inc. Notably, AMD is also said to be working on PC chips using Arm technology.

General Electric Co. (GE.US) reported a 20% year-over-year increase in Q3 FY23 revenues, reaching $17.3 billion, with adjusted earnings per share (EPS) of $0.82, surpassing the consensus estimate of $0.56. The company witnessed a surge in orders across various sectors, including a 25% jump in Aerospace’s Q3 revenues and a 15% rise in GE Vernova Renewable Energy revenues. GE's operating cash flow for the quarter was $1.89 billion, and free cash flow stood at $1.67 billion. The company also repurchased approximately 2.2 million shares for $0.3 billion. GE announced plans to spin off GE Vernova and launch GE Aerospace in Q2 2024. CEO H. Lawrence Culp, Jr. expressed confidence in the company's trajectory and raised the full-year 2023 guidance.

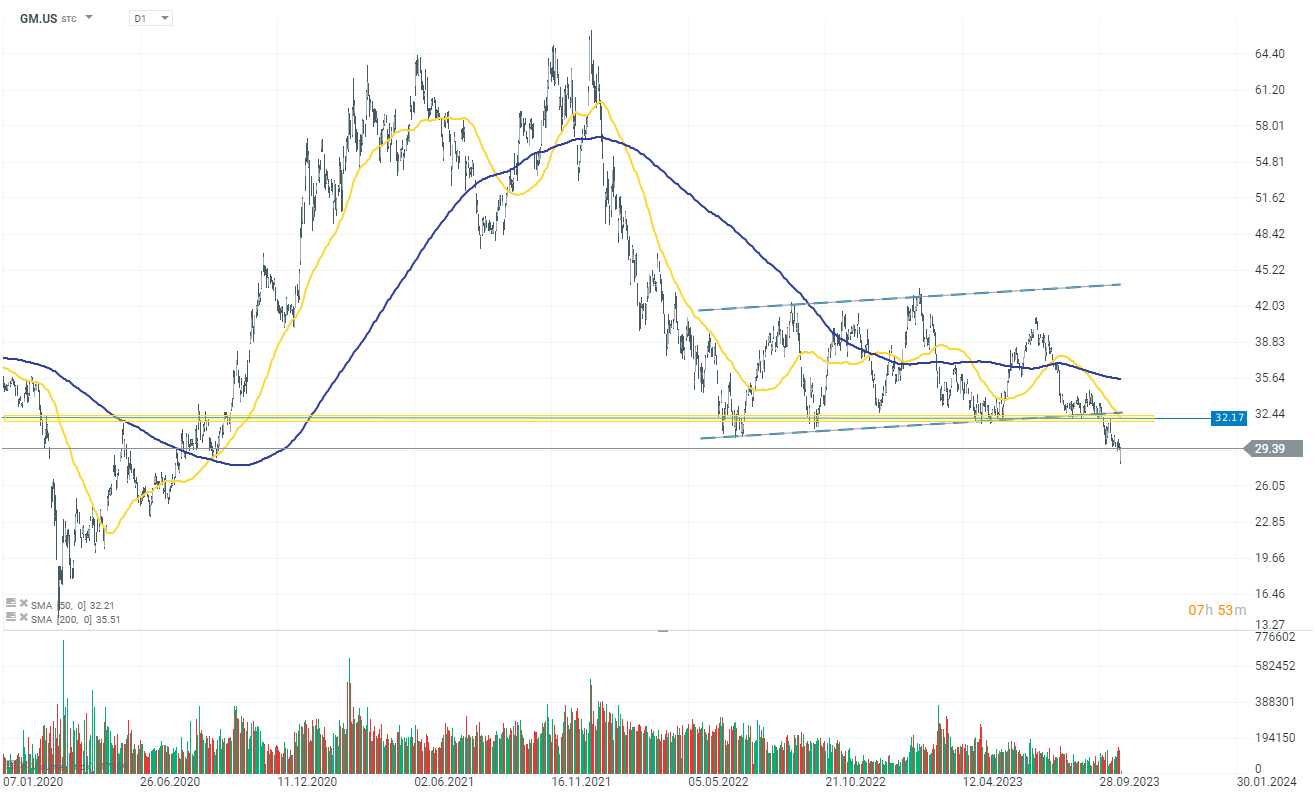

source: xStation 5

General Motors (GM.US) gains over 1.30% after reporting a third-quarter profit that surpassed analysts' expectations. The automaker's adjusted EPS was $2.28, compared to an estimate of $1.84, with net sales and revenue reaching $44.13 billion, marking a 5.4% increase year-over-year. Despite the positive results, GM withdrew its earnings guidance for the year due to the uncertainty caused by an ongoing workers' strike. The strike, which began on September 15, is expected to reduce GM's pretax earnings by $800 million this year, with further losses of $200 million per week. CFO Paul Jacobson noted that the strike had already impacted the company's Q3 net income, which was down 7% from the same period last year. CEO Mary Barra emphasized that while GM has made a significant offer to the union.

source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.