Summary:

-

US500 trading not far from all-time high

-

Markets attempt to shrug off Middle East concerns

-

ISM release (3PM) could be key going forward

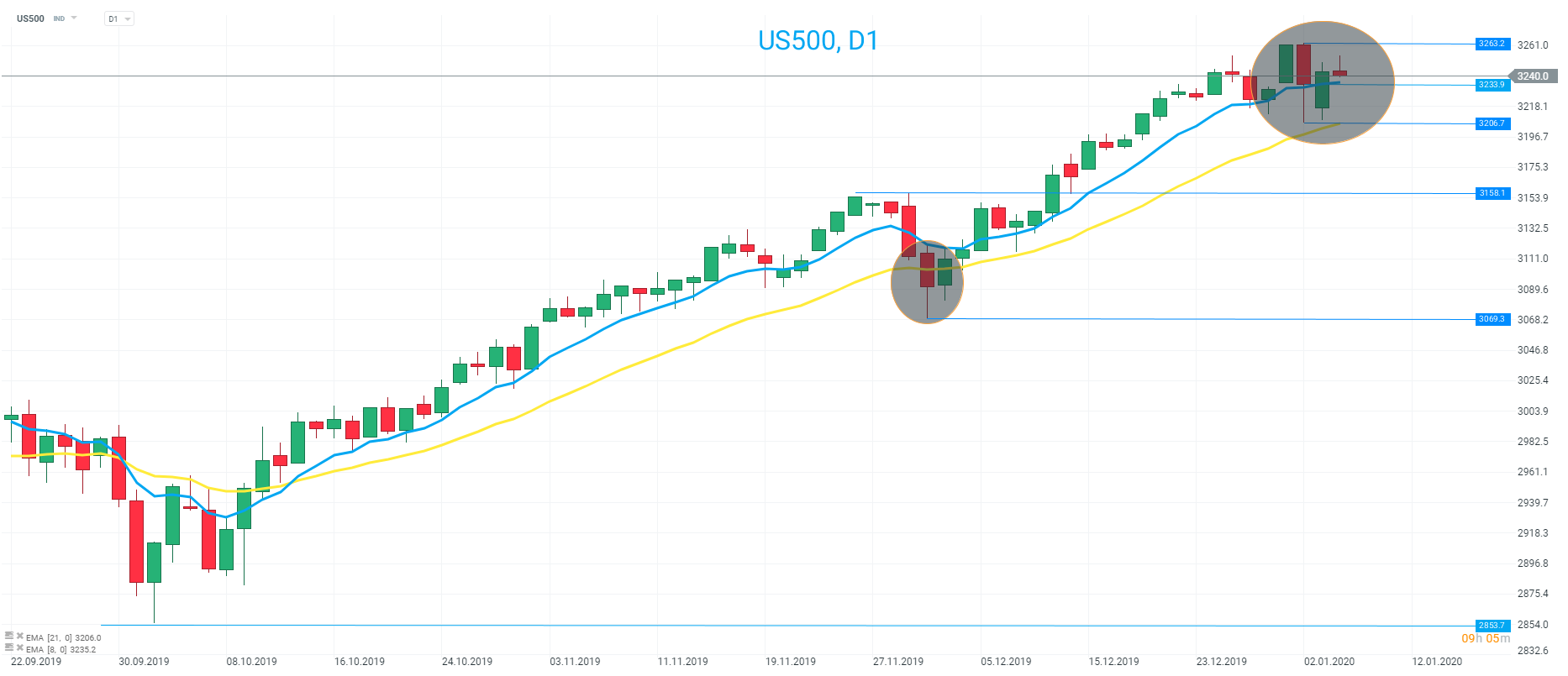

Monday’s trade for US indices was similar to Friday’s in some ways with indices trading firmly lower during the European morning before bouncing during the cash hours. The positive reaction yesterday was more impressive than that on Friday as a red open was keenly bought and the US500 ended the day with a sizable green candle on D1. Earlier today the market even came within 10 points of its all-time high at 3263, although the market has turned lower in the past hour or so.

The US500 once more found support around the 21 EMA (yellow line) and ended Monday’s session back above the 8 EMA (blue line). The uptrend remains in tact for now as long as the recent lows of 3206 aren’t breached with the record peak of 3263 a level to be aware of above. Source: xStation

The reasons for the weakness in the past couple of sessions are well versed with concerns surrounding rising tensions in the Middle East causing some disconsternation for investors. However, with both Oil and Gold pulling back from their recent peaks the markets are seemingly attempting to look through the clear and obvious threat of further military conflict and for now that is keeping indices supported. This afternoon there’s the 2nd most important US data point of the week due out at 3PM (GMT), with the ISM non-manufacturing PMI called to rise to 54.5 after 53.9 prior.

There’s some notable negative divergence on the RSI on a H4 timeframe which could be seen to suggest that the upwards momentum is on the wane. Source: xStation

There’s some notable negative divergence on the RSI on a H4 timeframe which could be seen to suggest that the upwards momentum is on the wane. Source: xStation

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.