- GBPUSD with potential inverse head and shoulders pattern

- Gold rallies after breaking above the consoldiation range

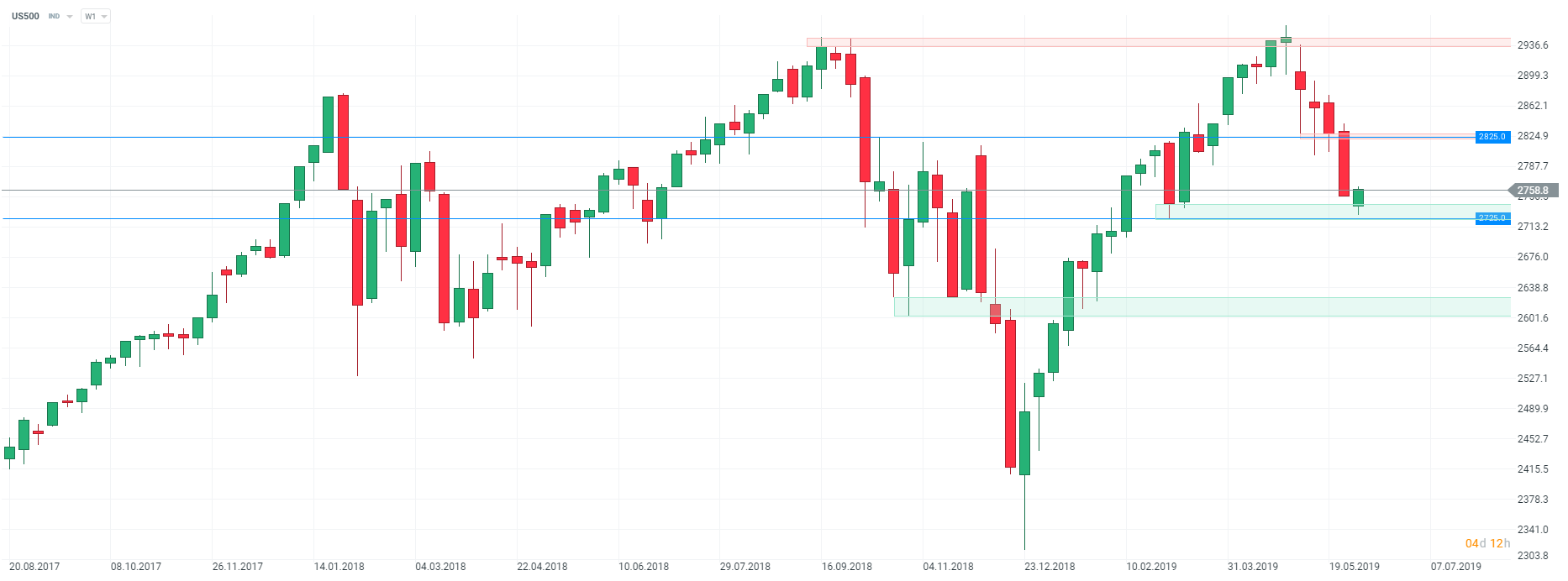

- US500 defends key support zone

GBPUSD

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appBrexit impasse and announcement of the resignation of PM May pushed GBPUSD down to the key support zone in the vicinity of 1.26 handle. Taking a look at the pair at higher time frame one can see that this price zone has halted downward price moves a few times in the past. From a technical point of view, the potential inverse head and shoulders pattern can be spotted. A break above the 1.33 handle could be seen as a potential “buy” signal. Nevertheless, taking a long position is subjected to increased risk now as the pair has been trading within a downward trend for the past few weeks. However, as the latest steep downward move had a 3-wave structure one could expect an upward correction in case the 1.26 price zone continues to fend off the bears. On the other hand, a break below the zone could see decline accelerate and possibly cause the pair to test lows from December 2018.

Source: xStation5

Source: xStation5

GOLD

Gold benefits from risk-averse moods this week. Upward move accelerated following a break above the upper limit of the consolidation range. In case gold traders continue to embrace the precious metals in the weeks to come, one cannot rule out the possibility of price testing highs from February 2019. Slightly higher one can find resistance zone that turned to be a hurdle for bulls at the beginning of 2018. While these levels may look distant, one should keep in mind that bullish momentum and geopolitical situation could quickly push prices higher.

Source: xStation5

Source: xStation5

US500

The past week was not too good for equity markets. S&P 500 (US500) index moved over 2.6% lower and beginning of Monday’s session on Wall Street did not hint at any reversal. Market is trying to recoup some losses on Tuesday but sentiment is still downbeat. From a technical point of view, the index bounced off the relevant support zone. Solid upward momentum bodes well for the future but one should keep in mind that break below the 2725 pts handle could see downward move accelerate and potentially deepen towards the 2600 pts handle.

Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.