The latest read on the service sector has come in on the soft side with the PMI reading for October missing forecasts. A print of 52.2 is the 2nd lowest of the year and the worse reading back in March is the only release lower that today’s since August 2016. While there was a moderate rise in business activity during the month, new work increased at its slowest pace since July 2016 and it is pretty clear to see that the continued uncertainty surrounding Brexit as the Article 50 deadline approaches is weighing ever more heavily.

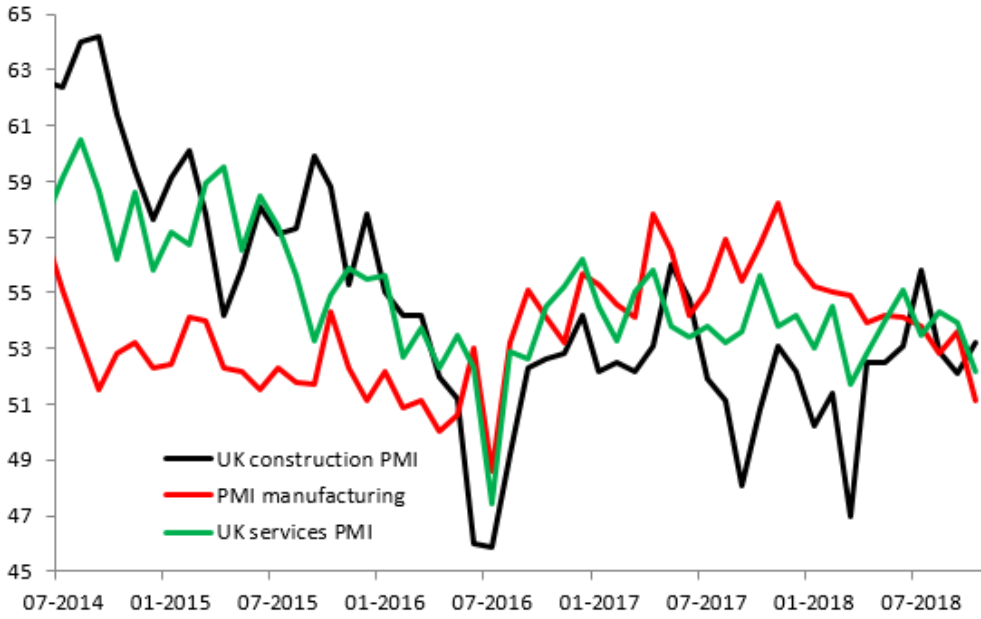

The service sector PMI has fallen lower alongside the manufacturing and construction equivalents. Overall, it appears that economic growth is slowing down with Brexit uncertainty continuing to weigh. Source: XTB Macrobond

GDP growth to slow?

Today’s data on services is the last sector to release the October survey and overall there’s been a marked slowdown with an all-sector PMI consistent with GDP growth of just under 0.2%, below the Bank of England’s forecasts for 0.3%. While the service sector PMI is the most widely viewed of all here in the UK, talk surrounding a possible financial services deal with the EU has the potential to be a bigger driver for the pound. On this front reports this morning that Finance Ministry Services Minister John Glen, is extremely confident on reaching a Brexit deal imminently are a pleasing development and there’s scope for a sharp move higher in sterling should there be a breakthrough. The pound gapped higher over the weekend after a strong end to last week, but the market has dipped back since this release to trade below $1.30 once more.

Washington grant waivers to Iranian oil sanctions

The decision by the US to reimpose sanctions against Iranian oil exports from today had caused fears of a supply shock to the crude oil markets, with price hitting 4 year highs at the start of last month. However, Washington now appears to be taking a more soft approach by announcing that some of its closest allies will have exemptions that allow Tehran’s biggest customers, mostly in Asia, to still buy crude for now. 8 countries have been granted the waiver including Japan, India and South Korea. Brent crude, fell every day last week and the market is now back in the low $70s per barrel and trading not far from the lows seen in August.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.