- Indexes drop at the opening of the cash session

- Dollar trades highers

- Bond yields rise

The market reacted mixed to the CPI release. The report showed a sharp decline in headline inflation to the lowest level before price increases. However, investors were hoping for a similar surprise for core inflation. But the core data turned out to be even slightly higher than expected. While the annual data met expectations, the monthly data were slightly higher. This increase is caused by a rebound in rental housing prices, which theoretically is not typically demand-driven. Therefore, the path to interest rate cuts next week is practically open. At the time of publication, a 25 basis point cut seems most likely.

Immediately after the publication, the dollar strengthened significantly, and bond yields rose dynamically. This means that the markets were hoping for slightly lower readings for core inflation, and thus expectations for a larger cut, i.e., 50 basis points, are now much lower. However, over time, the initial reaction was erased, and index contracts were even noted in the plus at one moment. The opening of the cash session in the US increased downward pressure, thereby pushing the main benchmarks lower. Currently, US500 is down 0.80% to 5450 points, US100 down 0.20% to 18800 points, and US2000 down 1.40% to 2070 points.

US500

The index records losses today after increased volatility during the CPI data publication. It now seems that the bears are taking control, and the ratings may find another support zone around 5440 points. The next level worth noting is around 5300–5330 points, which has been an effective technical level three times in the past.

Source: xStation 5

Stock news

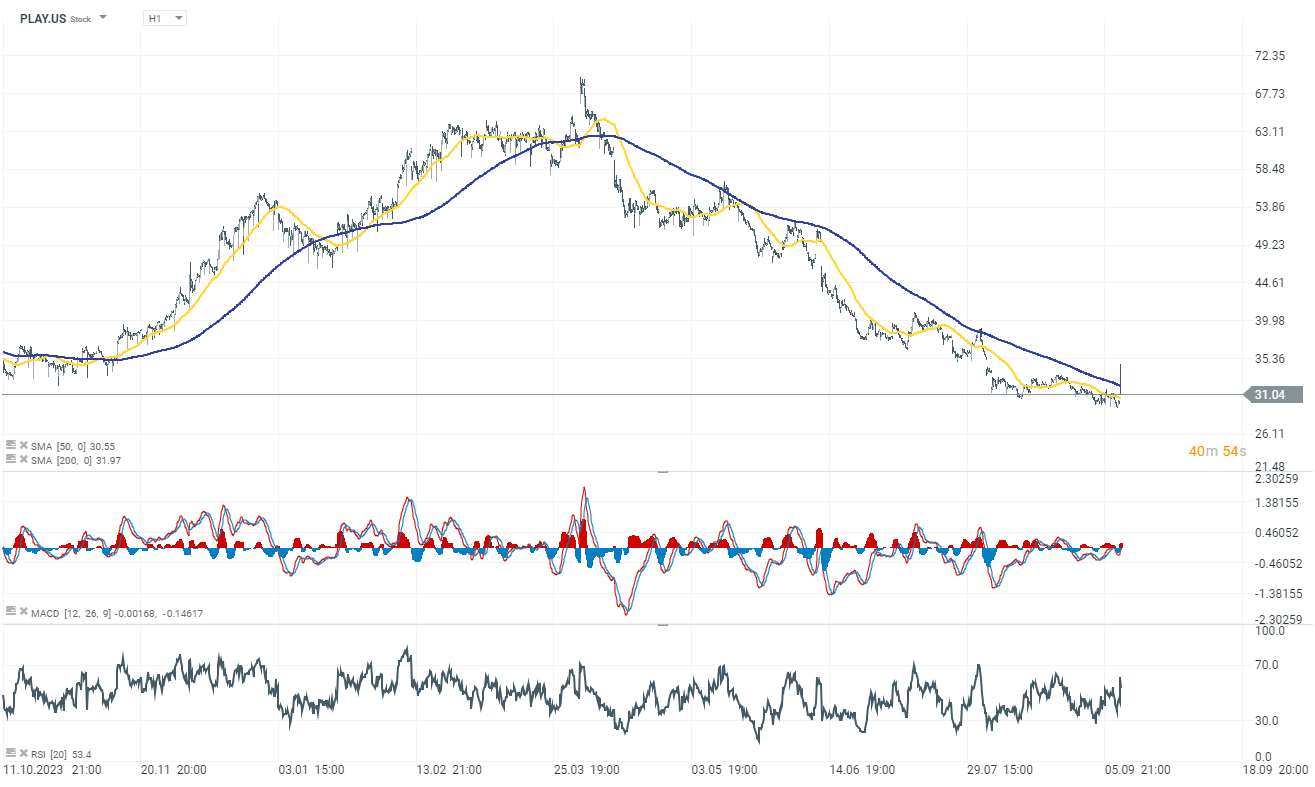

Dave & Buster's Entertainment (PLAY.US) Stock price increased by over 6% after Q2 results. Despite missing revenue estimates with a 6.3% drop in comparable sales, the company surpassed profit expectations and achieved an 8.1% increase in adjusted EBITDA through effective cost management.

GameStop (GME.US) stock fells 13.50% following Q2 earnings. The company beat profit forecasts but experienced a significant 32% drop in sales, with software sales falling to 26% of total revenue from 34.1% last year. Selling, general, and administrative expenses also increased, making up 33.7% of sales.

Viking Therapeutics gains 5.65% at the opening, due to JPMorgan’s buy recommendation, prior to the release of obesity pill clinical trial data. The drug is expected to be released in 2023, with estimated sales of $1 bn by 2035. According to the bank's analysts, 30-60% gain on the company's shares is very much feasible.

Southwest Airlines’s CEO Gary Kelly is set to resign from his position next year. Company’s board awaits a reshuffle, opted by Elliott Investment Management who acquired an almost $2 bn stake in June. Carrier’s stock trades currently 0.6% lower.

Trump Media & Technology (DJT.US stock dropped by 15% after the U.S. presidential debate. A CNN poll indicated that 63% of viewers thought Kamala Harris won the debate, versus 37% for Donald Trump, impacting the stock negatively.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.