Summary:

-

US benchmarks firmly higher on improving sentiment

-

US trade deficit higher than expected

-

S&P500 set to retest key resistance (2946) once more

There’s been a clear push higher in global equities today with sentiment improving markedly on reports that the protests in Hong Kong could soon come to an end. European markets have rallied broadly with the German Dax back above the 12000 level and US indices are trading firmly in the green ahead of the cash open.

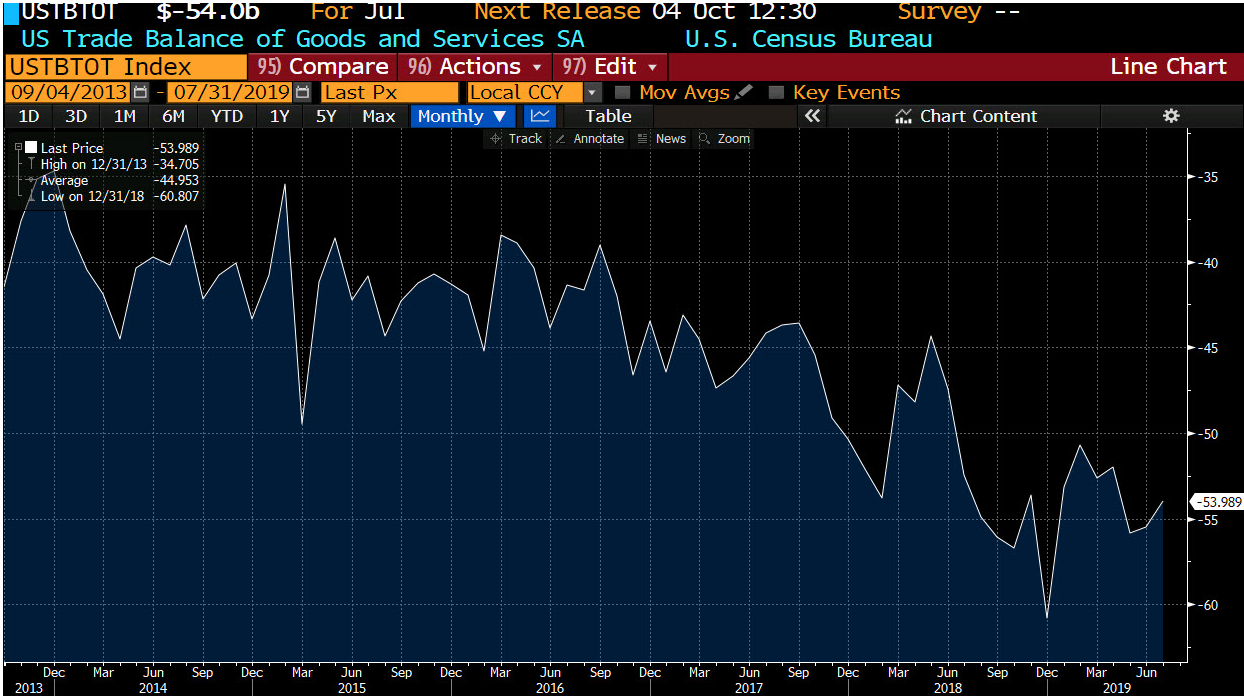

The US trade balance for July came in at $-54.0B and while this is a reduction in the deficit compared to the $-55.5B seen last time out, it is still more negative that the expected $-53.4B. The prior month was also revised lower after initially coming in at $-55.2B. Looking at the breakdown of trade, exports rose by 0.6% vs a 1.9% drop in June whereas imports fell by 0.1% compared to a -1.7% print previously.

While the US trade deficit improved in July, the improvement was less than had been hoped and the level still remains low compared to recent years. Source: Bloomberg

There’s no more major US economic releases due during the forthcoming session with Fed speak from Williams, Bullard and Evans the main things to keep an eye on. Bullard in particular could be worth watching as he has recently been outspoken, both in his criticism of the Trump administration and also in calling for larger than 25 bps rate cuts.

The S&P500 has once more moved back up near the prior resistance zone around 2946. Numerous previous attempts to break above this level have failed, but a clean move above there would end the recent consolidation phase. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.