GOLD

Let’s start today’s analysis with the gold market after precious metal failed to break above the $1,810 handle last week. This resistance area was a result of 78.6% Fibonacci retracement of the downward impulse started at the beginning of September as well as previous price reactions. Gold has pulled back from this zone twice, which may herald a deepening of a downward correction. Should the price stay below the local resistance at $1,798, the next potential target for sellers could be $1,773.7 support, where a lower limit of 1:1 structure as well as lower limit of upward channel can be found. On the other hand, according to the Overbalance methodology, bouncing off this support ($1,774.7) may herald a resumption of the upward move.

GOLD H4 interval. Source: xStation5

GOLD H4 interval. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

US100

Next, let’s move to the US tech index chart - Nasdaq (US100). Looking at the D1 interval, one can see that buyers manage to erase the whole downward correction that started in early September. However, shortly after reaching the 15,700 pts resistance near record highs, sellers arrived and the shooting star formation was painted on the chart. This candlestick pattern usually heralds a trend reversal, so buyers should stay on guard. Considering the bearish scenario, the nearest key support - in the 15,280 pts area - could be at risk. The area marked with green colour on the chart below is a result of previous price reactions, as well as local 1:1 structure. If buyers manage to hold the price above the 15,280 pts support, another attack on 15,700 pts may be launched. On the other hand, should sellers manage to break below 15,280 pts area, a bigger sell-off may occur.

US100 D1 interval. Source: xStation5

US100 D1 interval. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

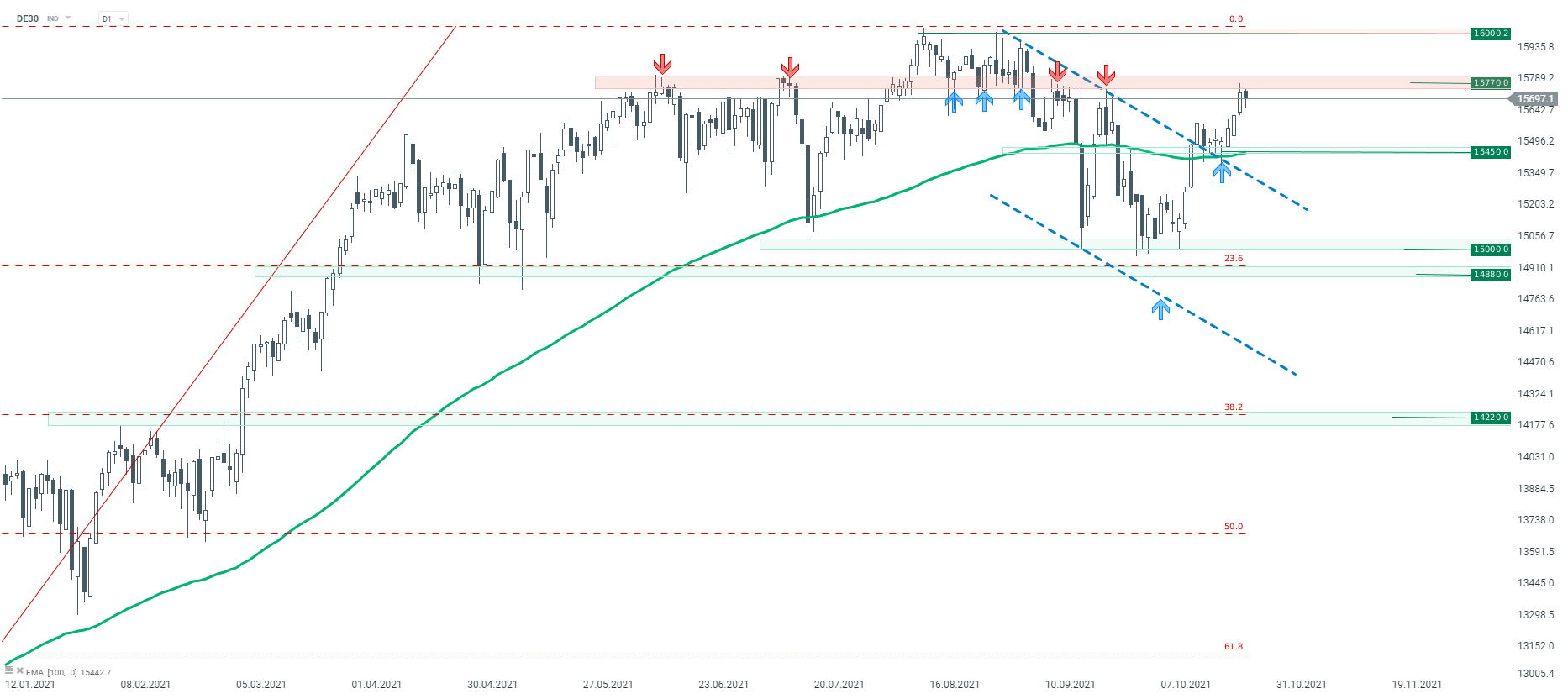

DE30

Last but not least, let’s take a look at the German index - DAX (DE30). Looking at the D1 interval, one can see that buyers regained control on this market. The price has broken above the local upward channel and after a short sideways move, index pushed higher. However, the upward move was halted at the key horizontal resistance area at 15,770 pts. The zone marked with red color is crucial for now - in case of a berak higher, the upward move may quickly reach all time highs near 16,000 pts. On the other hand, should the price stay below the aforementioned resistance, the downward correction may deepen. In such a scenario, the earlier broken area at 15,450 pts is considered to be the first key support.

DE30 D1 interval. Source: xStation5

DE30 D1 interval. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.