The global uranium market is on the edge of a potentially unprecedented expansion, driven by the mounting demand for nuclear power as a solution to climate change concerns. With uranium prices soaring to their highest in over a year, investors are eying a gold rush in this once-overshadowed sector. But with the world's hunger for clean energy intensifying, is the uranium market truly poised for a long-term boom?

The global uranium market is witnessing significant interest due to the rising demand for nuclear power as a clean energy source. Recent developments indicate the potential for the most substantial expansion of nuclear power in decades. Prices for uranium have surged to their highest in over a year, with the weekly spot price of uranium reaching more than $58 marking an approximate increase of 23% year to date. This surge is attributed to the combination of heightened demand and a production deficit resulting from reduced investments after Japan's Fukushima nuclear disaster in 2011. The total world uranium production was 49,000 metric tons in 2022, showcasing a slow recovery from past curtailments due to oversupply and impacts of the COVID pandemic. With current uranium production lagging behind global consumption by more than 50 million pounds annually, there is a pressing need for new mines.

Top Uranium companies operating in the mining sector or related industry.

Nuclear power is now perceived differently in global energy markets, especially in light of the ongoing concerns over climate change and the need for clean energy. The United States recently witnessed the operational commencement of its first newly-constructed nuclear unit in over 30 years. There's also a budding interest in innovative technologies such as small modular reactors in North America. Eastern European countries are progressively turning to nuclear power, with Poland planning a significant nuclear energy program and nations like Czech Republic and Romania aiming to expand their existing nuclear initiatives. At present, nuclear power contributes to around 10% of global electricity, with projections indicating potential growth in nuclear power capacity by at least 40% by 2040. In the investment sphere, uranium stocks and ETFs have observed remarkable growth, with some like Cameco Corp. witnessing an increase of nearly 60% year to date. However, despite these gains, there's a belief that the uranium market is still in its early stages of recovery.

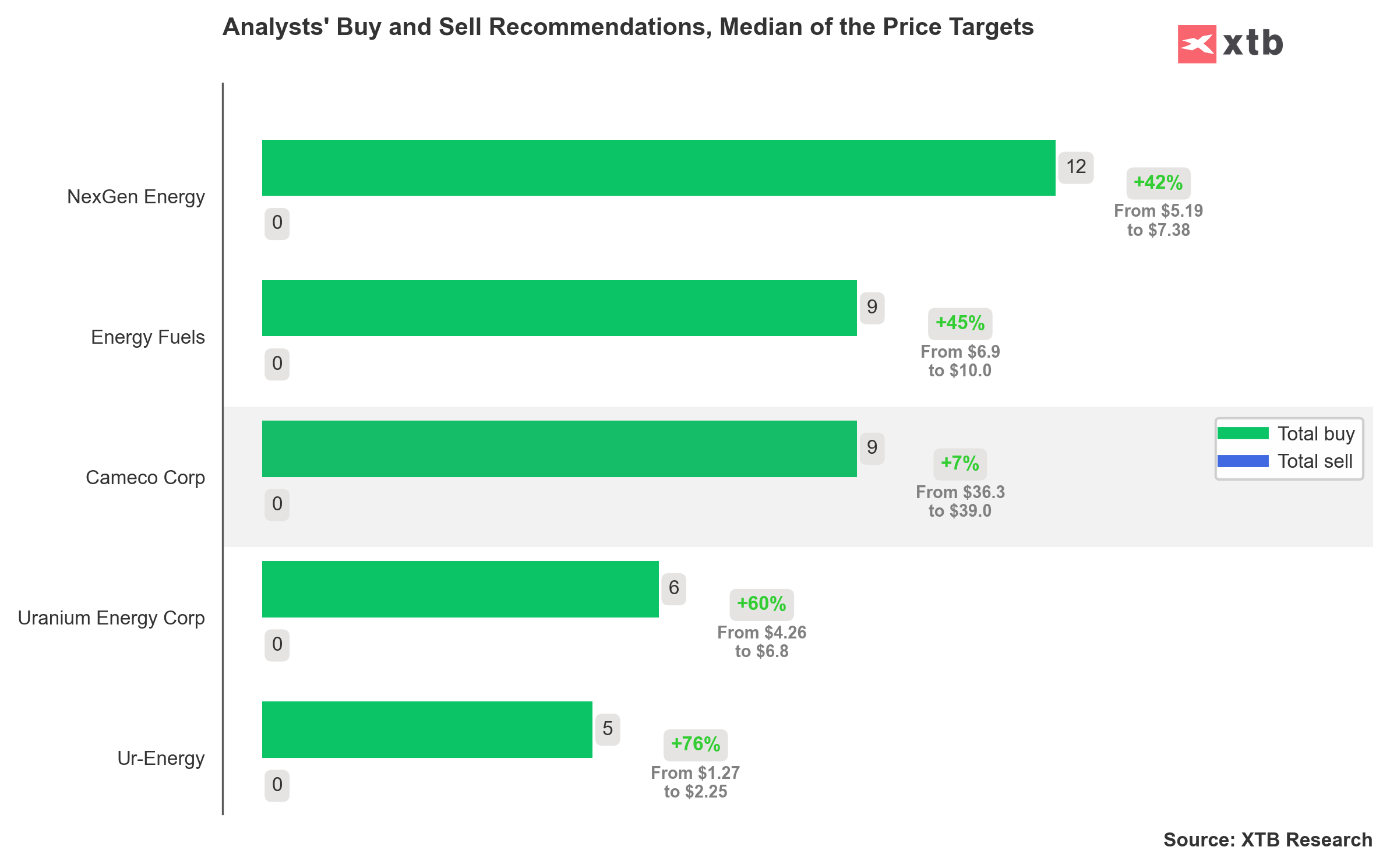

All analyst recommendations are positive, with no recommendations indicating a sell signal

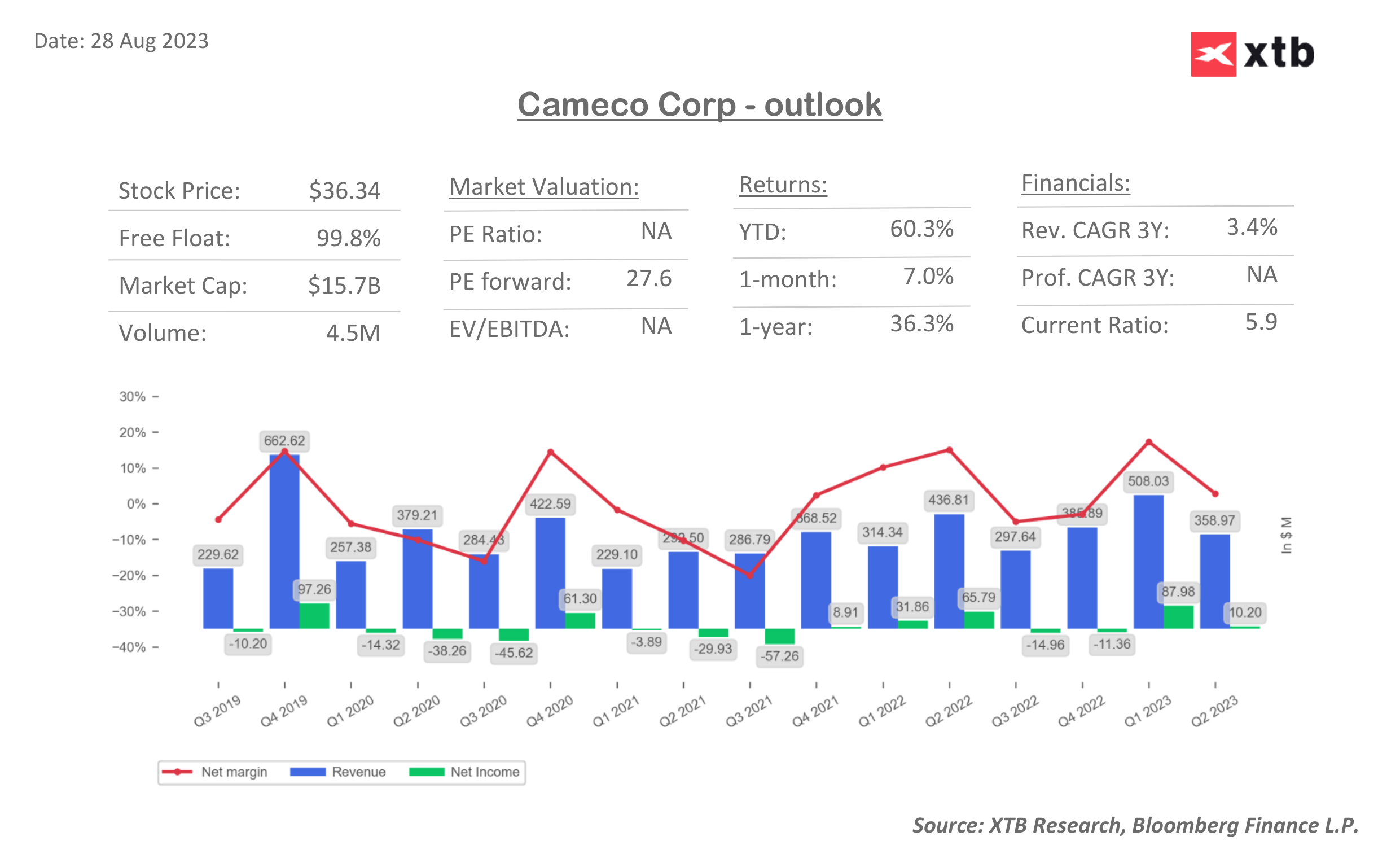

On August 2, 2023, Cameco, based in Saskatoon, Saskatchewan, unveiled its Q2 results revealing an EPS of ($0.01), falling short of estimates by ($0.17), and generating $360 million in revenue, marking a 13.6% revenue decline year-over-year. Despite challenges company benefits from the uptrend in the nuclear energy industry, the demand for uranium is projected to surge. Cameco, as one of the primary suppliers, is set to witness a rise in demand for its products, especially with improving uranium market fundamentals.

On August 2, 2023, Cameco, based in Saskatoon, Saskatchewan, unveiled its Q2 results revealing an EPS of ($0.01), falling short of estimates by ($0.17), and generating $360 million in revenue, marking a 13.6% revenue decline year-over-year. Despite challenges company benefits from the uptrend in the nuclear energy industry, the demand for uranium is projected to surge. Cameco, as one of the primary suppliers, is set to witness a rise in demand for its products, especially with improving uranium market fundamentals.

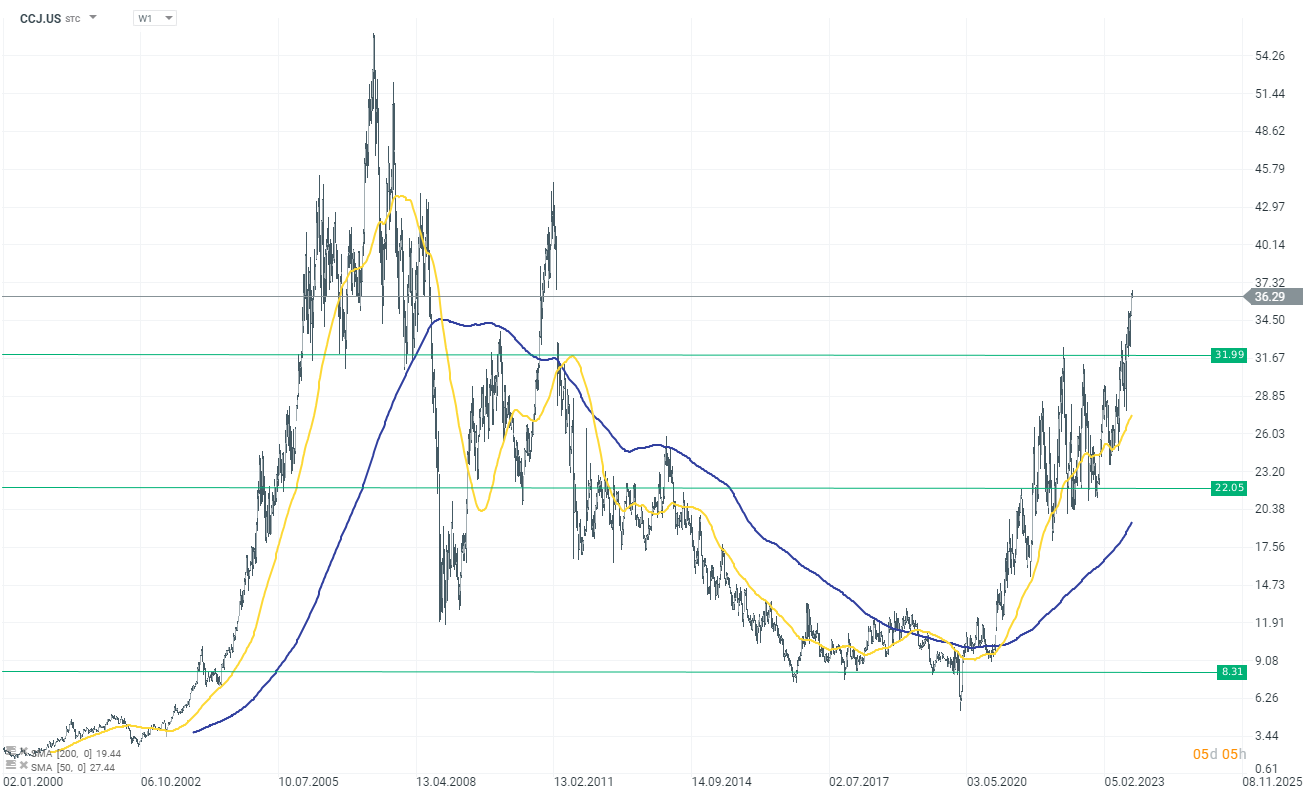

Cameco (CCJ.US) shares experienced significant gains starting in 2020. The rise in the company's stock price reflects the immense potential of the uranium market and the anticipated growth in demand.

Cameco (CCJ.US) shares experienced significant gains starting in 2020. The rise in the company's stock price reflects the immense potential of the uranium market and the anticipated growth in demand.

Politics batter the UK bond market once more, as Starmer remains under pressure

STM is growing stronger thanks to a new partnership with AWS!

The Week Ahead

Kongsberg Gruppen after earnings: The company catches up with the sector

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.