- Main indices on Wall Street open lower

- U.S. bond yields are rising again

- The dollar (USDIDX) strengthens by 0.40%

Midweek on stock markets, we continue to see persistent selling pressure. All major U.S. stock indices, including US500, US100, and US2000, opened with losses. The strengthening dollar and rising U.S. bond yields are contributing to this selling pressure.

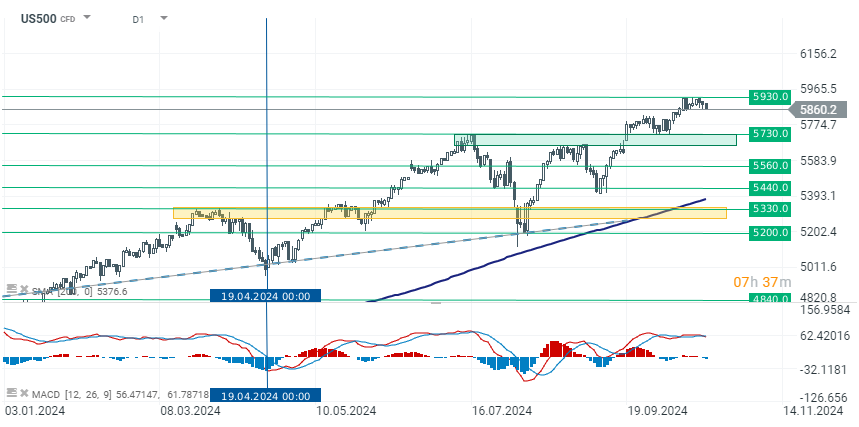

US500

The upward momentum on the US500 index has clearly slowed. A local and historical peak was formed around 5930 points last week. Bulls are currently facing evident difficulties in sustaining demand amidst a particularly strong dollar. The dollar index USDIDX has gained over 4.00% since its low in early October and is gradually putting more pressure on the stock market. However, key catalysts for upward or downward movement could be the earnings reports of the largest companies in the index, which we will learn this week and next. Next week will also bring labor market reports. Lower-than-expected data will certainly increase expectations for interest rate cuts. Conversely, higher data may suggest fewer rate cuts this year, consequently increasing downward pressure on the indices.

Source: xStation 5

Company News

Trump Media & Technology Group (DJT.US) gained another 6.30% on investor speculation surrounding Donald Trump’s potential success in the upcoming election. This followed a 10% gain on Tuesday, marking the stock's highest close since July, driven by growing optimism about Trump's election prospects.

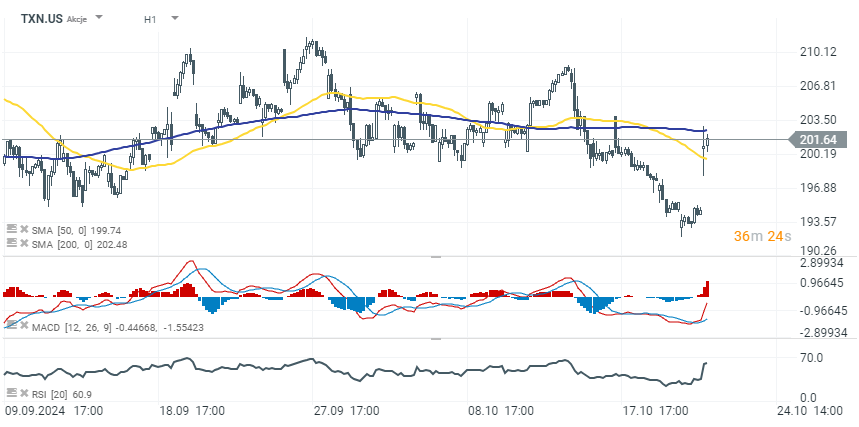

Texas Instruments (TXN.US) gains 3.60% after the company surpassed Q3 expectations, showing a 9% sequential revenue growth. However, its Q4 forecast of $1.07-$1.29 earnings per share and $3.7B-$4B in revenue fell short of analyst estimates, which had predicted $1.35 per share and $4.08B in revenue, indicating potential challenges ahead despite the recent gains.

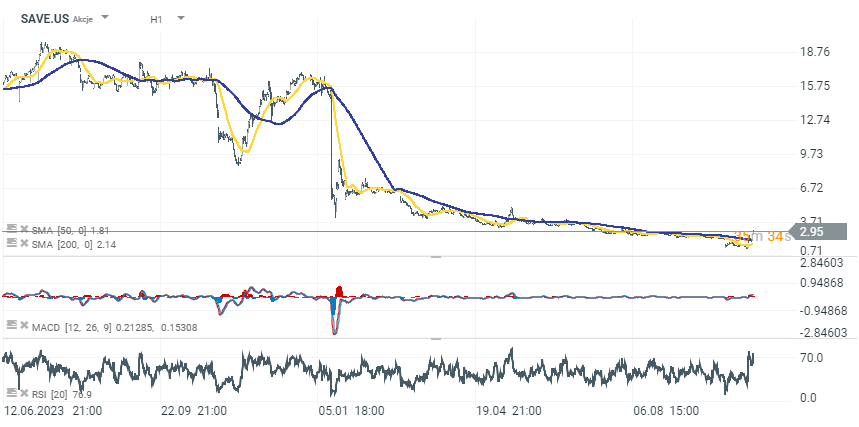

Spirit Airlines (SAVE) surged 38% following reports of merger talks with Frontier Group (ULCC), potentially as part of a debt restructuring process through bankruptcy. The news, which could lead to operational synergies and financial stability, followed a 53% spike on Monday after Spirit secured a debt-refinancing extension, helping ease financial pressures.

Starbucks (SBUX.US) reduces stock drop from initial 4% to the current 0.80% after reporting a 7% decline in global comparable store sales and a 3% drop in net revenue for Q4, missing analyst estimates. Despite a 7% dividend increase, weak performance in North America and China, along with suspended FY2025 guidance, contributed to investor concerns.

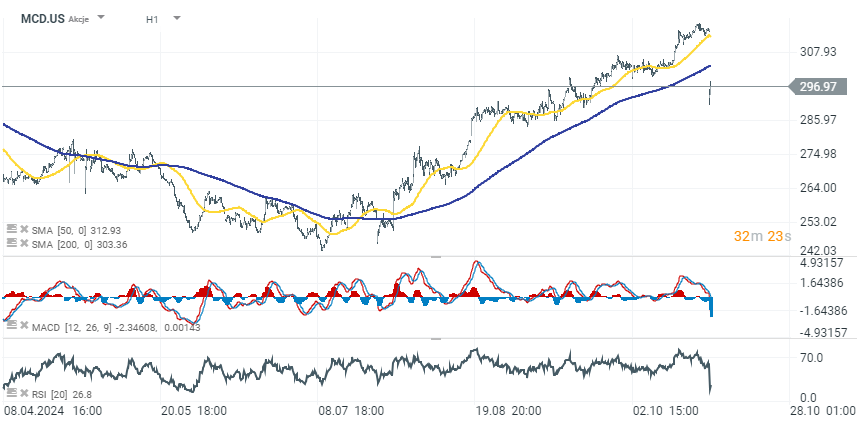

McDonald's (MCD.US) stock dropped 5.70% following a CDC warning about an E. coli outbreak linked to the Quarter Pounder, causing the company to remove slivered onions from its supply chain and temporarily halt Quarter Pounder sales in several U.S. states. The swift response reflects potential food safety risks impacting the chain.

Enphase Energy (ENPH.US) dropped 13.30% after posting a 31% year-over-year revenue decline in Q3, with net income falling to $45.76M from $113.95M the previous year. The company issued disappointing Q4 guidance, projecting revenue below expectations at $360M-$400M, with weaker-than-expected gross margins, signaling ongoing difficulties.

Qualcomm (QCOM.US) stock slipped over 2.50% after Arm Holdings terminated a key license agreement, intensifying a legal battle between the two companies. The dispute, related to Qualcomm's acquisition of chipmaker Nuvia, threatens Qualcomm's access to Arm's intellectual property and poses significant risks for its chip design operations.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.