- US500 gains 0.10%

- US2000 gains 1.30% to 2,300 points

- The dollar remains strong

- Morgan Stanley gains 7% at the open after quarterly results

At the start of the U.S. cash session, indices are opening without a clear direction, except for the US2000 index (Russell 2000). The positive sentiment among small-cap companies can be attributed to investors' growing confidence in a "soft landing" scenario—returning interest rates to lower levels without triggering an economic recession. Additionally, the sentiment is bolstered by very strong quarterly results from Morgan Stanley, which is up over 7% at the opening of the cash session.

US2000

At the time of publication, the index is already up 1.40% to 2,300 points. This is a major resistance level and the upper boundary of the consolidation channel. These levels have been tested three times since July 2024, and each time we observed a return to declines and a deeper correction. If the bulls manage to permanently break through the 2,300-point zone this time, we can expect a continuation of the upward trend.

Source: xStation 5

Company News

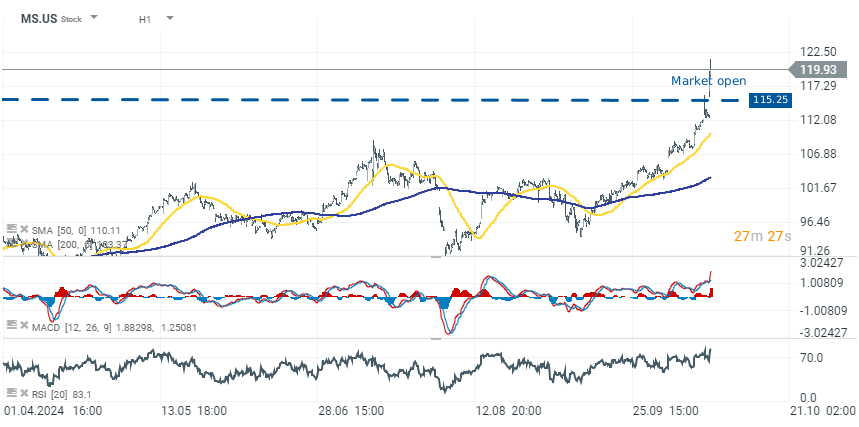

Morgan Stanley (MS.US) gains almost 7% after better-than-expected Q3 2024 earnings, reporting a 32% rise in profit to $3.2 billion, or $1.88 per share, compared to a $1.58 estimate. Revenue increased by 16% to $15.38 billion, surpassing the $14.41 billion forecast. All key divisions performed well, with Wealth Management revenue up 14% and Investment Banking revenue soaring 56%.

J.B. Hunt Transport Services (JBHT.US) gains 4.80% after Q3 earnings beat estimates, despite a 2.8% year-over-year revenue decline. Key drivers included growth in the JBI segment and higher revenue per load in ICS. Excluding fuel surcharges, the revenue decrease was less than 1%.

U.S. Bancorp (USB.US) stock opens 4.75% higher after better-than-expected Q3 earnings, driven by growth in net interest income. The bank maintained stable Q4 guidance and reaffirmed its full-year outlook for net interest income and adjusted non-interest income.

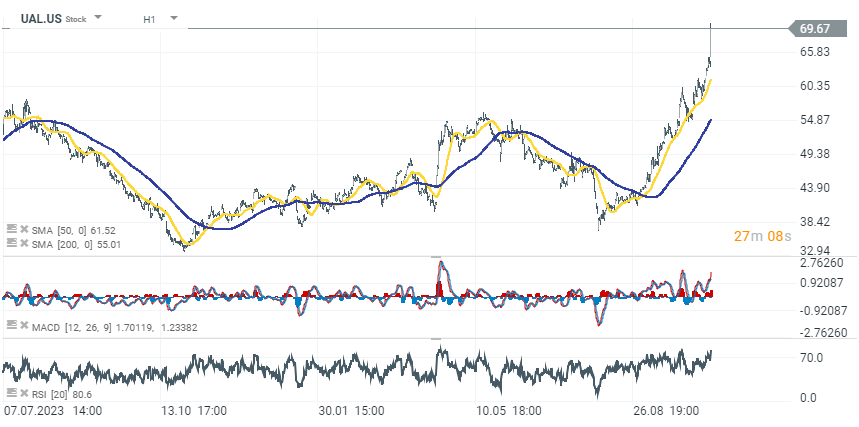

United Airlines (UAL.US) surged 9.80% after exceeding Q3 expectations and announcing a $1.5 billion share repurchase program. The company forecasted Q4 earnings of $2.50 to $3.00 per share, significantly higher than the prior year.

ASML (ASML.US) dropped over 4.70% after reporting weaker-than-expected Q3 bookings, with a 53% sequential decline. Despite strong Q3 net sales and income, concerns over 2025 revenue due to export controls contributed to the decline.

Interactive Brokers (IBKR.US) fell 3.24% after mixed Q3 results. Although revenue grew by 20% year-over-year, net interest margin decreased, contributing to the stock's decline.

Novavax (NVAX.US) plummeted nearly 16.40% following an FDA clinical hold on its COVID-19 and flu vaccine trials, citing safety concerns after a trial participant developed motor neuropathy.

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.