Summary:

-

ISM in focus after impact of Tuesday’s releases

-

NFP release also on the radar

-

S&P500 languishes near 5-week lows

Two economic releases from the US in the next 24 hours could well go a long way to dictating the outcome of the next Fed rate decision at the end of the month. First off the ISM non-manufacturing PMI is due at 3PM (BST) and given the strong negative reaction seen to Tuesday’s manufacturing equivalent this could well have a clear impact on equities.

Comparatively speaking, the non-manufacturing or service sector is far larger than the manufacturing and is therefore arguably more important, and with the data coming just 30 minutes after the opening bell it will likely set the tone for the rest of the session.

Tomorrow’s US jobs report (read our preview here) is potentially the biggest of the year as if it shows a clear weakening of the labour market then the pressure will be ramped up further on the Fed to act and provide further stimulus later this month. The ADP yesterday was a little weak but not horrendous and we’ve also just got the latest initial jobless claims which came in at 219k vs 215k expected. The prior week was revised higher to 215k from 213k originally.

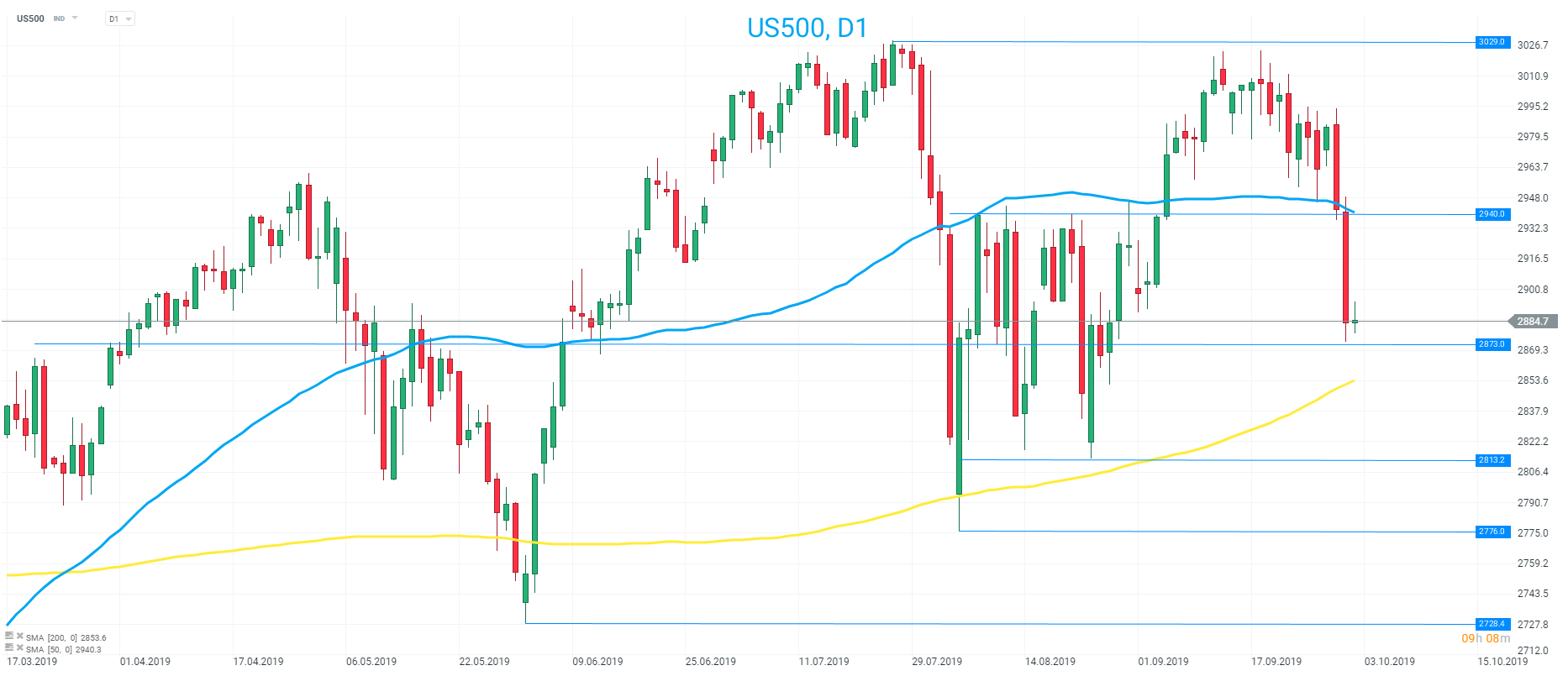

The outlook for US stocks has changed quickly this week with the S&P500 falling from trading around 1% from its all-time high to trade not that far from the 200 SMA in the space of just a couple sessions. Source: xStation

The outlook for US stocks has changed quickly this week with the S&P500 falling from trading around 1% from its all-time high to trade not that far from the 200 SMA in the space of just a couple sessions. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.