Summary:

-

US Advance GDP beats forecasts; prior revised lower

-

ADP employment change in line with estimates

-

US500 edges towards ATH ahead of FOMC decision

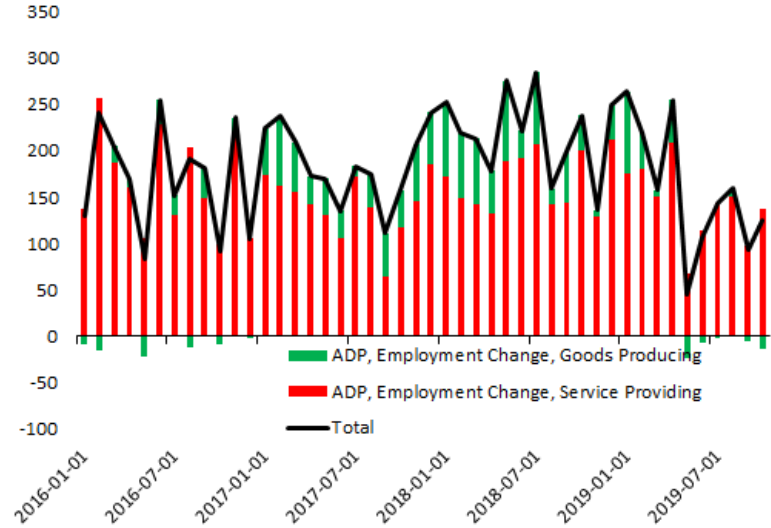

It’s a busy North American session this afternoon with several key economic releases. Kicking things off the ADP employment change for October came in bang inline with the consensus forecast at 125k but there was a notable downward revision to the prior which now reads 93k after 135k originally. One key story to watch for the US labour market is the impact of the GM workers strike where 50,000 employees stopped working for 6 weeks in the middle of September. This isn’t captured in the latest ADP release but will have a negative impact on Friday’s more widely viewed NFP.

The current ADP reading is amongst the weakest in several years and saw a decline in goods producing roles - something of a trend of late with 5 of the past 6 months seeing a decline in this area. Source: xStation

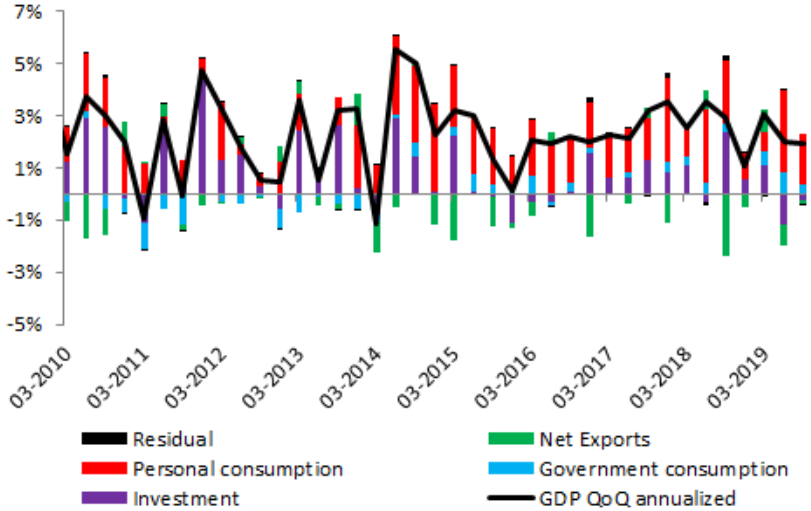

A more keenly viewed data point than the ADP is the first look at 3rd quarter growth in the US. The Q3 advance GDP reading came in at +1.9% Q/Q in annualised terms, comfortably above the 1.6% forecast. There was a small downward revision to the final Q2 read which will now stand at 2.0%, 10 basis points lower than last stated, but on the whole this is a positive release.

Looking at the breakdown personal consumption remains surprisingly strong (+2.9% vs +2.6% expected). Source: XTB Macrobond

Both of these releases will be taken into account when the FOMC announce the outcome of their latest policy meeting later this evening at 6PM GMT. Our preview of the event can be viewed here.

A mini head-and-shoulders may be forming in the Nasdaq with the head coming in at the all-time high of 8125. The region from 8035-8045 could be seen as the neckline although how this market reacts to the FOMC decision will likely outweigh any technical setups. Source: xStation

A mini head-and-shoulders may be forming in the Nasdaq with the head coming in at the all-time high of 8125. The region from 8035-8045 could be seen as the neckline although how this market reacts to the FOMC decision will likely outweigh any technical setups. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.