OIL.WTI

Let’s start today’s analysis with the oil market. Commodity has been trading higher recently. Investors bet that reopening of major economies will gradually bring oil demand back to pre-crisis levels. Looking at the H4 interval, one can see tha oil has been trading in an upward trend since April 22. Market has a problem with breaking above the resistance at $34.50 but the uptrend is not in danger right now. As long as price sits above $31.00 further upward move is possible. To talk about a downward move, price would have to pull back below the trendline marked with blue colour on the chart below. Should it do so, the downward move could deepen and the first support to watch will be the aforementioned $31 handle.

OIL.WTI H4 interval. Source: xStation5

OIL.WTI H4 interval. Source: xStation5

GBPUSD

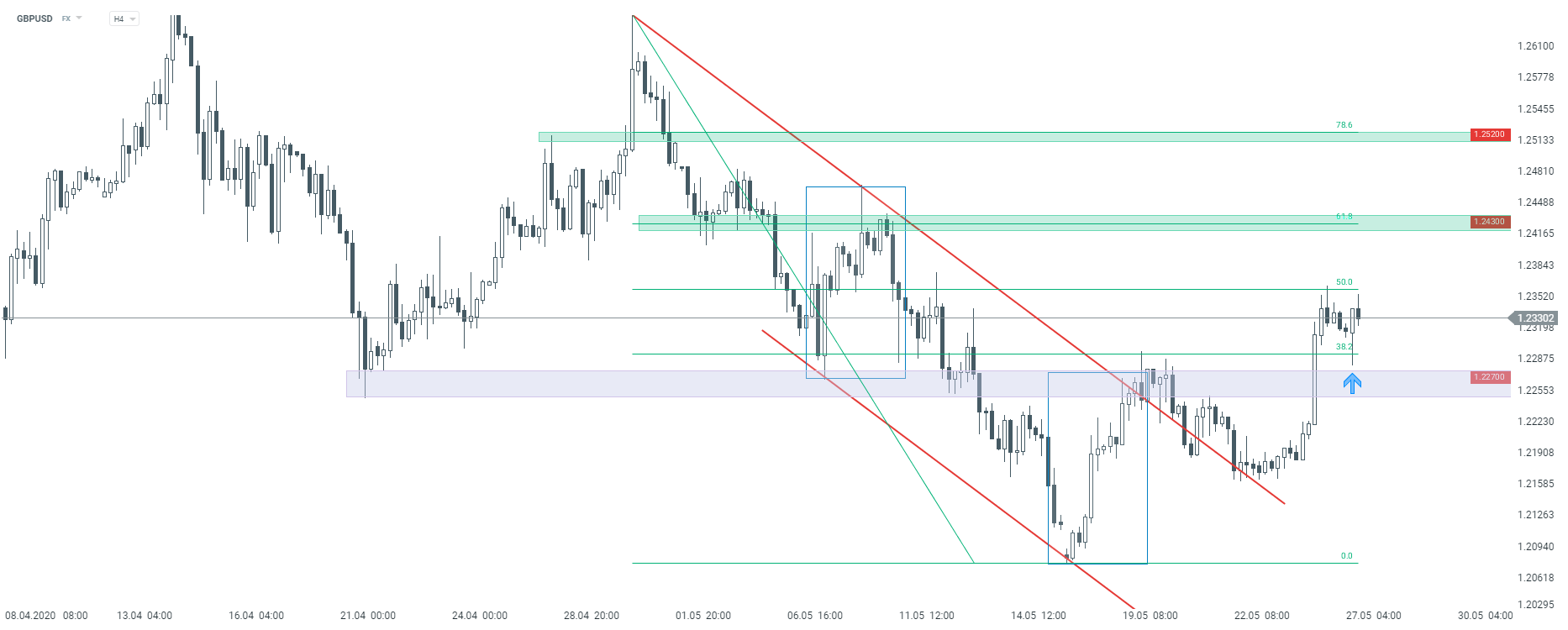

Technical situation on the British pound also looks interesting. Looking at the H4 interval one can see that GBPUSD broke above the downward channel and the sentiment has turned bullish. According to the Overbalance methodology, as long as the pierce sits above the support at 1.2260, trend remains upward. The pair reached 50% Fibonacci retracement of the recent downward move yesterday but buyers defended the area and continuation of the upward move may be on the cards now. In such a scenario, the next key resistance to watch is the zone at 1.2430, where the next Fibonacci retracement and previous price reactions are located.

GBPUSD interval. Source: xStation5

GBPUSD interval. Source: xStation5

DE30

Last but not least, let’s take a look at the German index. Looking at the H4 interval, the index is trading in an upward trend. Price broke above the key resistance at 11330 pts yesterday and gains accelerated. DE30 is trading above the 127.2% exterior retracement of recent downward correction. The nearest sport to watch can be found at 161.8% exterior retracement of the recent upward correction. However, one should also take into consideration an area at 12,250 pts which should act as a supply area. Anyway, the ongoing upward trend is very strong and robust and so far, there are no signs that it could end in the near-tern.

DE30 D1 interval. Source: xStation5

DE30 D1 interval. Source: xStation5

Key support on Ethereum 💡

S&P 500 futures retreat 1% amid hawkish Fed rhetoric and robust data

Technical Analysis - Ethereum (14.01.2026)

Technical Analysis - GOLD (02.01.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.