- Indices open higher

- Bond yields gain

- Dollar also slightly positive

On the last day of this week, equity market indices continue to rise, gaining about 0.15-0.30% at the time of publication. We observe a slight rebound in US bond yields after recent declines. The dollar, however, does not follow a clear direction and remains around the opening levels.

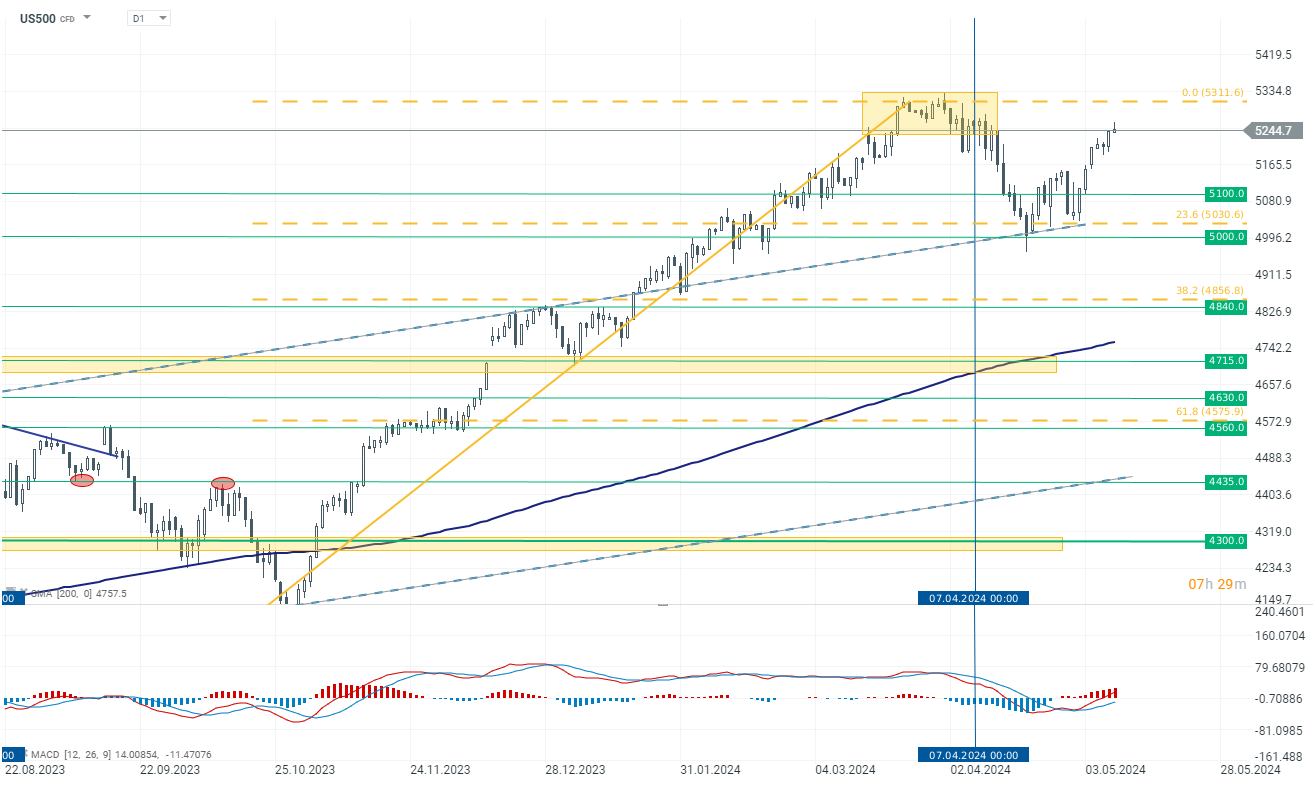

US500

Contracts on the main SP500 index are up 0.15% at the time of publication. The increases are not significant, but the levels are again close to historical highs. Bulls are currently battling the resistance zone around 5250 points.

Source: xStation 5

Company news

Novavax (NVAX.US) surged by over 120% following the deal announcement. Sanofi will acquire a 4.9% stake in the U.S. drugmaker. The taj deal and the stake acquisition values Novavax at about $1.4 billion, almost double its market capitalization of about $628 million yesterday. Additionally, Novavax will earn royalties on vaccine sales and potentially for future Sanofi vaccines that use their technology.

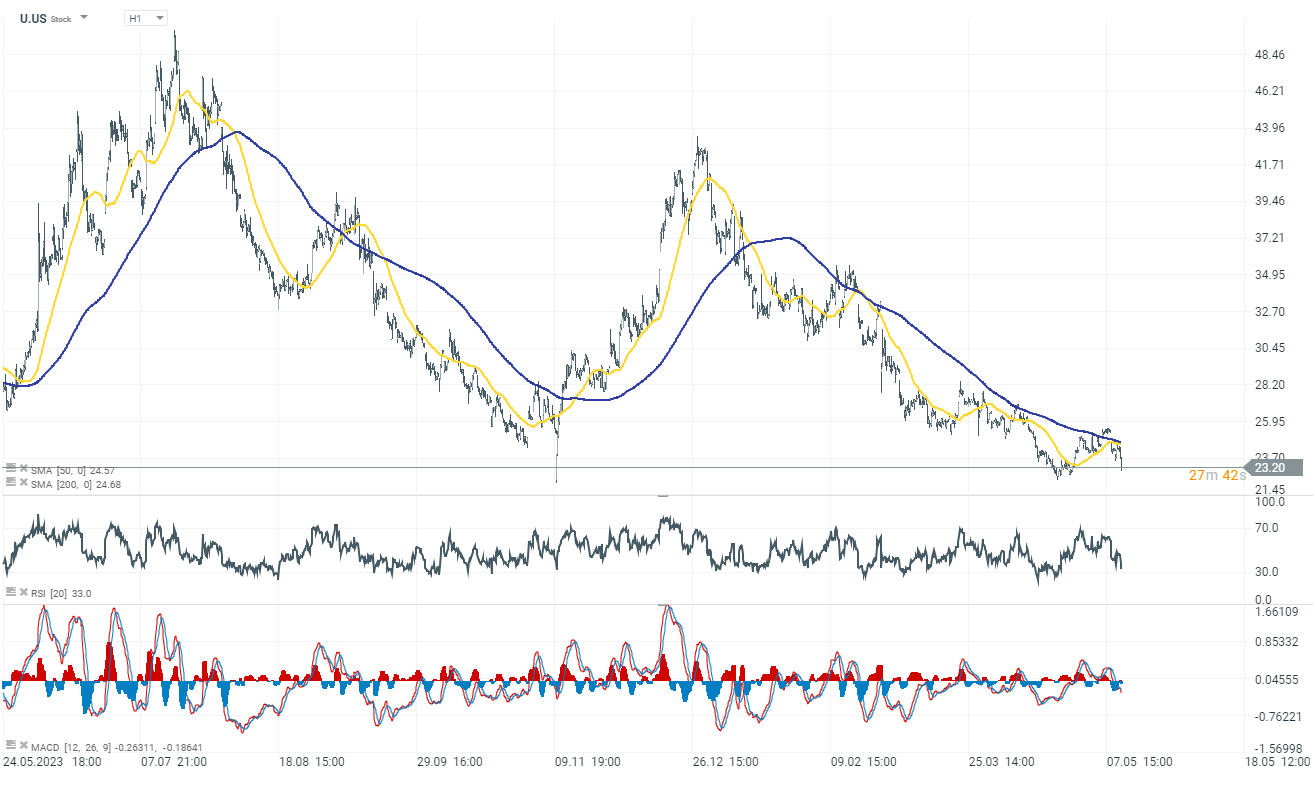

Unity Software (U.US) fell more than 5% due to mixed Q1 results and a disappointing Q2 revenue forecast. The company expects Q2 revenue between $420M and $425M, representing a 6% to 7% year-over-year decline and falling short of the consensus forecast of $443.22M. Despite the lower projections, interim CEO Jim Whitehurst emphasized the completion of a recent portfolio and cost reset, aiming to accelerate revenue growth while maintaining attractive profit and cash flow margins.

Source: xStation 5

Akamai Technologies (AKAM.US) plummeted nearly 9% after reporting mixed Q1 results and a Q2 outlook that missed market expectations. The company anticipates Q2 earnings per share between $1.51 and $1.56, below the consensus of $1.63, and sales between $967M and $986M, compared to a consensus of $1B. Akamai's board also approved a new three-year, $2 billion share buyback program.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.