Summary:

-

US 10-year yield once more at 3%

-

T-note been steadily declining since NFP release

-

USD falling lower despite higher US yields

The yield on the US 10-year bond has reached its highest level since May today, and in doing so moved back above the big round number of 3%. For the last 7 years the market has struggled to gain traction above the 3% level with pushes into this region often marking highs. The market is still lower than the level reached back in May but with the Fed meeting next week, where the central bank are widely seen as hiking rates by 25 basis points there is a feeling that the price action in the coming weeks could prove pivotal longer term. A failure around these levels once more would see the region around 3% further cemented as a ceiling whereas a sustained break higher could lead to a substantial amount of upside.

The US 10-year yield has hit its highest level in several months today and the market is once more around the 3% level - a region that has rarely been breached in the last 7 years. Source: Twitter @ReutersJamie

On xStation the 10-year bond is the TNOTE which moves inversely to the yield. As such we can observe that this market has been declining in recent trade with the strong NFP number earlier this month a clear catalyst. The lows from May around 118.33 could now be set for a retest as price has just breached the July lows of 119.09.

The TNOTE has dropped to its lowest level since May today after falling below 119.09 and the YTD lows around 118.33 are now exposed and could be set for a retest. Source: xStation

The TNOTE has dropped to its lowest level since May today after falling below 119.09 and the YTD lows around 118.33 are now exposed and could be set for a retest. Source: xStation

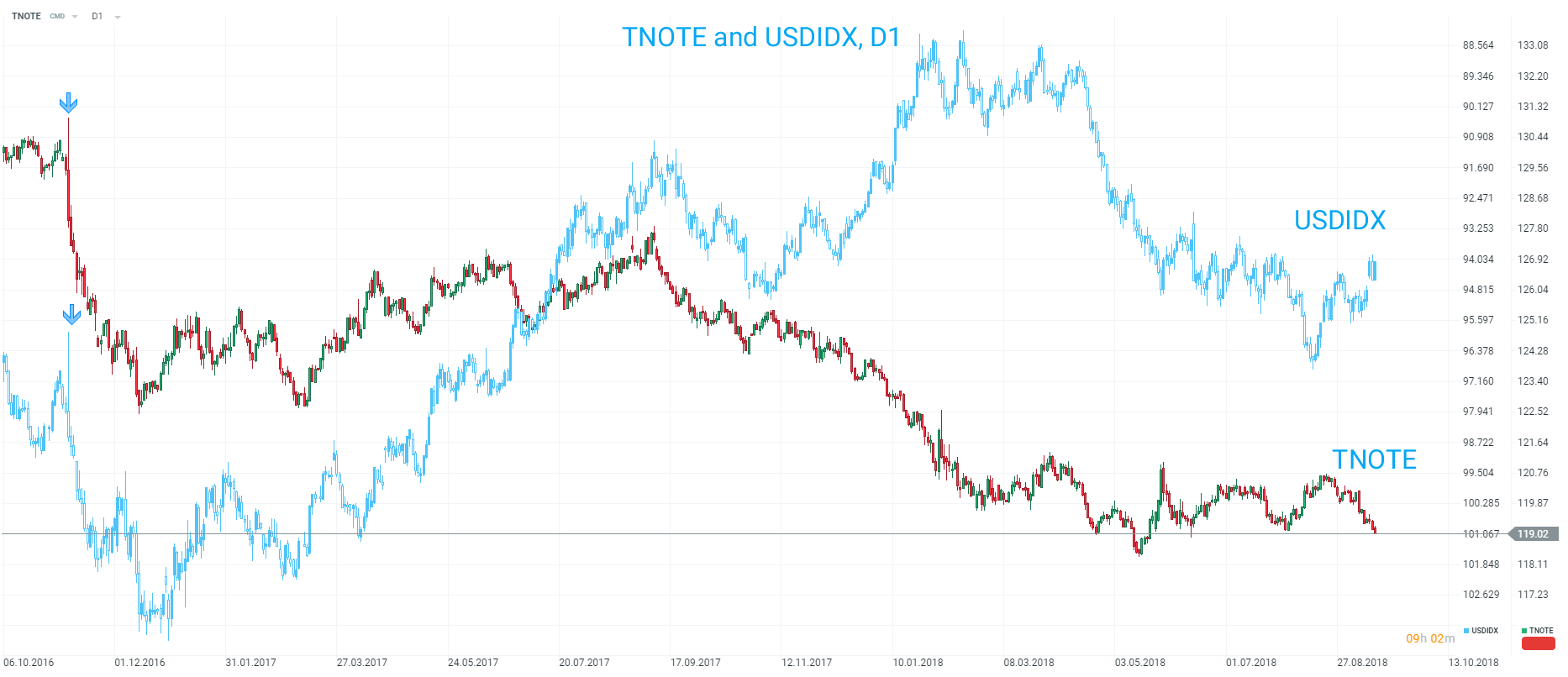

The TNOTE has been seen previously as exhibiting an inverse correlation with the US dollar, with a lower TNOTE price indicating higher US yields which is seen as positive for the US dollar. This was particularly evident in the aftermath of the 2016 US election when the TNOTE fell strongly while the US index (USDIDX on xStation) rallied. Since then however the relationship has noticeably weakened and at present the relationship has actually been a fairly good positive correlation.

The TNOTE and USDIDX have previously exhibited a strong inverse relationship as can be seen from the TNOTE falling and USDIDX rallying after the US election in 2016 - shown by downward arrows. Note the USDIDX axis is inverted. Source: xStation

Recent months however have seen this relationship exhibit a positive correlation. This is also evident today where the US dollar is falling lower alongside the TNOTE. Source: xStation

Recent months however have seen this relationship exhibit a positive correlation. This is also evident today where the US dollar is falling lower alongside the TNOTE. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.