The pace of economic growth for the UK has slowed of late after a surprisingly large increase over the summer as Brexit uncertainty continues to provide a headwind. On a rolling 3-month basis GDP to October increased by 0.4% compared to 0.6% for the previous period as the strong reading from July rolls out of the data set. In month-on-month terms it looks a little better as there was a rise of 0.1% which ended two consecutive readings which showed no growth on the previous month. It’s not hard to see that the ongoing uncertainty surrounding Brexit is weighing on the economy, with the negative impact increasing as we approach the Article 50 deadline next March. On this front we could well get some clarity in the not too distant future with tomorrow’s parliamentary vote on May’s Brexit deal a key driver for the pound.

The pace of economic growth in the UK appears to be slowing as the strong increases over the summer start to roll out the data on a 3 month basis and the ongoing Brexit uncertainty becomes a larger headwind. Source: Bloomberg

The pace of economic growth in the UK appears to be slowing as the strong increases over the summer start to roll out the data on a 3 month basis and the ongoing Brexit uncertainty becomes a larger headwind. Source: Bloomberg

The ECJ has ruled that the UK can unilaterally end Brexit, in a decision which comes as little surprise following the legal advice given to the court saying as much last week. This is quite a significant development in the whole process as it now means that the chances of a no deal Brexit are diminished while at the same time increasing the prospect of a period of further protracted negotiations. Should May’s deal fail to pass tomorrow then it looks increasingly likely that Article 50 will ultimately be withdrawn as it would be highly challenging given the time needed to renegotiate new terms and also to gain the necessary parliamentary approval before the deadline next March.

Eurozone investor confidence sinks to 4-year low

It’s been a bad year for equities on the continent with the Eurostoxx benchmark on the verge of bear market territory and this morning falling close to its lowest level since December 2016. Disappointingly slow growth figures after a strong 2017 increasingly make last year look like a one-off rather than the start of a new period of prosperity, while the re-emergence of political headwinds, most notably in Italy and France, alongside the winding down of the ECB’s asset purchase programme have caused a triple threat of negative developments to European markets.

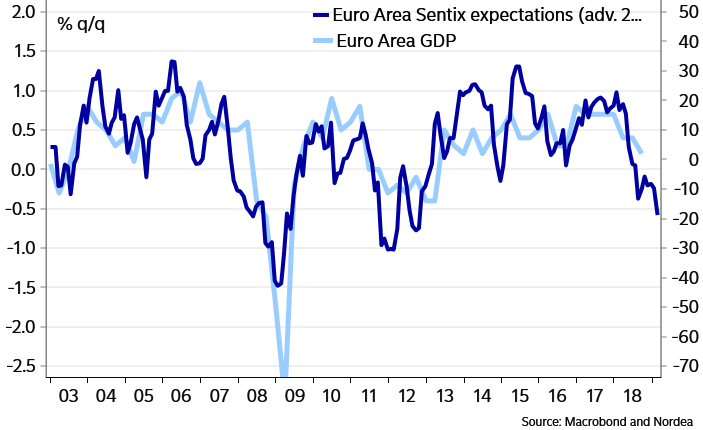

Euro Area sentiment has dropped sharply with economic expectations falling to its lowest level since August 2012. This could be seen to offer an ominous warning sign for GDP going forward. Source: Macrobond and Nordea

Given this, it is not too surprising that investor confidence has taken a hit with the most recent data showing the Sentix index fall into negative territory and its lowest level in 4 years. The group’s economic expectations sub-index makes for even worse viewing, dropping to -18.8 and the lowest since August 2012. Summarising the pessimistic mood neatly, Manfred Hubner, the managing director of the firm responsible for the index said that “there is practically no glimmer of hope.” It is worth keeping in mind that overly negative/positive sentiment readings can often provide contrarian signals and with so much doom and gloom around at present it wouldn’t take a lot for markets to receive some good, or at least less bad, news in the not too distant future which could ease the current downtrend.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.