- Wall Street Opens with Slight Gains

- Dollar Index Gains in the First Part of the Day

- Bond Yields Decline Following Fed Decision

Markets today are recovering slightly from a nervous start to the week. The Fed's decision yesterday stirred a lot of emotions in the market. Now, volatility is somewhat lower, and investors are reassessing the Fed's monetary policy. We are seeing a gentle recovery in risky assets, including the stock market. The S&P 500 and Nasdaq 100 opened about 0.20-0.40% higher. The Dollar Index is gaining 0.20%, and 10-year US bond yields are retreating below 4.65%.

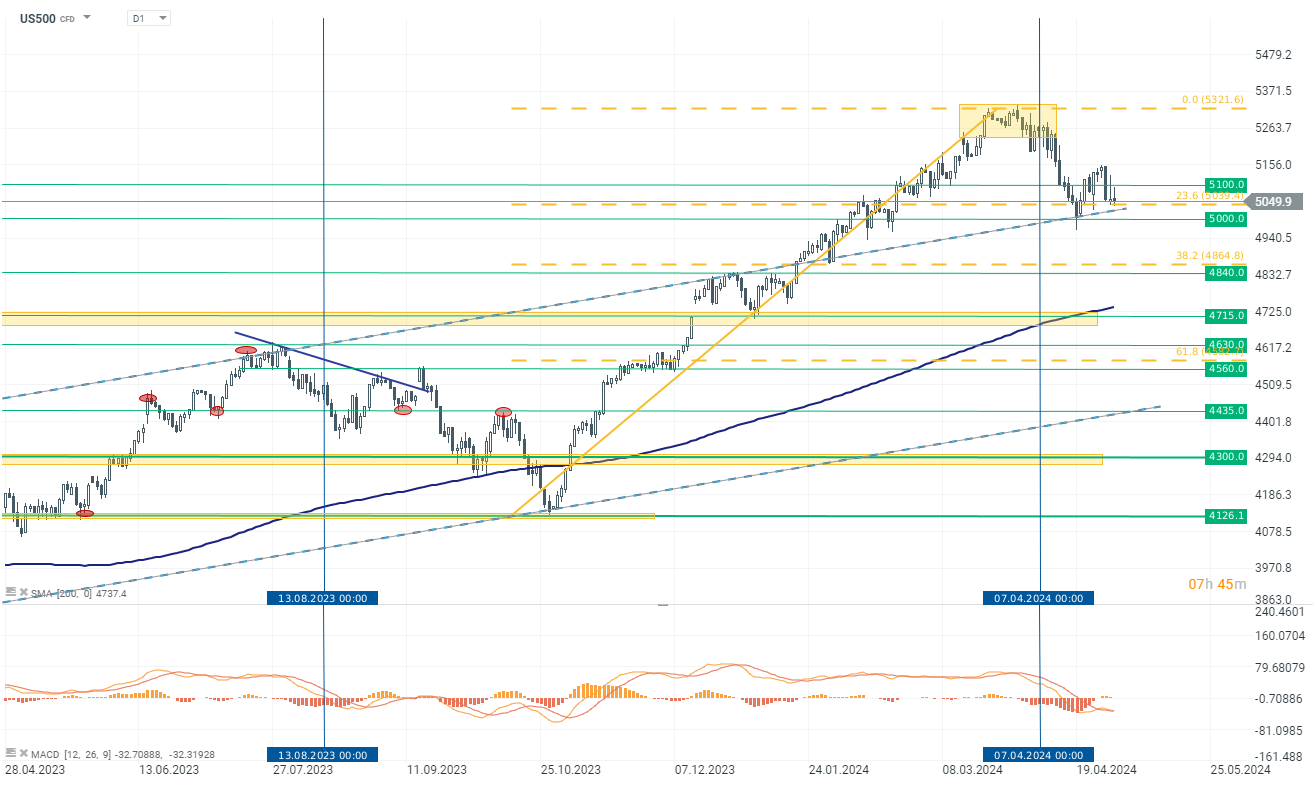

US500

US500 futures on the S&P 500 index are trading around zero today. However, at the time of publication, bulls are dominating the market. The index is up 0.15% to 5060 points. The current key support level is in the 5000-5040 points range. This is where the 23.6% Fibonacci retracement of the recent upward movement converges, and it's also a significant support level and an upward trend line marked on the chart with a dashed blue line.

Source: xStation 5

Company News

Peloton Interactive (PTON.US) dips over 6.00% after the company reported mixed financial results for Q3 FY2024, revealing a revenue of $717.7 million, slightly below the estimated $723.21 million, and a net loss of $167.3 million, worse than the expected $132.59 million. EPS was -$0.45, underperforming the projected -$0.37. Despite these setbacks, the company achieved its first positive free cash flow in over three years at $8.6 million, along with a significant gross margin increase to 43.1% from 36.1% year-over-year. Additionally, Peloton launched a new restructuring program aiming to cut annual expenses by over $200 million to streamline costs and improve cash flow sustainability.

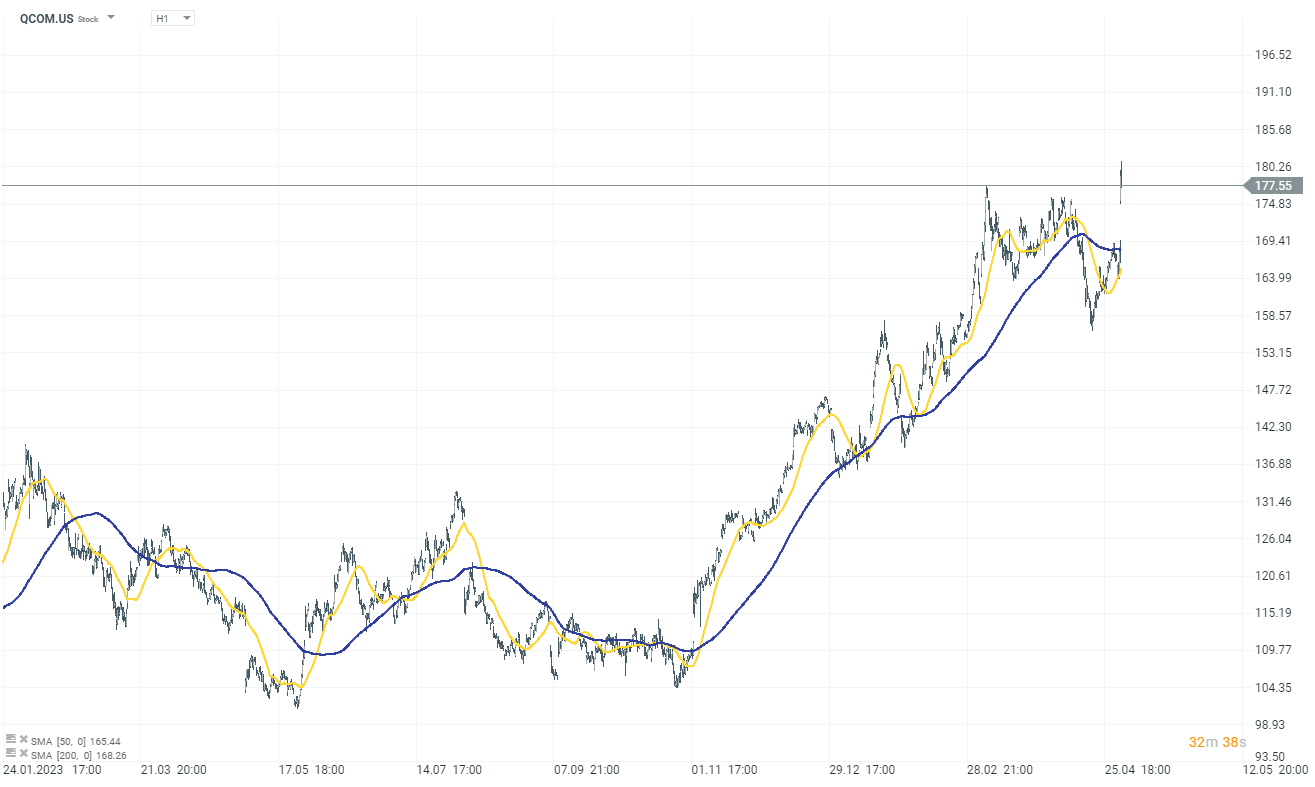

Qualcomm (QCOM.US) gains 7.70% following an upbeat Q2 performance and positive Q3 outlook. Qualcomm forecasts Q3 revenue between $8.8B and $9.6B (consensus of $9.05B) and adjusted EPS between $2.15 and $2.35 (consensus of $2.16). CEO Cristiano Amon highlighted the company's growth, diversification, and advancements in automotive sales, Snapdragon X launches, and on-device AI capabilities.

Source: xStation 5

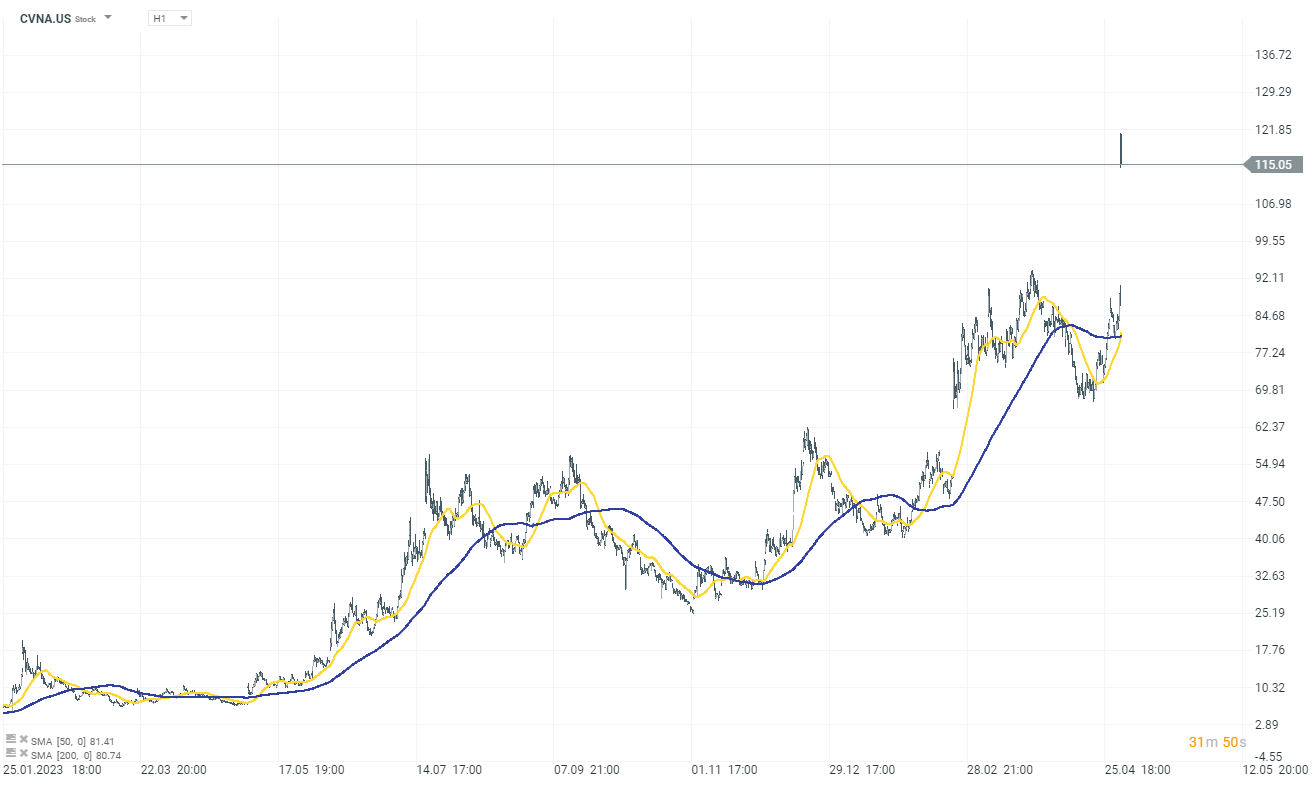

Carvana (CVNA.US) soared over 35% after a successful Q1, with 91,878 cars sold, marking a 16% Y/Y increase despite less inventory and reduced marketing spending. This is the company's third consecutive quarter with positive net income, with adjusted EBITDA surpassing expenses. Carvana anticipates continued growth in Q2, with increased sales and profitability.

Source: xStation 5

XPeng (XPEV.US) gains 6.00% after delivering 9,393 Smart EVs in April, a 33% Y/Y increase and a 4% M/M increase. The XNGP system has achieved an 82% penetration rate in urban driving scenarios, and the company is set to launch its new brand, MONA, in June 2024.

DoorDash (DASH.US) fell 15% despite strong revenue growth, beating consensus on orders, and achieving record adjusted EBITDA. The company processed 620 million orders in the quarter (+21% Y/Y), surpassing consensus of 607.7M orders. However, the company reported a disappointing profit forecast for the current quarter, projecting adjusted EBITDA between $325 million and $425 million, with the midpoint below average estimates.

Fastly (FSLY.US) fell by 34% following mixed Q1 earnings and a disappointing outlook. Q2 revenue is forecasted between $130M and $134M (below the consensus of $140.4M), with adjusted EPS between -$0.10 and -$0.06 (below the consensus of -$0.02). FY2024 revenue is expected to be between $555M and $565M, with adjusted EPS of -$0.12 to -$0.06 (vs. the consensus of -$0.04).

Sentiments on Wall Street are falling 📉S&P 500 earnings season highlight

The Week Ahead

Middle East Crisis: market impact

Three markets to watch next week (27.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.