The dollar is gaining after today's CPI report and is currently the strongest currency among the G10 currencies. The Dollar Index (USDIDX) gains over 0.70% and breaks above key levels.

The high inflation reading could be a catalyst for short-term USD appreciation. However, the reaction is likely to be limited until the next labor market reports in two weeks and the next month's CPI report. Markets may also quickly shift their attention from higher inflation readings back to the stock markets, due to the upcoming Nvidia report next week, which could reignite emotions around tech companies.

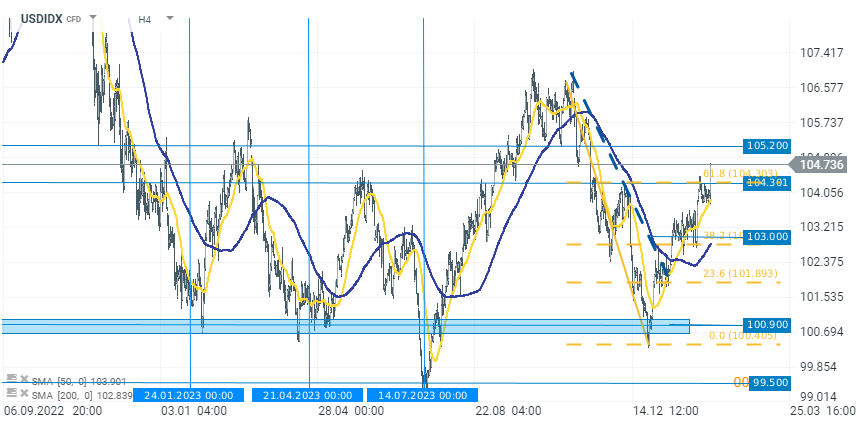

Looking at the USDIDX chart, we see that the dollar has broken above the key resistance zone at the 104.300 points level. This was also the 61.8% Fibonacci retracement of the last downward move. If the current upward momentum is extended, the next level of resistance worth noting is 105.200. Otherwise, the support for bulls is the aforementioned level of 104.300 points.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.