Shares of the contract manufacturer of the world's most advanced chips, Taiwan Semicondcutors (TSM.US), have come under pressure to realize gains after the company shared a mixed report and expects a further slowdown in important business segments like PCs and smartphones. An additional risk factor for the stock is geopolitics due to the political positioning of key global chipmaker Taiwan between China and the US.The weaker report did not immediately affect the declines of other chip companies although Nvidia is losing nearly 2% today and has retreated below $450 per share.

TSMC indicated that higher demand for AI chips is not at this stage able to offset the company's slump in other business segments caused by the weaker economy. China's weakening economy is also an issue, heralding a problem with corporate and consumer final demand.

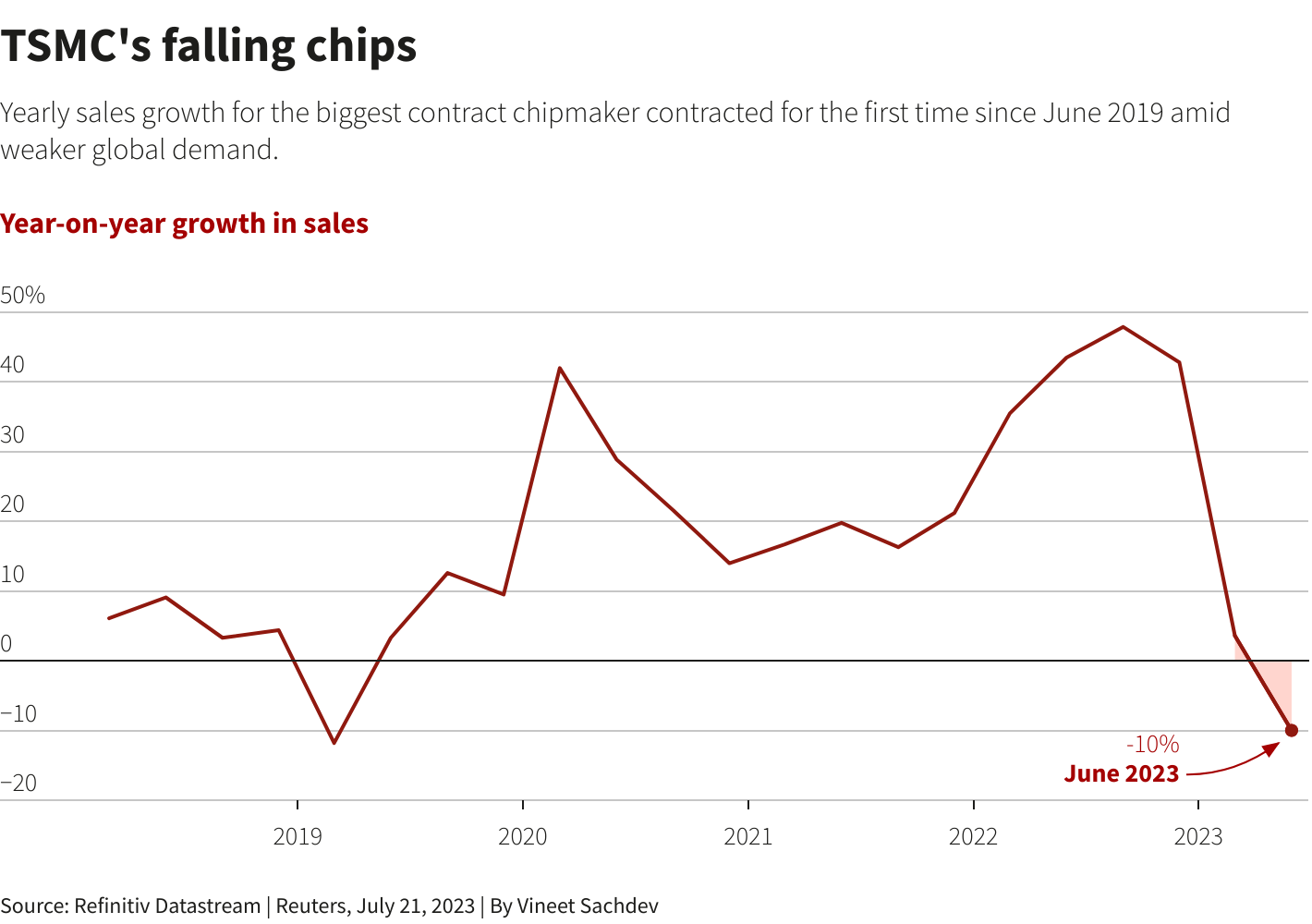

- The company's revenue in the neighborhood of $15.4 billion was down 10% year-on-year, and net income was down 23% year-on-year at $5.8 billion (eps 1,18 USD vs 1,08 USD exp.). The company's CEO, Che Chia Wei forecasts a 10% drop in revenue for the whole of 2023 as demand for electronics sees a big drop. The company unsurprisingly cited higher inflation and interest rates as factors dampening demand.

- Developments in technology and the relocation of production outside of Taiwan may have a greater impact on margins later in the year. TSMC's gross margin fell 2.2% on a sequential basis in Q2 and is projected to fall another 3 to 4% in the second half of the year according to TSMC CEO Mark Liu. The company sees also Q4 revenues from 16,7 to 17,5 billion USD (17,1 billion USD average), analysts estimated 17,4 billion USD.

AI is not enough?

- The company's CEO, Wei stressed that the craze for AI is not offset by the cyclical nature of the business in which the company operates. He also surprised the market by saying that the decline in chip demand may even worsen at a time when Wall Street is counting on a recovery in demand and a drop in inventories starting next year). He conveyed that after decades of growth during which contract foundries benefited with leverage from the growth of the industry as a whole;

- The company estimates that the capacity shortage caused by high demand in the narrow AI segment could persist into next year. It estimates that the AI-related processor business, which it supplies to Nvidia, among others, will grow at a 50% y/y rate over the next few years by increasing TSMC's revenue share from the current 6% to 10%.

- The company also postponed to the future the opening of a factory in Arizona where it is expected to eventually construct chips in 4nm and 3nm technology for iPhones and AI. It cited, among other things, staffing shortages, having so far sent 500 trained specialists to help set up the srzpa.Wall Street speculates, however, that the real reason is lower-than-forecast demand and a sizable supply of chips, produced in the era of the crazy 2020 and 2021 demand years.

- The company has conveyed that it is negotiating with the U.S. government for various sub-tax credits to cover at least the first 5 years of higher costs of moving production to the States. As much as 66% of the company's net revenues through 2023 came from North American customers wobe 12% from China and 7% from Europe, Africa and the Middle East.

TSMC posted its first annual sales decline since June 2019, its biggest customers include companies such as Apple (smartphone chips) and Nvidia (production of designer semiconductors).Source: Reuters, Refinitiv

TSMC posted its first annual sales decline since June 2019, its biggest customers include companies such as Apple (smartphone chips) and Nvidia (production of designer semiconductors).Source: Reuters, Refinitiv

Shares of Taiwan Semiconductors (TSM.US), D1 interval. The price failed to permanently break above the 38.2 Fibonaccegio drift of the March 2020 upward wave. The key support is located at the 61.8 Fibo elimination, near $80 per share. MACD and RSI indicate significant signs of cooling sentiment. Source: xStation5

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Is a recovery on the cards? A deep dive into why bitcoin is weighing on tech stocks

Morning wrap: Tech sector sell-off (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.