Office prices in the US are anticipated to crash, with the commercial real estate market expected to face continued declines for at least another nine months, according to Bloomberg’s Markets Live Pulse survey. About two-thirds of the respondents believe that the US office market will only see a rebound after a significant downturn. This poses challenges for the $1.5 trillion of commercial real estate debt that is due by the end of 2025, especially with approximately 25% of this debt tied to office buildings. Additionally, the Federal Reserve’s tightening campaign has negatively impacted commercial property values by increasing financing expenses.

Factors such as higher interest rates and tenant behaviors are influencing the property sector. Increased interest rates can take years to impact commercial real estate owners, especially those with long-term fixed-rate financing and tenants under long-term leases. Furthermore, in the US, office workers are showing reluctance to return to their workspaces, more so than their counterparts in Europe or Asia. This hesitation is partly attributed to inadequate public transportation options. The survey revealed that 20% of respondents had moved further from their offices during the pandemic, resulting in longer commutes for many due to relocations or transit service cuts during the pandemic era.

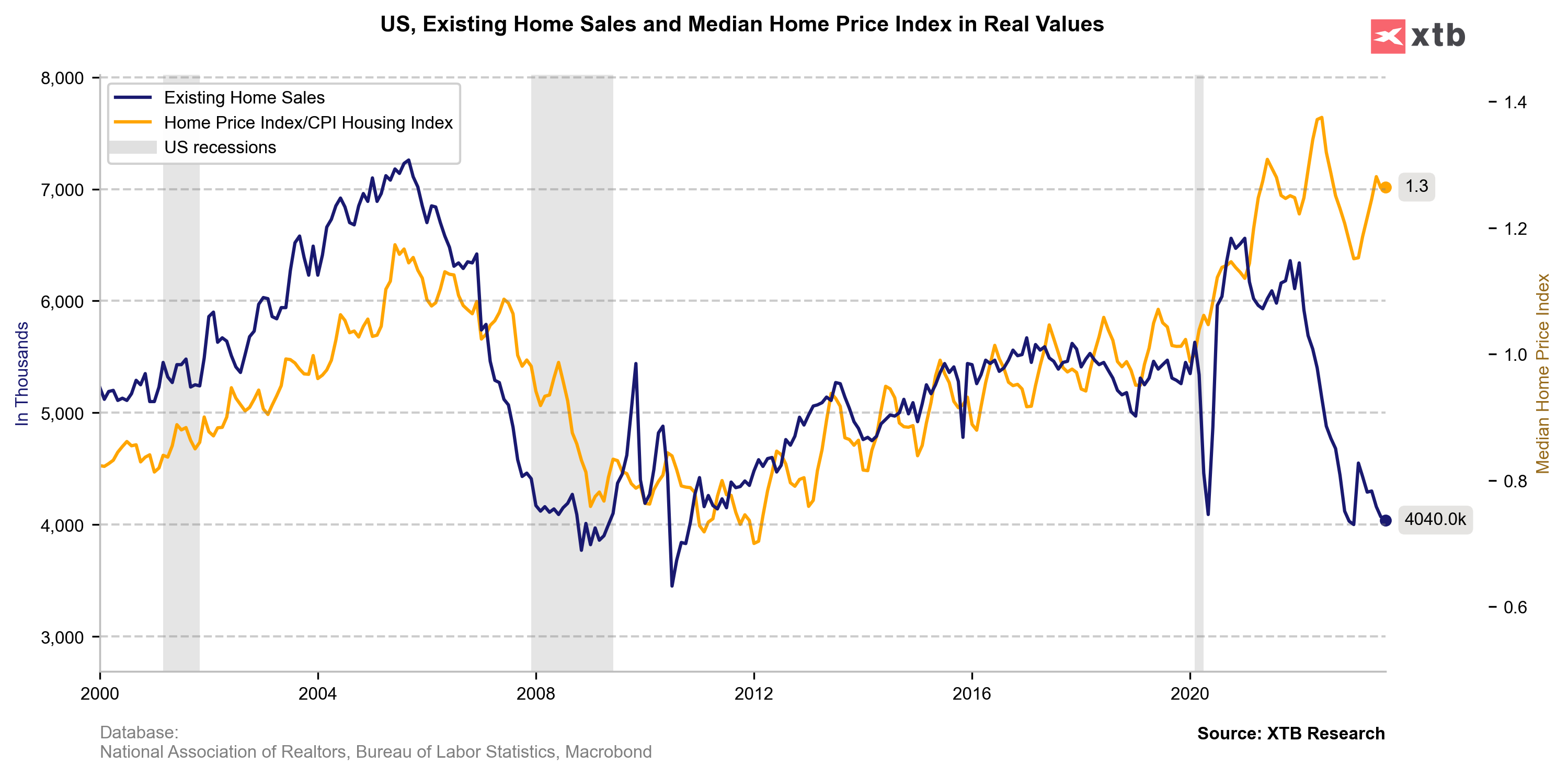

In real values for the entire real estate sector, we see that prices are currently relatively high. The inflation-adjusted housing price index is marked on the chart with a yellow line. At this moment, real estate prices are higher than at the peak before the 2008 crisis.

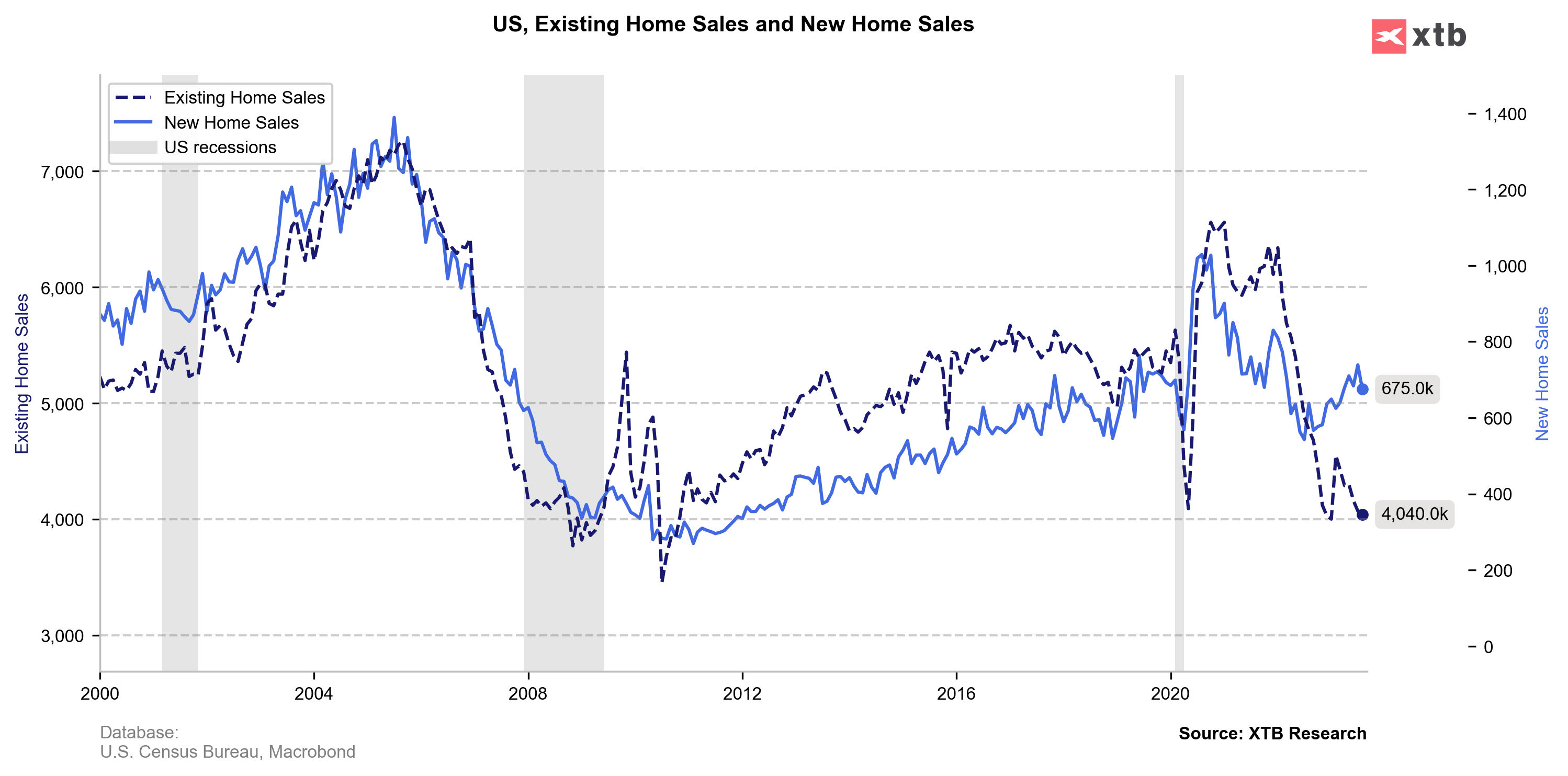

Sales of homes on the secondary market continue to be in a strong downward trend. High-interest rates and shrinking cash surpluses among consumers are putting pressure on the secondary market. On the other hand, the sale of new homes has remained high so far because it was profitable for developers to build due to the high real prices of real estate, and many investors decided to invest their capital in the primary market to protect their capital from inflation. However, recent data shows that this sector is also beginning to weaken.

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.