- Turkish lira hits record low amid concerns of lower interest rate hike

- Turkey's budget deficit widens significantly to $8.37 billion in June

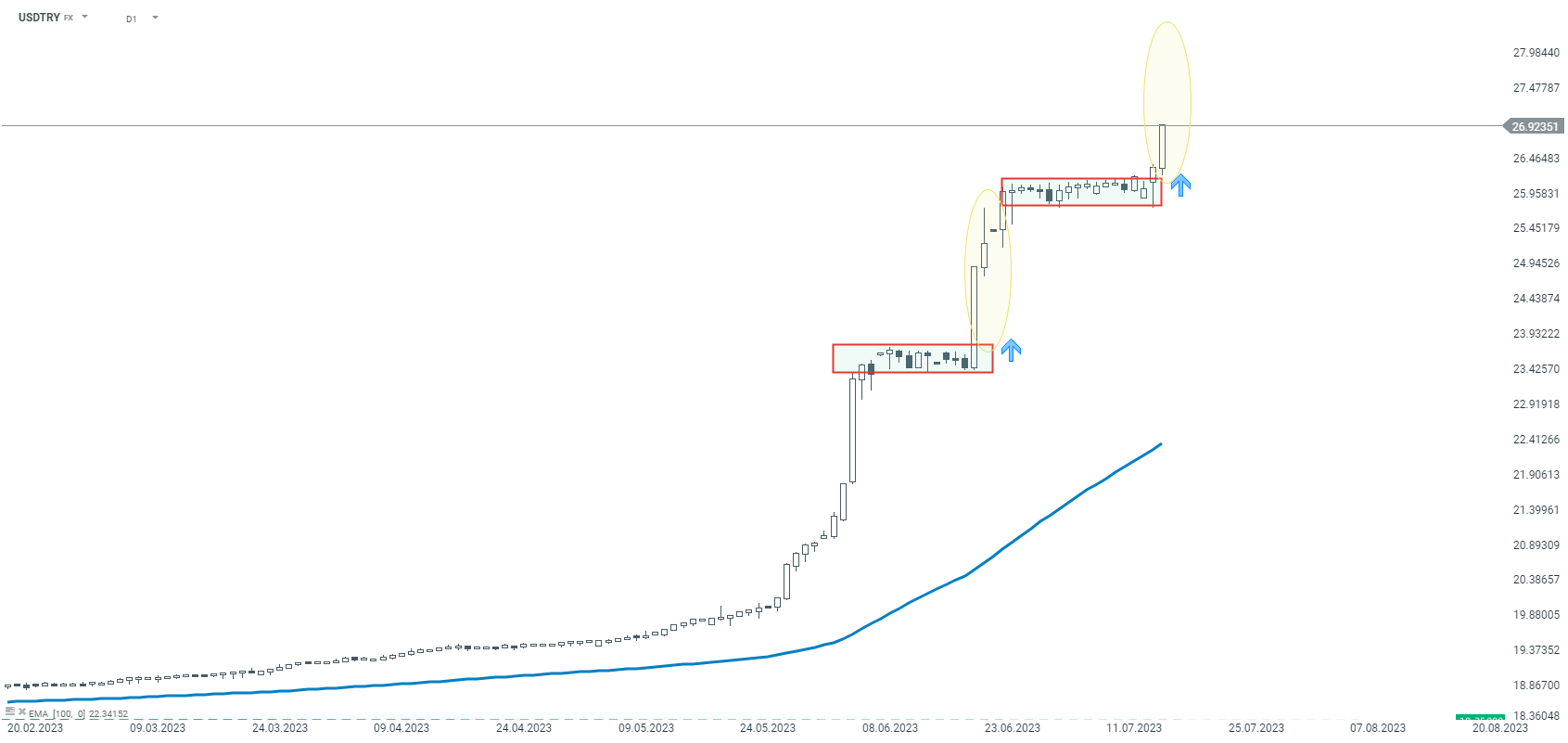

The Turkish lira suffered a decline of over 2.4% against the US dollar, hitting a new record low. Concerns emerged in the market regarding speculation that the central bank might implement a lower-than-expected increase in interest rates. The lira reached an unprecedented low of 26.93 against the US dollar, signifying a depreciation of 30% since the beginning of the year.

Moreover, state banks reportedly pulled back their support prior to Thursday's interest rate decision meeting. Additionally, Turkey's budget deficit significantly widened in June to 219.6 billion lira ($8.37 billion), exhibiting a seven-fold increase compared to the same period last year. The primary deficit, excluding interest payments, also expanded from 18.29 billion lira to 182.3 billion lira year-on-year. In the first half of this year, the deficit accumulated to 483.2 billion lira.

During yesterday's session, USDTRY quotations broke out upwards from consolidation, forming a hammer candlestick formation on the D1 timeframe. If we look at history, we can observe a certain analogy in June. The quotations similarly held in a narrow consolidation, followed by a strong upward breakout. If history were to repeat itself, it is not excluded that the range marked in yellow could be filled, Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.