- The dollar is down 0.20%

- US100 is up 0.50%

- Yields are returning to declines

Indices are opening with uncertain gains at the end of the week. The technology-heavy US100 index is gaining the most. The small-cap US2000 index is still trying to break above the key level of 2300 points. Bitcoin is also gaining in the first part of the day.

Investors will likely have to wait until next week for another strong catalyst on Wall Street, as more interesting quarterly reports will be released. So far, the earnings season has not disappointed investors, with relatively strong results from the banking sector drawing particular attention. Next week, we will see some results from the technology sector, which will affect sentiment in the US500 and US100 indices.

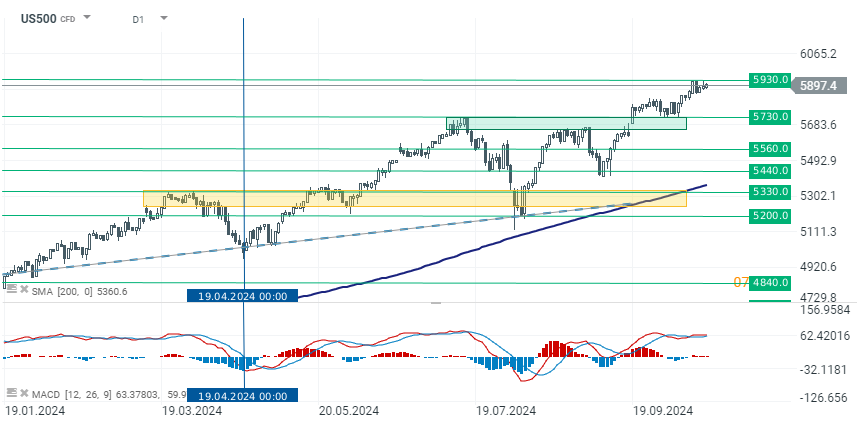

US500

The index is still consolidating around the 5900-point level, awaiting the next strong catalyst to move either up or down. This week has been driven by a strengthening dollar due to solid macroeconomic data. However, a strong dollar may gradually weaken the upward momentum of the index. In this context, much will depend on next week's quarterly results. From a technical analysis perspective, key support is around 5730 points, with resistance above 5900 points.

Source: xStation 5

Company News

The U.S. Commerce Department is investigating whether Taiwan Semiconductor (TSM.US -2.00%) violated export rules by making AI or smartphone chips for Huawei, potentially using intermediaries to bypass U.S. restrictions. TSMC denied any wrongdoing, stating it complies with all regulations and has a robust export control system. The probe examines whether TSMC conducted proper due diligence on its customers and whether it was involved in producing Huawei’s AI chips or smartphone chips. If violations are found, TSMC could face fines or further penalties, as seen previously with other companies like Seagate Technology.

Philip Morris International (PM.US +0.5%), British American Tobacco (BTI.US -2.50%), and Japan Tobacco (JAPAF) agreed to pay C$32.5 billion ($23.6 billion) to settle all tobacco product-related claims and litigation in Canada. The settlement follows a 2015 Quebec court ruling that accused the companies' Canadian units of knowing their products caused cancer.

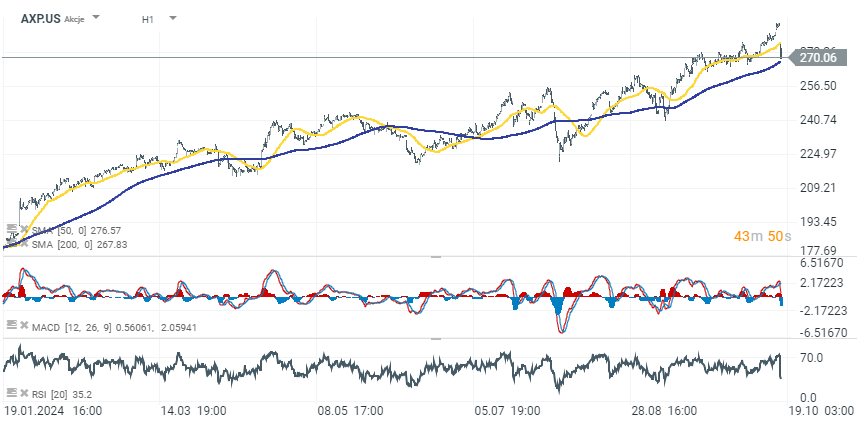

American Express (AXP.US)

American Express dropped nearly 5.50% after the company slightly lowered its full-year revenue growth guidance to about 9% for 2024, down from its previous forecast of 9%-11%. For Q3, American Express reported revenue of $16.64 billion, in line with estimates, while its discount revenue increased by 4% year-over-year to $8.78 billion.

Procter & Gamble (PG)

Procter & Gamble stock fall 1.50% after reporting a 1% year-over-year decrease in net sales for FQ1 2025. Two of its major segments—beauty and baby, feminine, and family care—struggled due to volume declines, particularly in China. Despite this, CEO Jon Moeller expressed confidence that the company would meet its financial targets for the fiscal year.

Schlumberger (SLB.US)

SLB shares dropped 1.80% after the company missed quarterly revenue estimates and warned of cautious spending by international producers. SLB's Q3 revenue totaled $9.16 billion, with international revenue growing 12% year-over-year to $7.43 billion, while North American revenue increased by just 3% to $1.69 billion. CEO Olivier Le Peuch highlighted softening growth in short-cycle activity.

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.