Uber Technologies (UBER.US) shares rose sharply before the opening bell after the ride-sharing company posted better than expected results for the latest quarter as demand surged.

-

Earnings of 29 cents a share topped market estimates for a loss of 15 cents a share.

-

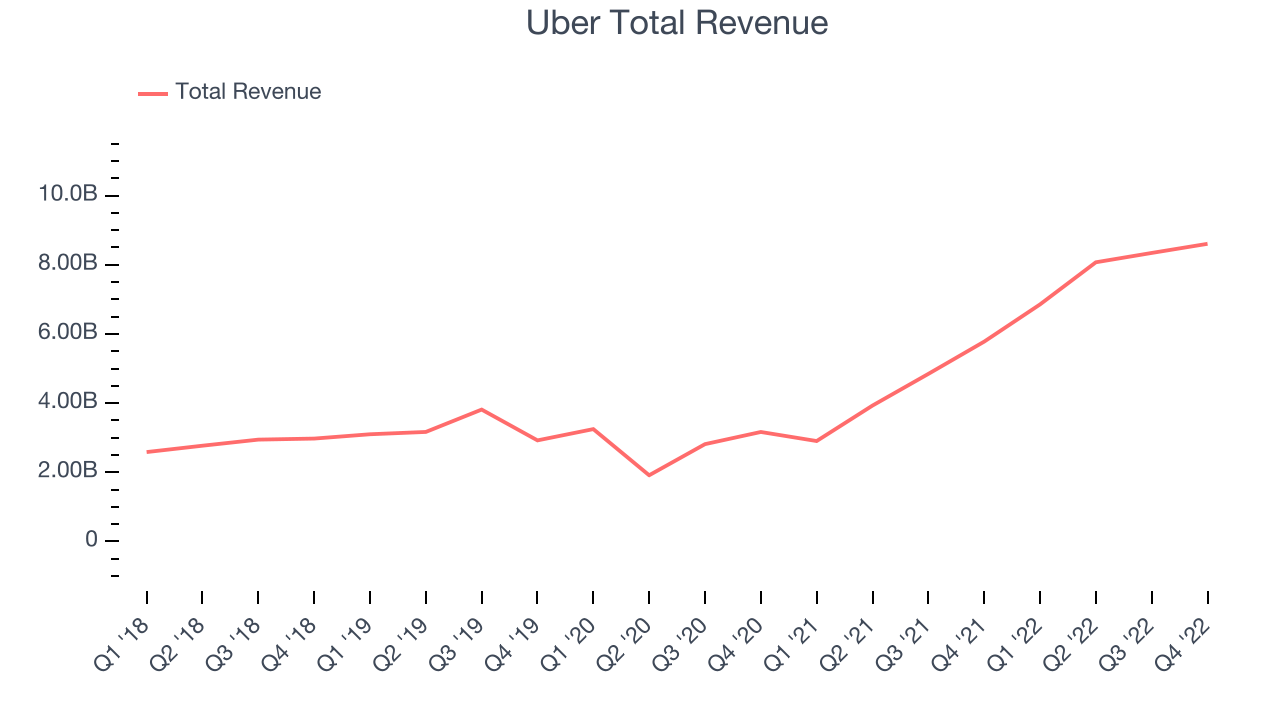

Revenue rose 49% YoY to $8.61 billion, beating analysts’ projections of $8.51 billion.

Since 2020 Uber's revenue on average rose 46.6% annually. Source: BarChart

-

Adjusted earnings before interest, taxes, depreciation, and amortization (Ebitda) reached $665 million, beating Wall Street expectations of $624 million.

-

Free cash flow was negative $303 million, down from positive free cash flow of $358 million in previous quarter

-

Gross Margin (GAAP): 38.3%, up from 36.8% same quarter last year

-

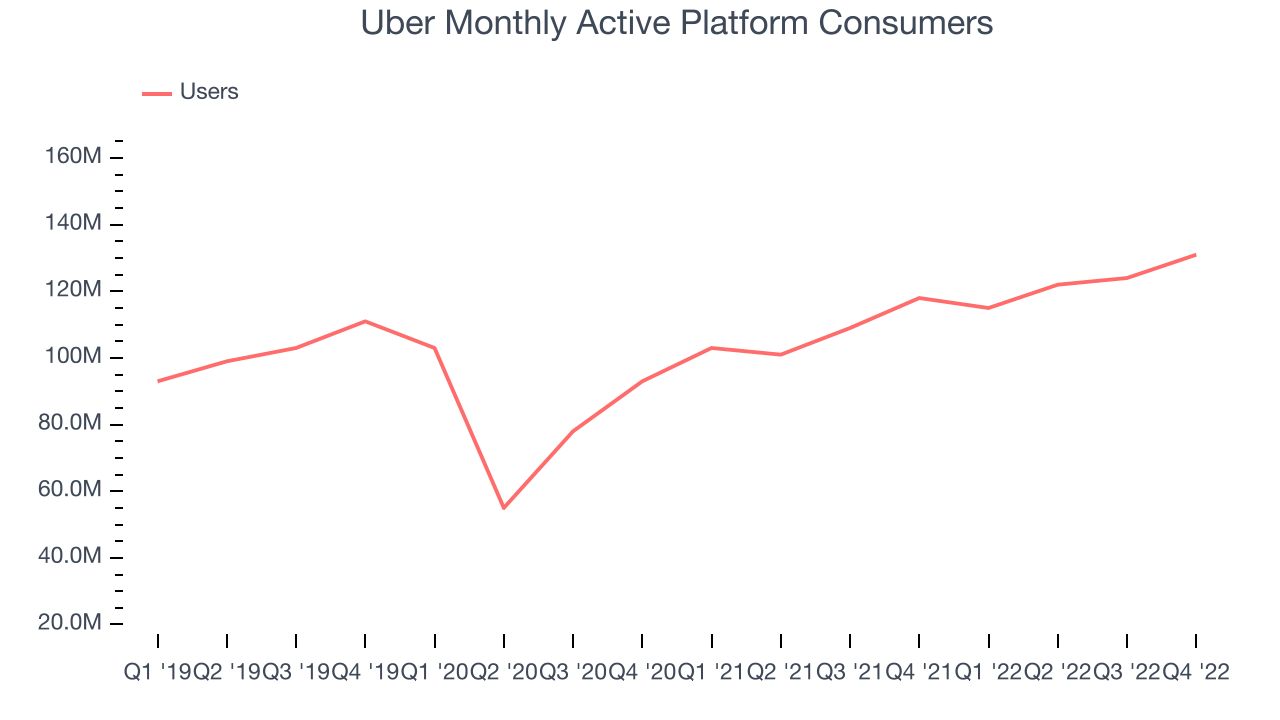

Number of monthly active platform consumers, a key usage metric, rose 13 million YoY to 131 million

Over the last two years the number of Uber's paying users recorded impressive growth of 25.9% annually. Source: BarChart

Performance of Uber’s core business segments:

-

Mobility (gross bookings): $14.9 billion vs. 14.8 billion expected by analysts, according to StreetAccount

-

Delivery (gross bookings): $14.3 billion vs. $14.3 billion expected by analysts, according to StreetAccount.

“We ended 2022 with our strongest quarter ever, with robust demand and record margins,” said CEO Dara Khosrowshahi. “Our global scale and unique platform advantages position us well to accelerate this momentum into 2023.”

-

For the current quarter, the company expects gross bookings to grow between 20% and 24% YoY ( of $31.0 billion to $32.0 billion) on a constant currency basis, and an adjusted EBITDA of $660 million to $700 million. Analysts were looking for $31.3 billion in gross bookings and $612 million of adjusted Ebitda.

"In 2022, we significantly exceeded our profitability outlook, with an incremental margin of 10%,” said CFO Nelson Chai. “Our outlook for a Gross Bookings and Adjusted EBITDA step up in Q1 builds on that progress, and sets us up for yet another record year."

-

Analysts pointed out that rival Lyft (LYFT.US) may lose market share to Uber. Lyft is scheduled to report results on Thursday.

Uber (UBER.US) stock jumped sharply in premarket and is currently approaching the upper limit of the 1:1 structure at $37.60. Should a break higher occur, the next target for buyers can be found around $44.50, which coincides with 38.2% Fibonacci retracement of the upward wave started in March 2020. Also medium-term 50-day SMA (green line) crossed above the long-term 200-day SMA (red line). This formed a bullish ‘golden cross’ formation. On the other hand, if sellers manage to halt declines around $37.60, then another downward impulse may be launched towards local support at $32.60. Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

STM is growing stronger thanks to a new partnership with AWS!

The Week Ahead

Kongsberg Gruppen after earnings: The company catches up with the sector

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.