-

US futures point to an over 1% bearish gap at session open

-

Gilead (GILD.US) set to surge another 5% at the open

-

Microsoft (MSFT.US) issued sales warning on coronavirus

While US indices finished yesterday’s session with just moderate declines, S&P 500 futures slumped overnight on news of the first confirmed US virus case of unknown origin. To make things worse, the New York Times reported that the patient was not immediately tested for the virus as he did not meet criteria set by Centre for Disease Control to qualify even for testing. S&P 500, Nasdaq, Dow Jones and Russell 2000 are all expected to open over 1% lower today.

Sell-off on Wall Street shows no signs of easing as coronavirus continues to spread worldwide. US500 (S&P 500 futures underlying) is closing in on a key technical hurdle - 200-session moving average (purple line). This one of the most often respected moving average by the market and was tested a dozen times over the past few years. The question remains whether it will manage to fend off the bears this time as well or is US500 set for a break lower? In case of a break lower major support can be found at 2940 pts. Source: xStation5

Sell-off on Wall Street shows no signs of easing as coronavirus continues to spread worldwide. US500 (S&P 500 futures underlying) is closing in on a key technical hurdle - 200-session moving average (purple line). This one of the most often respected moving average by the market and was tested a dozen times over the past few years. The question remains whether it will manage to fend off the bears this time as well or is US500 set for a break lower? In case of a break lower major support can be found at 2940 pts. Source: xStation5

Best Buy (BBY.US) released earnings report for fiscal Q4 2020 (ended February 1 2019). The company generated quarterly revenue of $15.20 billion against expected $15.05 billion. Adjusted EPS of $2.90 was 6.6% higher year-over-year and 6.2% higher than expected. International revenue stood at $1.35 billion and grew 3.4% YoY. The company expects Q1 2021 (February-April period) to fall in the $9.1-9.2 billion range while EPS should come in between $1.00 and $1.05. Quarterly dividend was boosted by 10% to $0.55 per share. Company said that it closely monitors coronavirus developments but is unable to determine the exact financial impact of supply chain disruptions.

Gilead Science (GILD.US) said it is starting two Phase 3 trials of its Remdesivir drug. The World Health Organization said that this drug may be the only one to show efficacy. One trial will be conducted on 400 patients with severe clinical manifestation of coronavirus while the other will be conducted on 600 patients with mild manifestation. Trials will start in March.

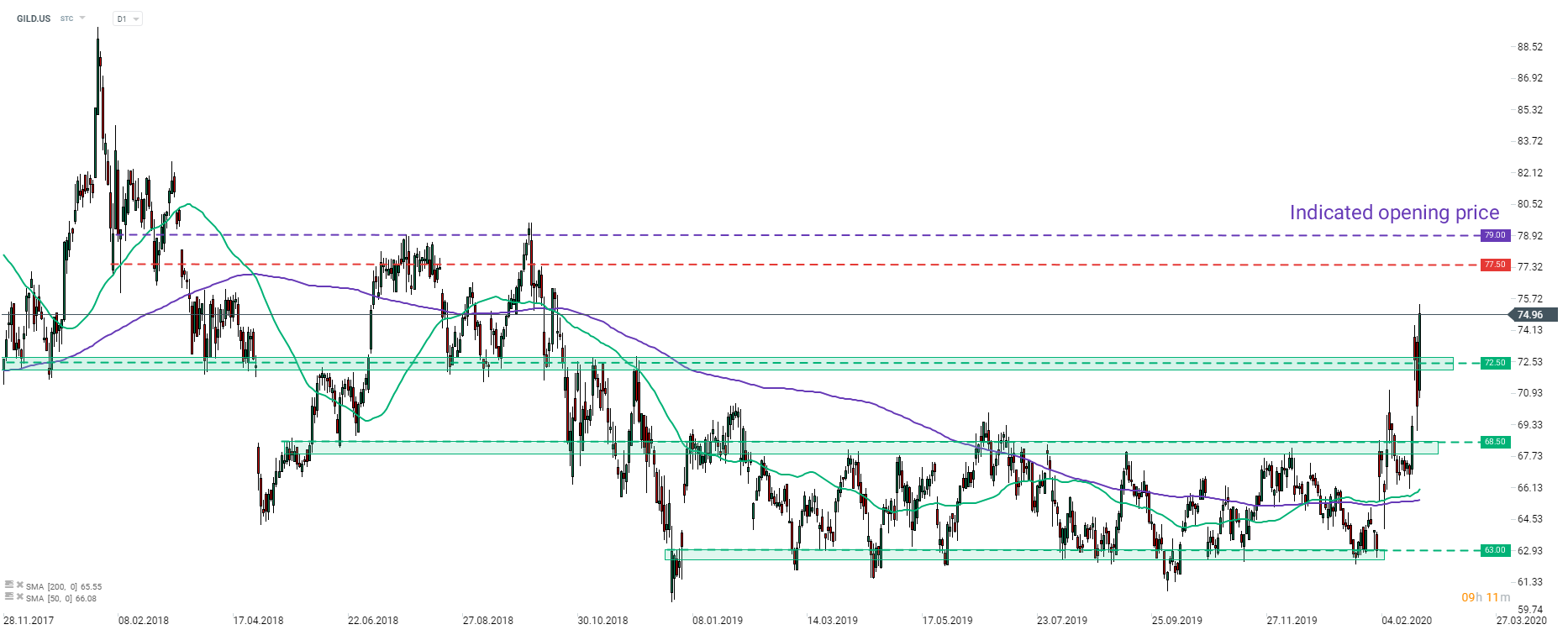

Gilead Science (GILD.US) is trading over 5% higher in premarket. The company is enjoying a strong run higher as investors hope its new drug will show effects in fighting coronavirus. The stock is set to launch today’s session near $79 handle. Note that this level met with price reaction a few times therefore bulls may find it hard to crack. Source: xStation5

Gilead Science (GILD.US) is trading over 5% higher in premarket. The company is enjoying a strong run higher as investors hope its new drug will show effects in fighting coronavirus. The stock is set to launch today’s session near $79 handle. Note that this level met with price reaction a few times therefore bulls may find it hard to crack. Source: xStation5

Microsoft (MSFT.US) issued a sales warning related to coronavirus. The US tech company said that it is likely to miss the previously issued forecast for fiscal Q3 2020 (calendar Q1 2020) for the personal computing segment. Forecast pointed at revenue coming in between $10.75 and $11.75 billion. The company still expects cloud revenue to fall in the $11.85-12.05 billion range. The company said that while demand for its PC products remains solid, supply chain disruptions are taking longer to abate. The warning came a few days after Apple (AAPL.US) said that the health crisis is likely to have a negative impact on its revenue in the quarter.

Uber Technologies (UBER.US) is trading lower in premarket. The situation is said to be an aftermath of Margrethe Vestager’s interview with Bloomberg. Vestager, who serves as EU Competition Commissioner, said that she is looking for ways to boost wages for employees of online food delivery companies or drivers of ride-hailing companies.

Share price of Uber Technologies (UBER.US) dropped over 15% this week and reached the support zone ranging above the 50% Fibo level of the upward move started in November 2019. The company is trading lower in premarket following Vestager’s interview with Bloomberg. Stock is set to open near the 61.8% Fibo level ($31.75 area). Source: xStation5

Share price of Uber Technologies (UBER.US) dropped over 15% this week and reached the support zone ranging above the 50% Fibo level of the upward move started in November 2019. The company is trading lower in premarket following Vestager’s interview with Bloomberg. Stock is set to open near the 61.8% Fibo level ($31.75 area). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.