- Wall Street’s indices continue their rally after PPI decreased close to 0%

- Delta Airlines and Pepsico kicked off the earnings season with great results and positive guidance

- US-listed Chinese stocks gain on hope for ending unilateral US sanctions

Decreasing inflation and a positive start of earnings season fuel further gains on Wall Street which aiming at all-time highs probably this year. PPI decreased significantly pointing that CPI may fall even lower in the coming months. Moreover, Delta Airlines and PepsiCo showed positive guidance, despite the fact that higher interest rates are coming in the US.

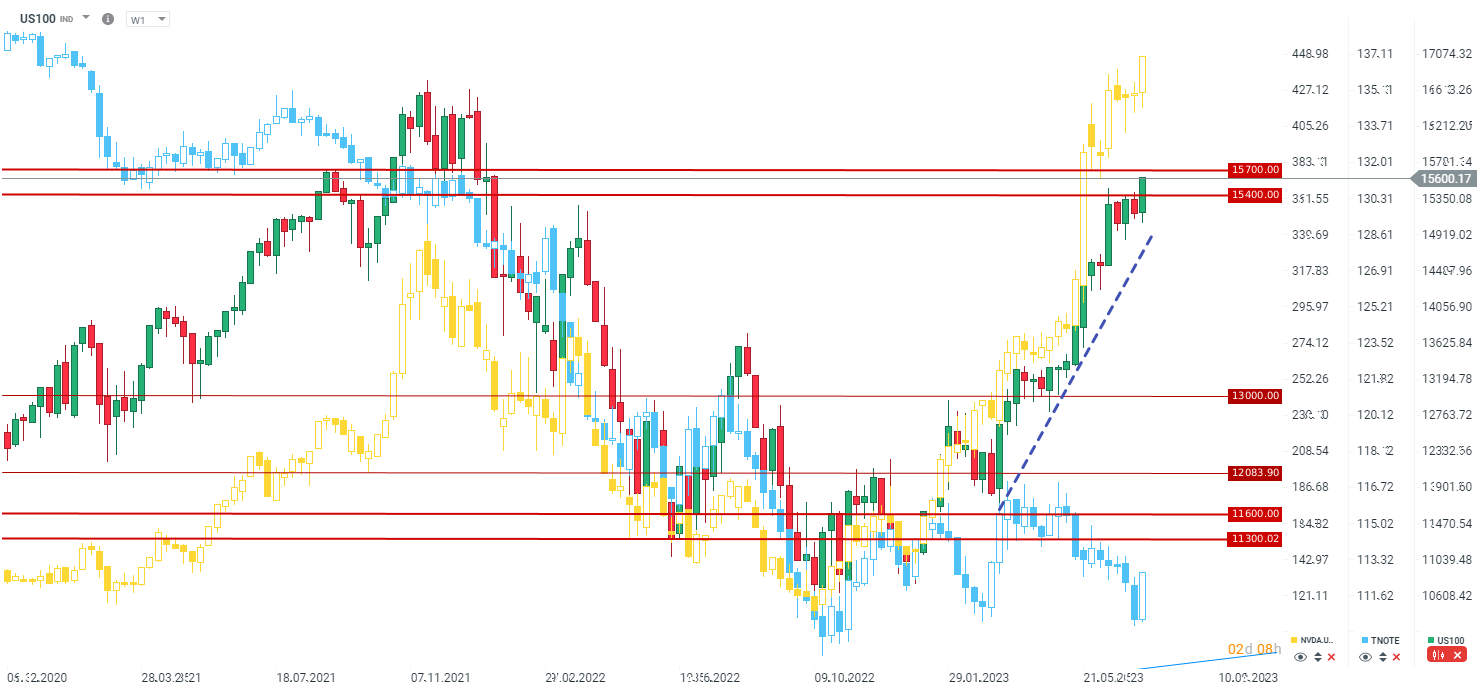

Following a 4-week consolidation, the US100 (Nasdaq 100) futures break an important resistance of 15 400 points and reached their highest since mid-January 2022! It is worth mentioning that the first half of this year was the best in history in terms of return, and the level of US100 is less than 9% short of all-time highs. Another important resistance at 15 700 points should not be a strong barrier to break if the results of tech companies surprise positively. However, the first major results of tech companies will be published in the coming weeks. On the other hand, the results of the banks, which will start publishing tomorrow, will be very important for the S&P 500 index.

NVidia indicates that the technology index may continue its rally. US bond prices (TNOTE - blue chart) have started a rebound which shows a lot of optimism about a further decline in inflation. Source: xStation5

NVidia indicates that the technology index may continue its rally. US bond prices (TNOTE - blue chart) have started a rebound which shows a lot of optimism about a further decline in inflation. Source: xStation5

Company news:

- Delta Airlines (DAL.US) is opening higher and gained nearly 4% as the company reported not only stronger-than-expected results but also the best-ever quarterly revenue and earnings. Revenue for Q2 2023 reached $14.6 billion vs $14.4 billion expected and EPS came out at $2.68 vs $2.41 expected. Due to the rebound of the flight demand, the company points to better results in the future, raising its full-year earning to $6-$7 versus $5-$6 earlier. The company is up 3.8% at the start of the session and nearly 50% up this year.

- Pepsico (PEP.US), the beverage and food company increased more than 2% at the opening bell after printing better-than-expected results. The company showed an adjusted EPS at $2.09 versus $1.96 expected on $22.32 billion revenue vs $21.73 billion expected. The company also raised its full-year guidance. It is worth mentioning that Pepsico is listed on Nasdaq.

- Alphabet (GOOG.US) gained about 1.5% at the start as the company released its Bard AI chatbot in the European Union and Brazil.

- Coinbase (COIN.US) fell about 1% as Barclays decided to downgrade the company to underweight from equal, ahead of the earnings report.

- Chinese companies, listed on US exchanges rise in early trading as China urges US to end unilateral sanctions on Chinese companies which may help with economic and international trade cooperation. Alibaba (BABA.US) gains 1%, Baidu (BIDU.US) is up 1.3% and JD.com (JD.US) increases 2.8%

Delta is up nearly 50% this year and is about 30% short of an all-time high from 2019. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.