The Federal Reserve's restrictive policies have put tremendous pressure on publicly traded companies, which have failed to generate positive cash flow and have depended heavily on market conditions, access to cheap credit and risky investment fund activities. Shares of cannabis companies Aurora Cannabis (ACB.US) and Tilray (TLRY.US) lost ground today amid concerns about a prolonged Fed monetary tightening cycle: Rising financing costs have also translated into deteriorating financing conditions for cannabis businesses like Aurora Cannabis (ACB.US) and Tilray (TLRY.US). Both companies are losing close to 10% today. We can see that 2022 debt has turned out to be higher than the industry's funding for the first time in many years, illustrating negative risk sentiment and the withdrawal of venture capital funds from risky ventures. Noteworthy, the period of risk aversion comes after a record-breaking previous year in this regard during which cannabis industry financing, in 41 weeks of the first week, amounted to nearly $4.7 billion, nearly 450% more than in the current year. Source: Virdian Capital

Rising financing costs have also translated into deteriorating financing conditions for cannabis businesses like Aurora Cannabis (ACB.US) and Tilray (TLRY.US). Both companies are losing close to 10% today. We can see that 2022 debt has turned out to be higher than the industry's funding for the first time in many years, illustrating negative risk sentiment and the withdrawal of venture capital funds from risky ventures. Noteworthy, the period of risk aversion comes after a record-breaking previous year in this regard during which cannabis industry financing, in 41 weeks of the first week, amounted to nearly $4.7 billion, nearly 450% more than in the current year. Source: Virdian Capital

Below are some other companies that have taken a massive hit this year, causing a more than 90% sell-off in shares:

The shares of advertising marketer and technology company Snap (SNAP.US) fell powerfully after the company was unable to meet analysts' forecasts for growing revenues, which had markets optimistic about projected future margins in 2021. This did not go unnoticed by valuations, which have consistently risen over the past two years when interest rates were near zero. The company's business has declined in the face of advertisers pulling back from the advertising sector. Reduced marketing and sales budgets of thousands of companies in anticipation of an economic slowdown pushed the company's Q3 revenue growth to 5.7% against Q3 2021. In the previous year, it posted double-digit revenue growth in every quarter and beat Wall Street expectations.

Virgin Galactic's (SPCE.US) shares have come under pressure as the company, which is supposed to offer space tourism services, continues to 'burn' the cash made available to it at a record pace with minimal profits. In a bull market, investors show far less patience and risk tolerance by which the company's stock has fallen by more than 90% counting from its July 2021 peak, when Richard Branson overtook Jeff Bezos in the commercial space race. Initially, Virgin Galactic's next test flight was to take place early this year, but the company has now moved the date to the first quarter of next year. In 2022, it signed several important business partnerships with Textron, among others, to supply parts for the next generation of spacecraft. It also announced the construction of its own construction plant in Phoenix. However, investors in an environment of rising interest rates eventually want to see margins and customers flying into space - not announcements and information. Concerns about withholding financing for the company have increased in an environment of increasingly restrictive monetary policy.

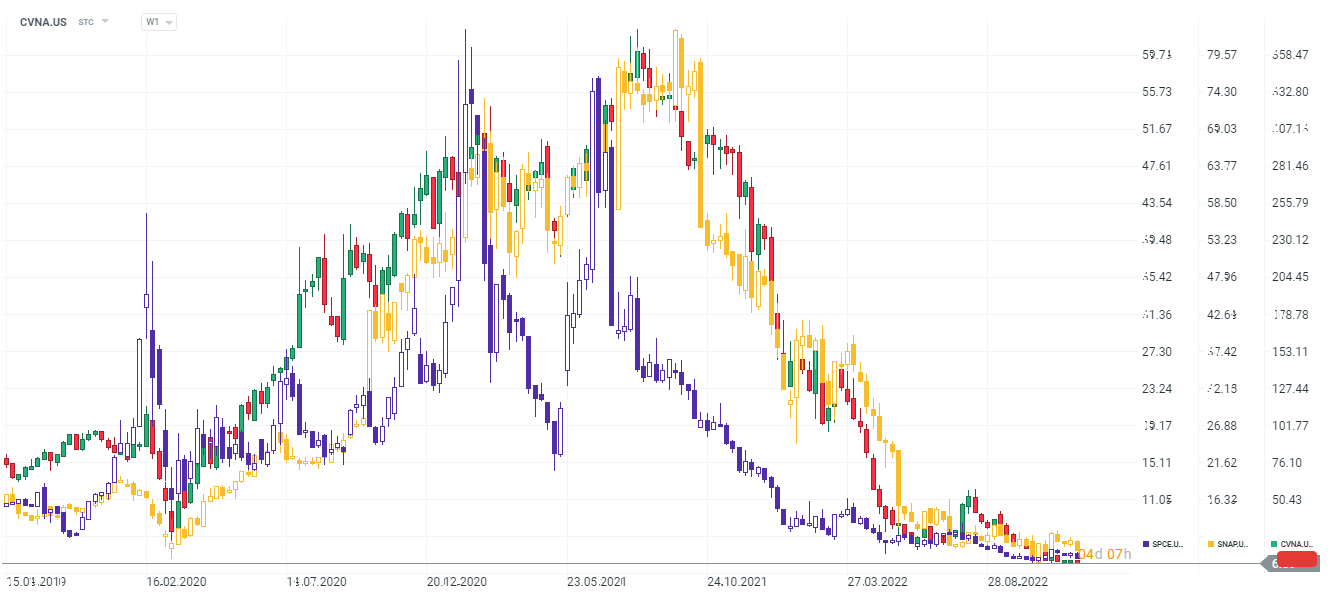

Carvana's (CVNA.US) stock, until recently still the fastest-growing used car sales platform in the U.S., is down nearly 97% this year. Faced with massive debt levels and ever-higher interest rates, investors fear bankruptcy. U.S. used car sales fell about 13% year-on-year in the third quarter of 2022, taking a toll on the company's earnings. According to FactSet, the company has $7 billion in debt and no significant cash on its balance sheet. It also still does not have positive cash flow. Net debt relative to cash on the balance sheets of non-banking companies in the S&P500 index is on average double that of Carvana. In August, when interest rates rose and demand for used cars weakened, Carvana set a goal of generating positive free cash by cutting costs so that the company could finance itself without the need for additional debt or equity however, it fell short of its goals using $200 million more than expected. Wall Street does not expect positive free cash flow at the company until 2026. Higher fuel prices and high interest rates have caused the second-hand car market in the US to weaken, the volatile financing environment has put powerful pressure on Carvana. Chart of Carvana's shares, Virgin Galactic (purple) and Snap (yellow), W1 interval. The chart shows the extent to which 2022 has hit sentiment and businesses run by companies with significant debt relative to market capitalization. Particularly clear is the case of Carvana, which has a debt level of $7 billion against $374 million in assets, a debt to equity ratio of 1.87 versus 1.29 for Snap and 0.68 for Virgin Galactic. Source: xStation5

Chart of Carvana's shares, Virgin Galactic (purple) and Snap (yellow), W1 interval. The chart shows the extent to which 2022 has hit sentiment and businesses run by companies with significant debt relative to market capitalization. Particularly clear is the case of Carvana, which has a debt level of $7 billion against $374 million in assets, a debt to equity ratio of 1.87 versus 1.29 for Snap and 0.68 for Virgin Galactic. Source: xStation5

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.