- Wall Street indices open mixed

- US100 trades above 20,000 pts after contract rollover

- Dell, Super Micro Computer and Nvidia trade higher on xAI news

- Accenture rallies after fiscal-Q3 earnings

Wall Street indices launched today's trading mixed, with tech sector gaining. S&P 500 opened 0.2% higher, Nasdaq gained 0.3% at session launch, Dow Jones opened 0.1% lower and small-cap Russell 2000 was down 0.3% at session launch.

US housing market data for May released at 1:30 pm BST turned out to be a huge disappointment. Report showed an unexpected 5.5% MoM plunge in housing starts to 1277k (exp. 1370k) as well as an unexpected 3.8% MoM drop in building permits to 1386k (exp. 1450k). US index futures as well as US dollar took a hit on the release. However, losses on USD market were quickly recovered.

Source: xStation5

Source: xStation5

Contract rollover took place on US index futures today, resulting in over-1% bullish price gaps on US500, US30, US100 and US2000. As a result, US100 is trading above an important psychological level for the first time in history - 20,000 pts mark. Taking a look at US100 chart at weekly interval (W1), we can see that 14-period RSI indicator is flashing a potential warning signal. The indicator jumped above 70.0 mark this week, a level often associated with local highs. However, it should be noted that, after climbing above this hurdle, the index tended to remain there for a few months before the downward correction actually began. This means that correction is neither certain nor immediate, but traders should keep in mind risk of one occurring given current stretched valuations.

Company News

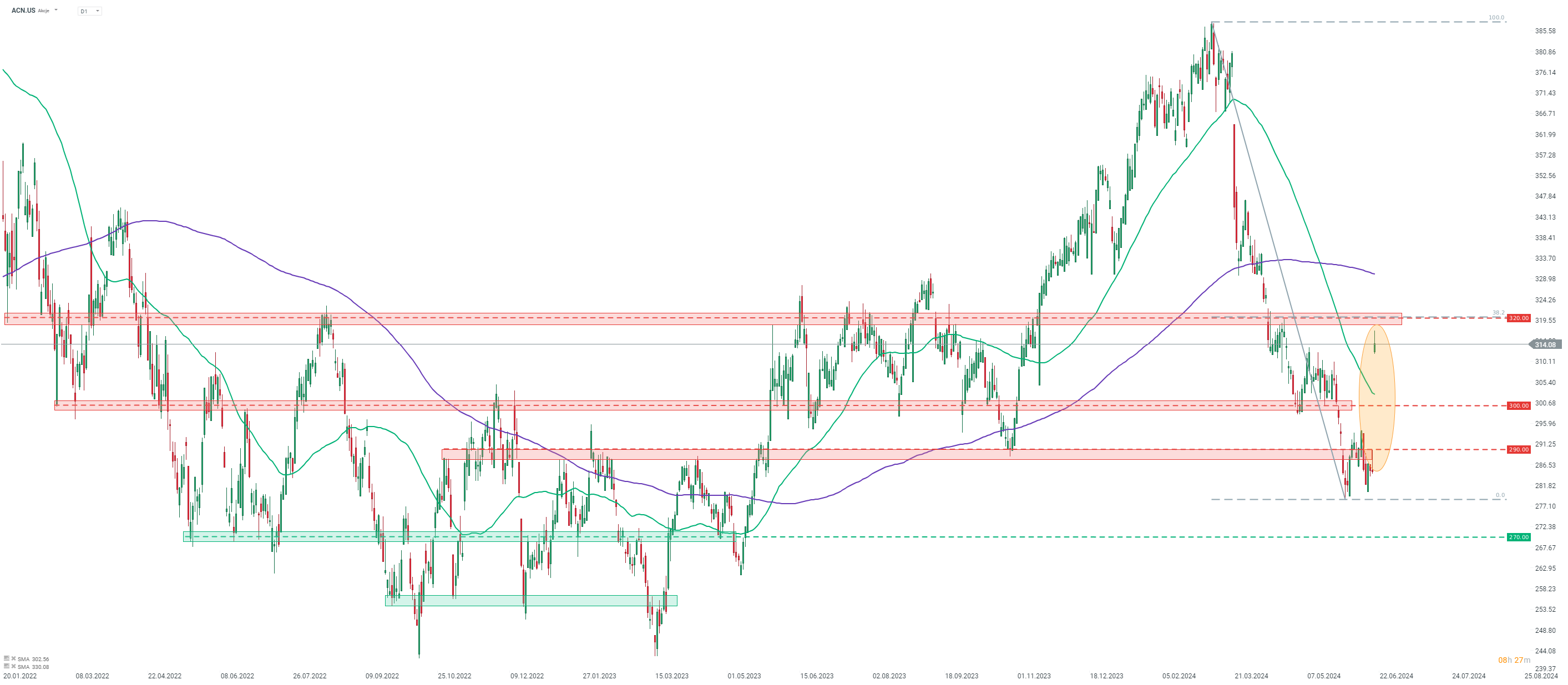

Accenture (ACN.US) trades higher after reporting fiscal-Q3 results. Revenue declined 0.6% YoY to $16.47 billion (exp. $16.56 billion), with drop being led by 7.8% YoY decline in Financial Services. Bookings climbed 23% YoY to $21.1 billion (exp. $17.69 billion), with Managed Services new bookings jumping 42% YoY to $11.8 billion (exp. $8.81 billion). Gross margin remained unchanged compared to a year ago at 33.4% (exp. 33.4%), while operating margin improved from 14.2% to 16.0%. Adjusted EPS of $3.13 was slightly lower than $3.14 expected and $3.19 reported a year ago. Company expects full-year revenue growth of 1.5-2.5%, narrower than previous forecast of 1.0-3.0%, and adjusted EPS of $11.85-12.00, slightly lower than $11.97-12.20 in previous forecast.

Dell Technologies (DELL.US) and Super Micro Computer (SMCI.US) are trading higher today after Elon Musk said in a post on X platform that the two companies will provide server racks for his artificial intelligence startup xAI.

Nvidia (NVDA.US) launched today's trading higher, extending its lead over Microsoft and Apple as the world's largest company in terms of market capitalization. Today's gains are supported by comments by Michael Dell, CEO of Dell Technologies, who said that his company is building an AI factory together with Nvidia to power xAI's supercomputer.

Accenture (ACN.US) launched today's trading with an almost-10% bullish price gap, after company reported a much better-than-expected bookings for fiscal-Q3. The next resistance zone to watch can be found in the $320.00 area, marked with 38.2% retracement of recent drop. Source: xStation5

Accenture (ACN.US) launched today's trading with an almost-10% bullish price gap, after company reported a much better-than-expected bookings for fiscal-Q3. The next resistance zone to watch can be found in the $320.00 area, marked with 38.2% retracement of recent drop. Source: xStation5

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

STM is growing stronger thanks to a new partnership with AWS!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.