- US stock markets gain at Thursday's opening

- The increases are supported by declines in the USD dollar

- Yields on 10-year bonds are also falling

Today's market sentiment is definitely better than in previous days. The first trading sessions of the new month and quarter were bearish, and today investors can expect a slight rebound. The US500 opens 0.60% higher, and the US100 0.80% higher. The indices thus recover a larger part of the decline from the previous days. The outlook for April may be mixed. It should be remembered that April 15th is the final deadline for paying taxes on 2023 profits, which usually correlates with somewhat higher selling pressure. On the other hand, we won't have to wait long for a catalyst for a bigger move, as the NFP labor market report is scheduled for publication tomorrow. From the Fed's point of view, this is an important report, and a publication far from consensus can affect volatility in the indices and forex.

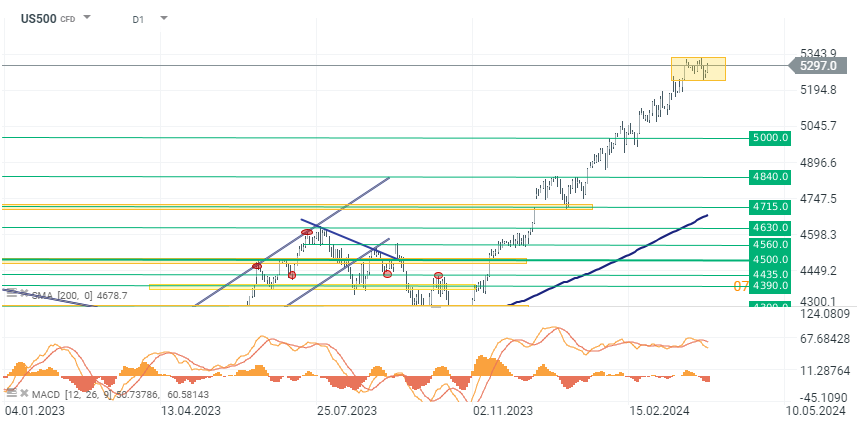

US500

Contracts on the main SP500 index gain 0.60% and are again approaching levels above 5300 points. Quotations in the 5250-5340 point zone have been consolidating for over two weeks. The market is consolidating in anticipation of the NFP data on the number of employed people in the USA.

Source: xStation 5

Company News

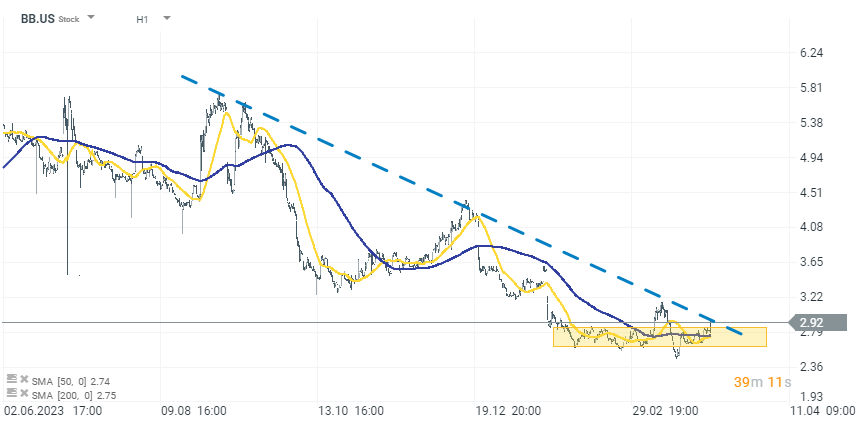

BlackBerry (BB.US) gains 4% after the company reported Q4 results that exceeded expectations. Despite that, the company's guidelines were below market expectations, projecting 1Q25 sales between $130M and $138M (below the consensus of $151.85M), and adjusted EPS for the quarter between -$0.04 and -$0.06 per share (below the consensus of -$0.03).

Conagra Brands (CAG.US) gains almost 5% after reporting a profit beat for FQ3 2024 and raising its fiscal adjusted operating margin guidance. Despite a 1.7% Y/Y decline in quarterly net sales to $3.03B and a 2% decrease in organic net sales, Conagra's performance was buoyed by U.S. consumers eating more at home.

Levi Strauss (LEVI.US): surges over 16% after the company surpassed Q1 expectations and raised its profit outlook. Levi Strauss reaffirmed its revenue growth outlook for the year at +1% to +3%, aligning with the consensus growth of 2.4%. It also increased its FY2024 EPS guidance range to $1.17 to $1.27, up from the prior range of $1.15 to $1.25 and above the $1.22 consensus.

Lamb Weston (LW.US) fell over 15% following a top and bottom line miss in FQ3 2024. The disappointing results were attributed to issues arising from a transition to a new ERP system in North America, which affected the company's ability to fill customer orders, impacting sales volume and margin performance. Consequently, Lamb Weston cut its fiscal 2024 net sales guidance from $6.8B-$7B to $6.54B-$6.60B.

Block (SQ.US) dropped almost 3% after Morgan Stanley downgraded the stock to Underweight from Equal-weight and lowered the price target to $60 from $62 (currently $77). The downgrade reflects concerns that the market is overestimating growth potential for its Cash App and Square business.

Ford (F) announced a delay in the launch of its all-new three-row EVs in Oakville, Ontario, from 2025 to 2027. Ford will focus on hybrid vehicles and plans to offer hybrid options across its North American lineup by the end of the decade. This move reflects the broader challenges in the automotive industry in adopting EVs.

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.